Expect Repricing for a Stingier Rate Cut Path Next Year if Powell Tries to Talk Down Inflation

Expect Repricing for a Stingier Rate Cut Path Next Year if Powell Tries to Talk Down Inflation

By:Ilya Spivak

Investors believed the large cut did not mean the Fed had fallen behind on offsetting economic weakness

Markets have embraced the Fed’s dovish signaling of a “soft landing” argument.

Traders are betting rate cuts combined with healthy growth will push prices upward.

Stocks won’t like it if Fed Chair Powell tries to talk down inflation expectations.

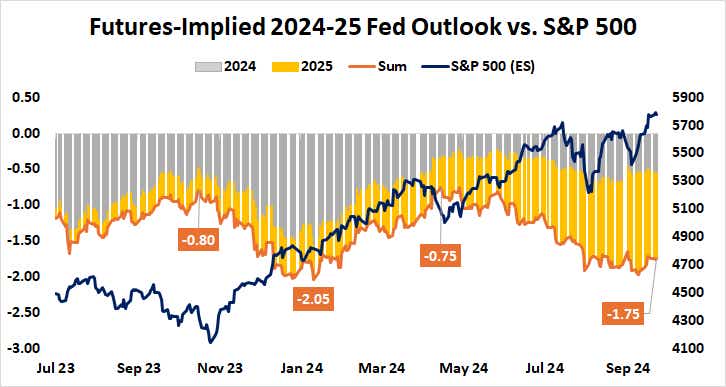

The Federal Reserve seemed to give financial markets exactly what they wanted with September’s tectonic monetary policy update. The central bank delivered a 50-basis-point (bps) rate cut and projected a further 50bps in easing before the end of the year. It also penciled in 100bps in rate cuts for 2025.

All of this lined up with remarkable precision to the policy path implied in benchmark Fed Funds interest rate futures ahead of the announcement. A slight difference in the view for next year—the markets had 123bps in view, a bit more than Fed officials—seems minor given the time horizon. There’s ample opportunity to close the gap.

Markets position for rate cuts with solid growth to lift prices

After a bit of cautious rumination, the markets appeared to embrace the argument made by Fed Chair Jerome Powell in the press conference following the rate cut announcement. He said the large cut and dovish reforecasting did not mean the Fed had fallen behind on offsetting economic weakness. Instead, it was insurance against that outcome.

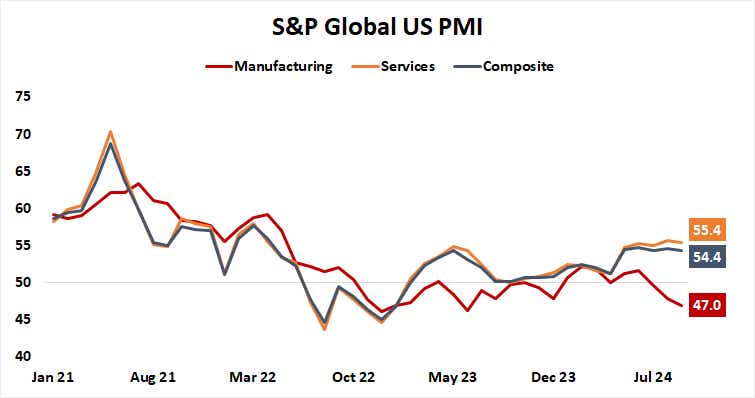

This optimistic view was endorsed by purchasing managers’ index (PMI) data published by S&P Global this week. U.S. economic activity growth jumped to a 12-month high in May. September marked the fourth consecutive month that it has hovered there, with strength in services continuing to offset contraction in the manufacturing sector.

Financial markets are forward-looking mechanisms. In their convergence with the Fed, they’ve reasoned that a successful “soft landing” for the economy today will translate into higher inflation downwind as monetary easing boosts demand and prices respond accordingly.

Stocks at risk if Fed Chair Powell tries to talk down inflation bets

Breakeven rates reflecting inflation expectations priced into the bond market began to creep higher a week before the Fed rate cut and have since extended to a two-month high. Gold prices have moved steeply upward, and the 10-to-two-year Treasury yield spread steepened to the highest since early June.

This would be welcome news were the economy on soft footing, where rising inflation expectations would signal improvement on the horizon. It is a different story when the economy is already growing at a healthy pace and the central bank is trying to ensure that price growth durably declines to an annual rate of 2%.

That will demand a delicate balancing act from Mr. Powell when he speaks at the 2024 U.S. Treasury Market Conference this week. Comments praising the economy’s resilience along with hesitation to declare victory over inflation may push markets to reprice for a stingier rate cut path next year. Stock markets may not like that.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.