Stocks Climb to Fresh Yearly, All-time Highs

Stocks Climb to Fresh Yearly, All-time Highs

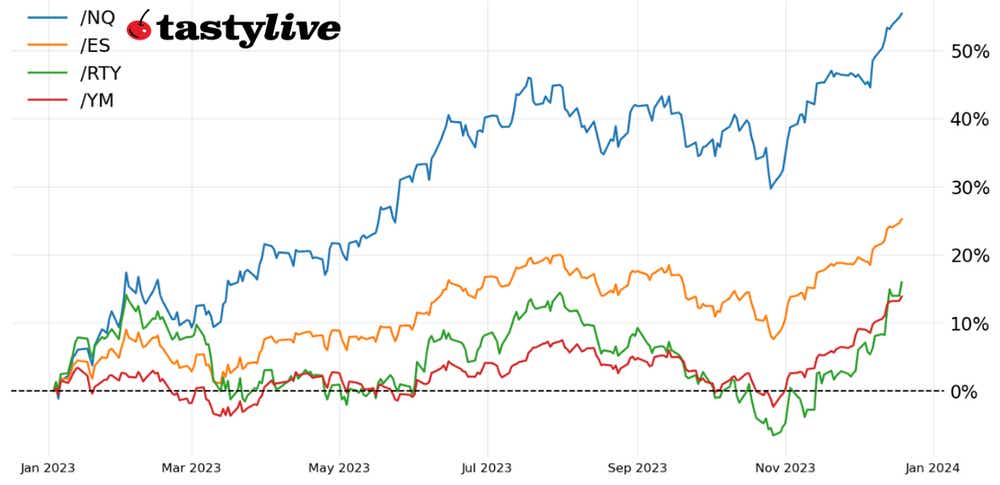

Market update: The Russell 2000 is up 12.85% month-to-date

- U.S. stock markets are trying for their eighth straight week of games.

- All four major U.S. indexes established fresh yearly highs today; each of the S&P 500 (/ESH4), Nasdaq 100 (/NQH4), and Dow Jones 30 (/YMH4) hit all-time highs.

- The Russell 2000 (/RTYH4) remains the best-performing major index in December, now up over +12.5%.

The second half of December has thus far seen the first half’s gains continue in stride.

Now in the bullish part of the month, and on the cusp of the Santa Claus rally window—the final five days of the year and the first two of the next, producing an average gain of 1.4% since 1950 in the S&P 500—there are few, if any, short-term reasons to bearish from a seasonal perspective.

Indeed, with each of the four major U.S. equity indexes hitting their yearly highs today, three of which have hit fresh all-time highs, the path of least resistance remains pointed higher from a technical perspective as well. 2024 may prove more challenging for stocks, but through the end of this year, little is standing in the way of a continuation higher.

/ES S&P 500 price technical analysis: daily chart (September 2022 to December 2023)

The S&P 500 (/ESH4) reached fresh yearly highs today, in the process overcoming the high established in January 2022 at 4808.50 to establish a new all-time high.

What else is there to say aside from the fact that momentum remains bullish? /ESH4 is still above its daily 5-, 13-, and 21-day exponential moving average (EMA) envelope, which is still in bullish sequential order. Slow stochastics are holding in overbought territory and moving average convergence divergence (MACD) is trending higher well-above its signal line.

We’re in unchartered territory now, but /ESH4 is a pure bullish momentum play in the short-term so long as volatility remains depressed; it remains the case that a close below the daily 5-EMA (one-week moving average) would warrant a reconsideration of this view.

/NQ Nasdaq 100 price technical analysis: daily chart (December 2022 to December 2023)

Last week we noted, “/NQH4 is a pure bullish momentum play in the short-term” after having reached a new all-time high. Since then, Friday, Monday, and now Tuesday have produced new closing records.

Thus, /NQH4 is still a pure bullish momentum play. /NQH4 is well-above its daily EMA envelope, which remains in bullish sequential order. Slow Stochastics continue to linger in overbought territory, and MACD is trending higher while above its signal line. Like in /ESH4, the view remains valid until a close below the daily 5-EMA (one-week moving average).

/RTY Russell 2000 price technical analysis: daily chart (April to December 2023)

The Russell 2000 (/RTYH4) has continued its strong run, posting the best performance on the day while carving out a new yearly high in the process.

Notably, the continuous contract has reached its highest level since April 2022. This may be an early attempt at breaking above multi-year range highs dating back to August 2022.

As noted last week, “what happens next is open to interpretation, but it appears that a multi-year sideways consolidation between 1635 and 2035 has been carved out; a move through multi-year resistance would suggest that a measured move, transpiring over multiple months or even more than a year, would begin towards 2435. As good as late-2023 has been for /RTYH4, 2024 may be even better.” Like in /ESH4 and /NQH4, /RTYH4 is a pure bullish momentum play in the short-term.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.