Stock Markets Are Still in Trouble as Weak U.S. PMI Data Revives Recession Fears

Stock Markets Are Still in Trouble as Weak U.S. PMI Data Revives Recession Fears

By:Ilya Spivak

Markets wanted to cheer as President Trump let Fed Chair Powell off the hook, but weak PMI data spoiled the mood

- Stocks and bonds jumped as President Trump walked back threats against Fed Chair Powell.

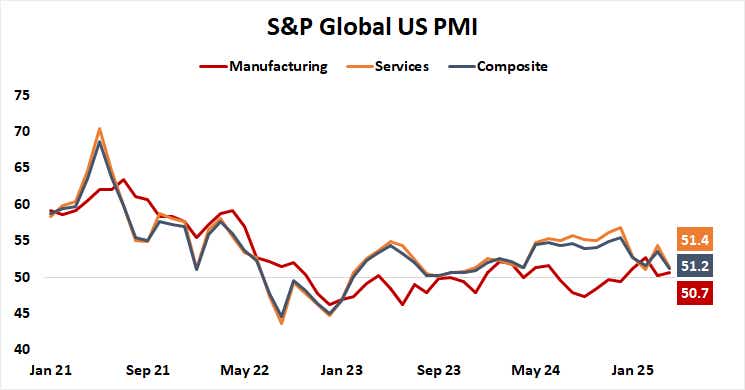

- S&P Global PMI data put U.S. economic activity growth slowest at the weakest in 16 months.

- Falling “breakeven” inflation may help bonds to rally as the Fed builds the case for rate cuts.

Stock index futures gapped higher as trading reopened overnight following Tuesday’s cash session close on Wall Street as President Donald Trump clarified he has no intention of trying to fire Federal Reserve Chair Jerome Powell. That seemed to defuse the latest trigger for market turmoil emerging at the start of the week.

Bond markets jumped higher as yields cooled, pointing to easing pressure ratcheted up by building term premium since the beginning of the month as unsteady markets demanded more compensation for duration risk since. The U.S. dollar rose as well, speaking to its newfound role as a proxy for U.S. fiscal policy concerns.

Stocks struggle to build higher PMI data warns of incoming recession

Rose-tinted comments from Treasury Secretary Scott Bessent seemed to help brighten the mood. He signaled in a speech that a trade deal between the U.S. and China was inevitable because the present status quo – a ratcheting up of tariffs to a point of practical embargo at both ends of the world’s most critical supply chain – is untenable.

The chipper mood would not find lasting follow-through however as dour purchasing managers index (PMI) data from S&P Global put recession fears back into the spotlight. The bellwether S&P 500 has sustained the session-opening gap upward, but not much more. As the close approaches, it has erased nearly 80% of its subsequent intraday gains.

A similar fate befell the bond market. The closely watched 10-year Treasury note is on pace to finish the day with a narrow loss having been up as much as 0.72% at the session’s peak. Curiously, the U.S. dollar diverged to find firmer footing as risk appetite fizzled, in a flashback to its formerly reliable safe haven appeal.

Bond markets may rally as the Fed builds its case for rate cuts

The PMI data showed that U.S. economic activity growth slowed to the weakest in 16 months in April. Most worryingly, the weakness came from the mission-critical service sector that has been the primary engine of global economic growth since May 2024. It was resilience here that allowed the U.S. to power on as China and Europe languished.

Service sector activity growth cooled to second-lowest reading in the past 12 months. Only February’s lurch lower produced a worse result.

However, it also pointed to the sharpest inflation in 13 months. Taken together, this sends mixed signals to the Federal Reserve as it ponders whether to prioritize boosting growth or curtailing prices.

This might explain the curious reaction in the bond market. It might have been expected to rally as recession fears inspire Fed rate cuts, especially after President Trump’s moderating rhetoric implicitly gave the central bank the green light to ease without the appearance of kowtowing to the White House.

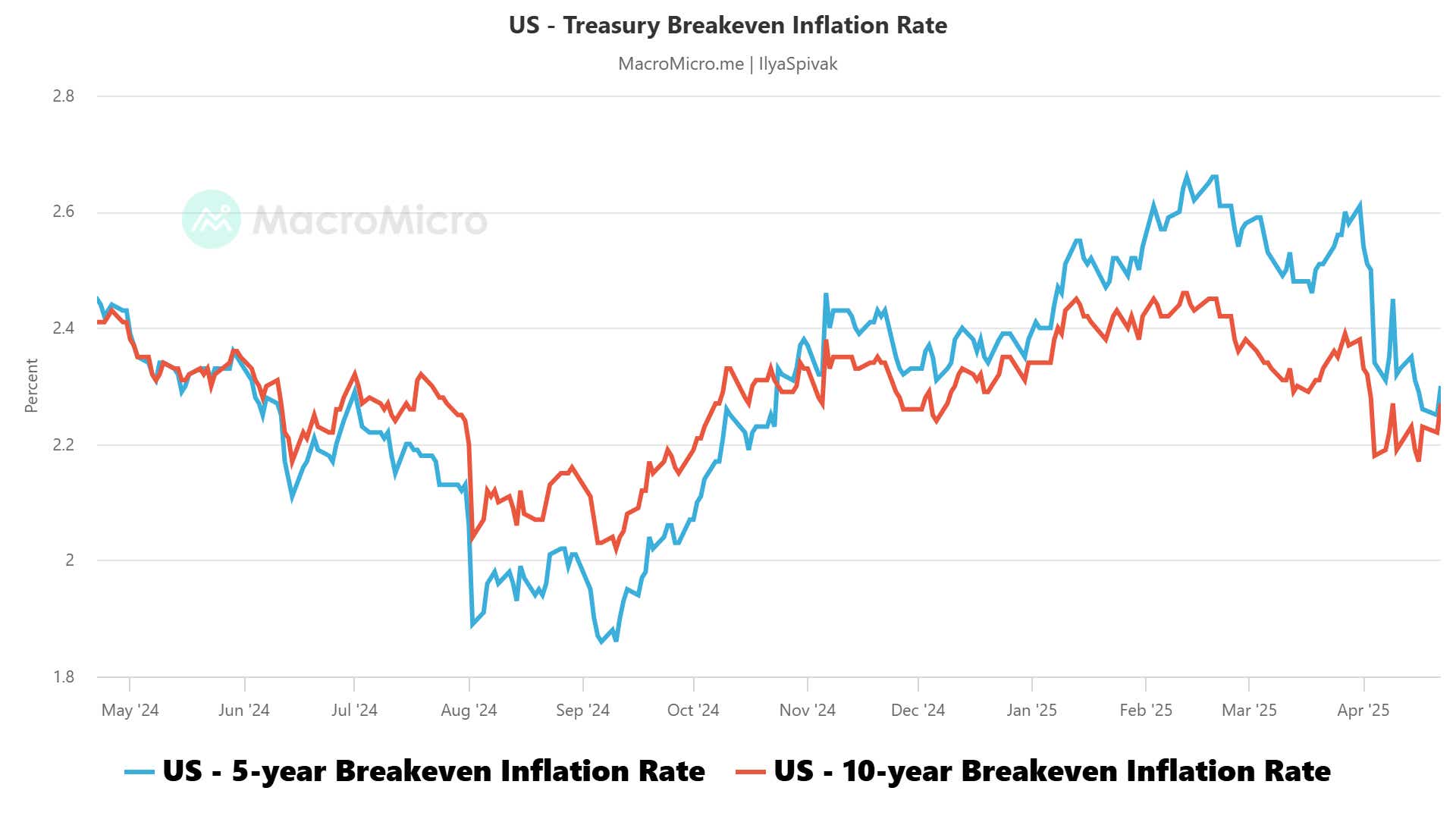

Nevertheless, stage-setting for a bond rally may be underway. Inflation expectations implied in Treasury yields are falling, suggesting that the markets are already looking ahead beyond any price increases from tariffs to the demand destruction they may cause. If the central bank gets a bit of “hard” data to support its case, rate cut speculation may heat up.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.