S&P 500 Edges Higher as China Calls Out Trump’s Tariff Talk

S&P 500 Edges Higher as China Calls Out Trump’s Tariff Talk

Also, 10-year T-note, gold, natural gas and Japanese yen futures

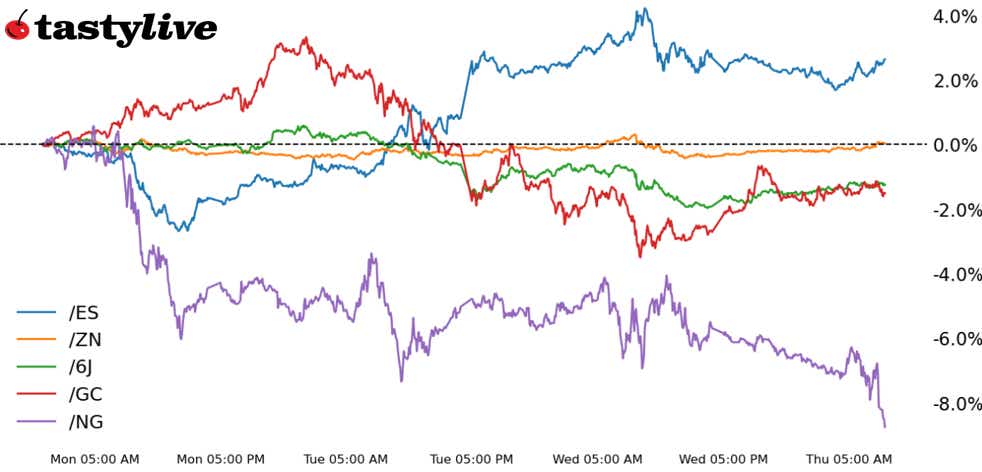

- S&P 500 E-mini futures (/ES): +0.44%

- 10-year T-note futures (/ZN): +0.35%

- Gold futures (/GC): +1%

- Natural gas futures (/NG): -3.82%

- Japanese yen futures (/6J): +0.58%

Trade talks between the U.S. and China may or may not be underway. “Reports on development in talks are groundless,” said Chinese Ministry of Commerce spokesman He Yadong. “Fake news,” noted Chinese Ministry of Foreign Affairs spokesperson Guo Jiakun. That’s the reaction overnight from China with respect to claims by President Donald Trump’s and Treasury Secretary Scott Bessent’s that “active” negotiations were happening between U.S. and China to de-escalate the trade war. Be that as it may, both Trump and Bessent have also signaled any deal could take years. But here’s some good news: Reports say the U.S. and India may be on the verge of announcing an understanding toward a trade deal—a deal to make a deal in the future, if you will.

Symbol: Equities | Daily Change |

/ESM5 | +0.44% |

/NQM5 | +0.63% |

/RTYM5 | +0.28% |

/YMM5 | -0.29% |

Equity index futures continue to be dragged along by the latest twists and turns from the White House, but this week’s barrage of earnings releases is continuing full steam ahead; 24% of S&P 500 companies are reporting this week. After-hours reports yesterday from Philip Morris (PM), IBM (IBM) and ServiceNow (NOW) came in solid, but the pre-market earnings releases from Procter & Gamble (PG), Merck (MRK), Pepsico (PEP) and Union Pacific (UNP) have all proved disappointing. Alphabet (GOOG) and T-Mobile (TMUS) report after-hours today.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4850 p Short 4950 p Short 5800 c Long 5900 c | 62% | +1337.50 | -3662.50 |

Short Strangle | Short 4950 p Short 5800 c | 67% | +4037.50 | x |

Short Put Vertical | Long 4850 p Short 4950 p | 84% | +600 | -4400 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.1% |

/ZFM5 | +0.24% |

/ZNM5 | +0.35% |

/ZBM5 | +0.68% |

/UBM5 | +0.77% |

The silver lining to all of the recent noise in the news has been the fact that the bond market isn’t showing signs of distress in the manner it did at the start of the month. The long-end of the curve is lifting more than the short-end, in part because term premium (compensation for holding duration) is dissipating. It remains the case that the Trump administration has seemingly drawn a line in the sand for 10s (/ZNM5) at 4.5% and 30s (/ZBM5) at 5%.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108 p Short 114 c Long 115 c | 63% | +265.63 | -734.38 |

Short Strangle | Short 108 p Short 114 c | 69% | +687.50 | x |

Short Put Vertical | Long 107 p Short 108 p | 86% | +125 | -875 |

Symbol: Metals | Daily Change |

/GCM5 | +1% |

/SIK5 | -1.12% |

/HGK5 | -0.31% |

The sharp drop in gold prices (/GCM5) this week is a welcomed development for those looking for a de-escalation in the U.S.-led global trade war. But the comments from Chinese officials overnight (see the opening blurb) have led traders back into bullion, if only modestly, as expectations for a quick off-ramp to the current malaise have been tempered. Somewhat noteworthy, gold volatility continues to decline rapidly, from 111.5 on Tuesday to as low as 44.5 today.

Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3000 p Short 3025 p Short 3625 c Long 3650 c | 66% | +620 | -1880 |

Short Strangle | Short 3025 p Short 3625 c | 73% | +5500 | x |

Short Put Vertical | Long 3000 p Short 3025 p | 84% | +250 | -2250 |

Symbol: Energy | Daily Change |

/CLM5 | +1.22% |

/HOK5 | +0.55% |

/NGM5 | -3.82% |

/RBK5 | +0.65% |

In a sense, nothing has changed for natural gas (/NGM5) this week as the real economic consequences of tariffs remaining in place. The U.S. remains the world’s largest producer of liquefied natural gas, and abrupt trade barriers leave the domestic market awash in supply in the short-term. It still holds that “a double top that was carved out in 1Q’25 sees potential losses below 2.8 in the short-term.”

Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.2 p Short 2.25 p Short 3.85 c Long 3.9 c | 69% | +150 | -350 |

Short Strangle | Short 2.25 p Short 3.85 c | 79% | +1940 | x |

Short Put Vertical | Long 2.2 p Short 2.25 p | 85% | +30 | -470 |

Symbol: FX | Daily Change |

/6AM5 | +0.28% |

/6BM5 | +0.27% |

/6CM5 | +0.11% |

/6EM5 | +0.41% |

/6JM5 | +0.58% |

Alongside the rebound in gold prices, the pullback by the U.S. dollar ($DXY) is somewhat concerning. After all, the biggest loser of the Liberation Day policy shift has been the greenback, so the potential for a stronger dollar and weaker gold prices would be indicative of extreme sentiment breaking. Alas, that’s not the case here today, with both the euro (/6EM5) and the Japanese yen (/6JM5) climbing back to the top of the leaderboard at the greenback’s behest.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.0068 p Short 0.0073 c Long 0.0074 c | 62% | +350 | -900 |

Short Strangle | Short 0.0068 p Short 0.0073 c | 68% | +850 | x |

Short Put Vertical | Long 0.0067 p Short 0.0068 p | 84% | +162.50 | -1087.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.