Stock Markets May Wobble if U.S. CPI Data Locks in Fed Rate Cut Bets

Stock Markets May Wobble if U.S. CPI Data Locks in Fed Rate Cut Bets

By:Ilya Spivak

Will investors care if bonds rise and the dollar falls after U.S. CPI inflation data?

- Financial markets have shrugged at recent U.S. inflation data.

- Will the U.S. CPI report shake up the chances of a Fed interest rate cut?

- Bonds may rise as the U.S. dollar falls and reflation bets digest.

Financial markets have been keen observers of U.S. inflation data in 2024. Naturally enough, the numbers are a primary input into Federal Reserve monetary policy expectations. This made them juicy fodder for speculators over the many months the U.S. central bank girded itself for the start of interest rate cuts.

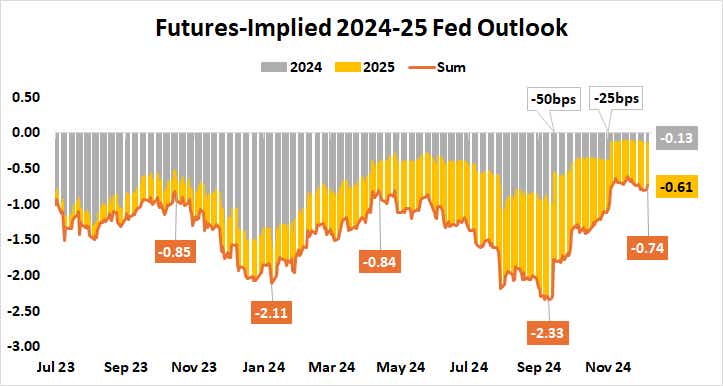

The numbers have garnered notably less interest since officials finally pulled the trigger in September, starting the way down on rates with a double-sized 50-basis-point (bps) reduction. In part, this reflects a sense of inevitability about the near-term policy trajectory.

Markets have shrugged off recent U.S. inflation data

The Fed’s Summary of Economic Projections (SEP) said that policymakers expected to cut by another 50bps this year after the opening shot, with just two subsequent meetings left on the calendar and relatively little time to reconsider. It did not take much of a logical leap to anticipate that each one of them would bring a 25bps reduction.

As it stands, November delivered accordingly, and this month is widely expected to follow suit. Fed Funds interest rate futures price in the probability of a cut at the December 18 conclave of the policy-steering Federal Open Market Committee (FOMC) at a commanding 88%, the highest in two months.

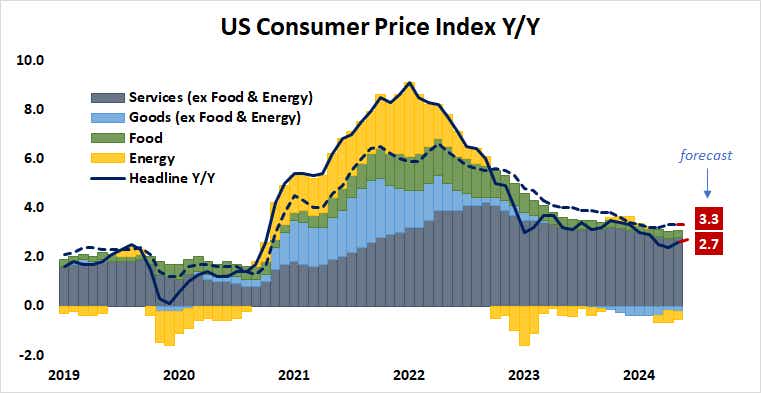

The Fed’s heretofore response to a “leveling off” in the data is another reason for its muted market impact recently. The march lower in core inflation – a measure of the underlying trend excluding volatile food and energy prices, and the focus for officials – has been stalling since July.

U.S. CPI report: will it shake up Fed rate cut bets?

A shorter pause along the way to lower in the first half of the year prompted loud hang-writing. May’s FOMC policy statement bemoaned a “lack of further progress”, and rate cut expectations were slashed by two rate cuts in June. Now, the Fed waves off economic data volatility and maintains that the trend to 2% inflation is intact.

This week, the Bureau of Labor Statistics (BLS) is expected to report that price growth quickened in November. The headline consumer price index (CPI) is expected to have grown at 2.7% year-on-year, the fastest since July. The core CPI measure is seen at 3.3%, marking a fifth month without disinflation.

The markets clearly think these numbers will not convince the Fed to reconsider this month’s rate cut. Might they instead inspire rethink of the path for 2025? As it stands, traders expect to see 60bps in cuts next year, amounting to two standard 25bps adjustments and a 40% probability of a third one.

Bonds may rise while the U.S. dollar falls as the reflation trade digests

Analytics from Citigroup suggest U.S. economic data outcomes are starting to normalize toward the markets’ baseline expectations after three months of accelerating outperformance. That might set the stage for CPI results that are close enough to consensus views to keep policy bets anchored until traders hear directly from the Fed next week.

In this scenario, traders might make more of the CPI data’s passing than its substance, taking relatively in-line results as permission to continue the speculative unwind of the two-month-long reflation trade triggered in the wake of the Fed’s September rate cut kickoff. A cautious retracement has been playing out over the past three weeks.

This might translate into rising Treasury bonds as yields backtrack. The U.S. dollar would probably decline against this backdrop. What this adjustment means for stock markets is more clouded. Rate cut hopes factored favorably into a blistering year of gains on Wall Street. Perhaps their near-term anchoring will encourage a bit of profit-taking.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.