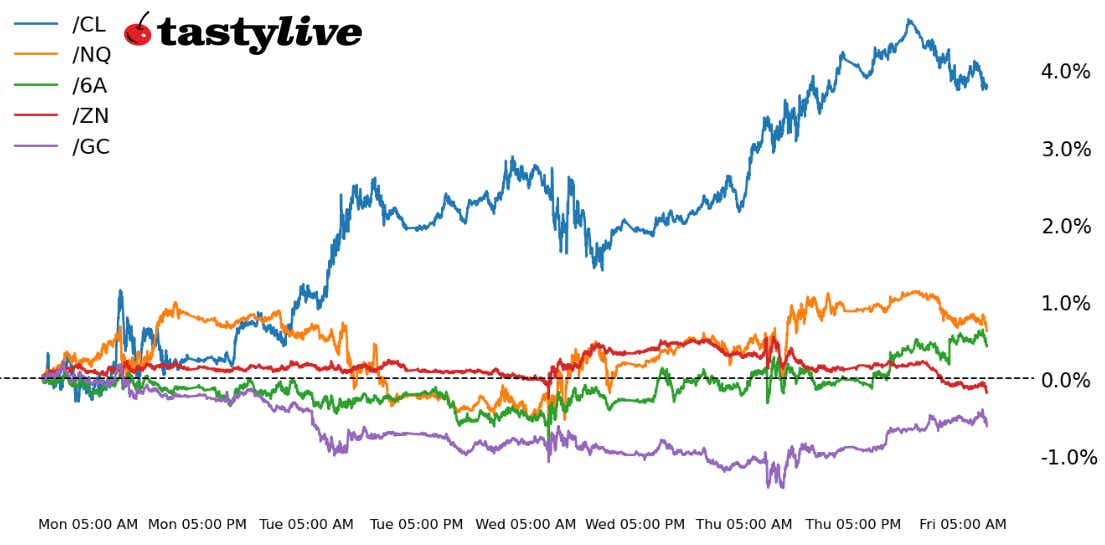

Nasdaq 100, 10-year T-Note, Gold, Crude Oil and Australian Dollar Futures

Nasdaq 100, 10-year T-Note, Gold, Crude Oil and Australian Dollar Futures

This morning’s Five Futures in Focus

- Nasdaq 100 E-mini Futures (/NQ): -0.19%

- 10-Year T-Note Futures (/ZN): -0.20%

- Gold Futures (/SI): +0.34%

- Crude Oil Futures (/CL): +0.12%

- Australian Dollar Futures (/6A): -0.17%

A relatively modest week of trading appears to be headed toward a modest end today. While the four major U.S. equity index futures are all on pace for gains over the week, enthusiasm is lacking ahead of the U.S. cash equity open. Triple witching is today, which may be boosting volume but is otherwise curtailing price action thus far. Overnight, news that the United Auto Workers would strike against the Big 3 Detroit automakers added another brick to the "wall of worry" in markets, while the other bricks "student loan repayments" and "government shutdown" take shape.

Symbol: Equities | Daily Change |

/ESZ3 | -0.01% |

/NQZ3 | -0.19% |

/RTYZ3 | -0.17% |

/YMZ3 | +0.10% |

The four U.S. equity index futures are mostly lower today, although gains for the week persist; three of the four have gains around 0.80%, while the Russell 2000 (/RTYZ3) remains the leader. Traders continue to keep an eye on Arm Holdings (ARM) following its strong initial public offering yesterday as a bellwether for renewed vigor of the AI narrative that has helped propel markets for much of 2023.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4500 p Short 4510 p Short 4590 c Long 4600 c | 48% | +500 | -400 |

Long Strangle | Long 4500 p Long 4600 c | 50% | x | -4850 |

Short Put Vertical | Long 4500 p Short 4510 p | 64% | +150 | -350 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.08% |

/ZFZ3 | -0.20% |

/ZNZ3 | -0.28% |

/ZBZ3 | -0.55% |

/UBZ3 | -0.55% |

Bonds continue to soften across the curve, led by the long-end: both 30-year (/ZBZ3) and ultras (/UBZ3) are down by 0.55% each. And while U.S. Treasury yields have pushed higher over the past few sessions, they have not been able to take out their weekly highs, keeping in place the daily outside engulfing bars (bullish on the bond price side, bearish on the yield side) that formed during Wednesday’s trading session.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 111 c Long 111.5 c | 43% | +250 | -250 |

Long Strangle | Long 107.5 p Long 111.5 c | 37% | x | -656.25 |

Short Put Vertical | Long 107.5 p Short 108 p | 82% | +109.38 | -390.63 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.34% |

/SIZ3 | +1.55% |

/HGZ3 | -0.22% |

Gold (/GCZ3) is benefiting from a modest pullback in the dollar, which is moving against a rise in Treasury yields. Metals traders are betting the Federal Reserve will opt to maintain a “wait and see” approach before further interest rate hikes despite data showing a resilient economy. Meanwhile, copper prices (/HGZ3) are trading slightly lower after trimming early gains made on Chinese economic data.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1935 p Short 1940 p Short 1950 c Long 1955 c | 11% | +460 | -60 |

Long Strangle | Long 1940 p Long 1950 c | 47% | x | -4,530 |

Short Put Vertical | Short 1940 p Long 1935 p | 60% | +240 | -260 |

Symbol: Energy | Daily Change |

/CLZ3 | +0.12% |

/NGZ3 | -1.08% |

Crude oil (/CLZ3) is pulling back slightly, down $0.15 per barrel, but remains on track to close out its third weekly gain. Overnight data from China is helping to underpin sentiment for the demand-sensitive commodity, with retail spending and industrial production figures for August coming in above analysts’ expectations. Overall, the backdrop for oil prices remains strong, suggesting today’s easing prices may be attributable to profit taking. U.S. industrial production data due this morning and Baker Hughes rig count numbers due this afternoon will provide oil traders with additional data.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 89 p Short 89.5 p Short 90.5 c Long 91 c | 10% | +450 | -50 |

Long Strangle | Long 89.5 p Long 90.5 c | 47% | X | -4,980 |

Short Put Vertical | Short 89.5 p Long 89 p | 51% | +250 | -250 |

Symbol: FX | Daily Change |

/6AZ3 | +0.17% |

/6BZ3 | -0.03% |

/6CZ3 | -0.16% |

/6EZ3 | +0.14% |

/6JZ3 | -0.33% |

It’s been a strong second half of the week for the U.S. dollar, buffeted by the European Central Bank throwing in the towel on its rate hike cycle yesterday with one final act of tightening. The euro (/6EZ3) is off of its lows, but spot prices reached their lowest point since late May, while futures hit their lowest point since mid-March. Meanwhile, one of the major currencies not in the DXY Index, the Australian dollar (/6AZ3), has been posting modest gains as concerns have relaxed in recent days following the August new yuan loans figure was reported Monday.

Strategy (21DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.63 p Short 0.635 p Short 0.655 c Long 0.66c | 54% | +210 | -290 |

Long Strangle | Long 0.63 p Long 0.66c | 28% | x | -280 |

Short Put Vertical | Long 0.63 p Short 0.635 p | 82% | +90 | -410 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.