S&P 500 and Treasuries Rally After November CPI Meets Expectations

S&P 500 and Treasuries Rally After November CPI Meets Expectations

Also, 10-year T-note, gold, crude oil and Japanese yen futures

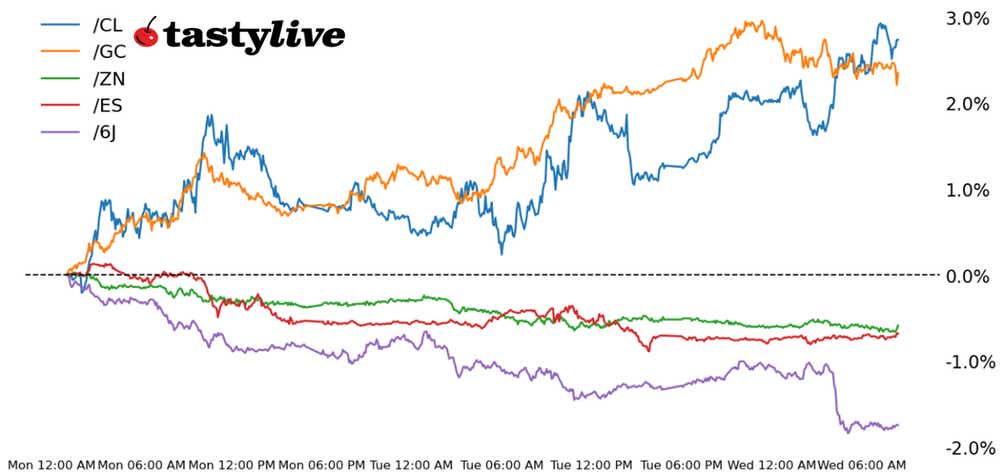

- S&P 500 E-mini futures (/ES): +0.34%

- 10-year T-note futures (/ZN): -0.03%

- Gold futures (/GC): +0.39%

- Crude oil futures (/CL): +1.17%

- Japanese yen futures (/6J): -0.32%

Price action today largely reflects relief that U.S. inflation rates are not rising faster than anticipated. U.S. equity markets rose in the wake of the November U.S. consumer price index (CPI) release, which showed gains of 0.3% month-over-month (m/m) and 2.7% Year-over-year (y/y) on the headline, right on the screws. Odds of a Federal Reserve interest rate cut for next week’s policy meeting eclipsed 90% in the wake of the report, giving Treasuries room to take back overnight losses across the curve. Elsewhere, a softer U.S. dollar may be helping to prop up commodities; gold, of note, has continued its bullish breakout attempt.

Symbol: Equities | Daily Change |

/ESZ4 | +0.34% |

/NQZ4 | +0.53% |

/RTYZ4 | +0.75% |

/YMZ4 | +0.18% |

U.S. equity markets are up across the board this morning in the wake of the November U.S. CPI report. Unsurprising inflation figures mean the near-term path for Fed rate cuts is correctly priced, and there are no major data releases or earnings reports until the meeting next week. While the Nasdaq 100 (/NQZ4) is quickly rising to the top of the pile, our focus remains on the S&P 500 (/ESZ4), which is fighting to reclaim territory above its one-week moving average.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5850 p Short 5900 p Short 6400 c Long 6450 c | 63% | +395 | -2105 |

Short Strangle | Short 5900 p Short 6400 c | 68% | +1800 | x |

Short Put Vertical | Long 5850 p Short 5900 p | 84% | +225 | -2275 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.02% |

/ZFH5 | +0.01% |

/ZNH5 | -0.03% |

/ZBH5 | -0.21% |

/UBH5 | -0.42% |

Treasuries are enjoying the fact that inflation is evolving in-line with expectations, and a lack of surprises on that front means the Fed can proceed with another round of policy loosening Dec.18. While not all in the green yet, Treasuries are reversing quickly from the overnight lows and the shorter duration issues are beginning to move into the green. An unremarkable three-year note auction failed to move markets meaningfully yesterday; there is a 10-year note auction (/ZNH5) today, with results due at 1 p.m. EST/12 p.m. CST.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 109 p Short 113 c Long 114 c | 62% | +234.38 | -765.63 |

Short Strangle | Short 109 p Short 113 c | 67% | +437.50 | x |

Short Put Vertical | Long 108 p Short 109 p | 89% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCG5 | +0.39% |

/SIH5 | -0.54% |

/HGH5 | -0.08% |

Gold prices (/GCG5) are up three days in a row this week in the wake of reports the Chinese central bank has resumed adding the shiny rock to its reserves. Alongside a U.S. dollar that’s struggling to move higher, /GCG5 has been propelled out of its symmetrical triangle and appears to be in the early throes of a bullish continuation effort. Clearing the late-November swing high (bearish engulfing candle) at 2748 would open up the technical skies for a return to all-time highs.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2590 p Short 2605 p Short 2870 c Long 2885 c | 62% | +490 | -1010 |

Short Strangle | Short 2605 p Short 2870 c | 72% | +3590 | x |

Short Put Vertical | Long 2590 p Short 2605 p | 83% | +260 | -1240 |

Symbol: Energy | Daily Change |

/CLF5 | +1.17% |

/HOF5 | +1.14% |

/NGF5 | +3.92% |

/RBF5 | +1.12% |

Energy prices are higher across the curve, led by natural gas prices (/NGF5) which continue to toil with an unwind of the widowmaker trader: this is the earliest time in nine years the winter/summer gas spreads have moved into contango. Elsewhere, crude oil prices (/CLF5) are edging high into the middle of a two-month trading range; depressed volatility (IVR: 8.5) suggests agnostic positioning for a directional breakout may be more prudent than looking to capitalize on the range itself.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 60 p Short 61.5 p Short 77.5 c Long 79 c | 63% | +360 | -1140 |

Short Strangle | Short 61.5 p Short 77.5 c | 70% | +1530 | x |

Short Put Vertical | Long 60 p Short 61.5 p | 80% | +220 | 1280 |

Symbol: FX | Daily Change |

/6AZ4 | -0.23% |

/6BZ4 | -0.13% |

/6CZ4 | -0.06% |

/6EZ4 | -0.07% |

/6JZ4 | -0.32% |

Improving risk appetite both locally (Asia) and globally are proving to be formidable headwinds for the Japanese yen (/6JZ4) this week. The in-line U.S. inflation data has helped the yen rebound modestly today, but it remains down vs. every other major currency this week. Broadly, the U.S. dollar has been clawing back its post-CPI losses against the British pound (/6BZ4) and euro (/6EZ4), both of which are struggling to make hay of inverse head and shoulder bottoming formations.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0062 p Short 0.0063 p Short 0.0069 c Long 0.0069 c | 67% | +262.50 | -987.50 |

Short Strangle | Short 0.0063 p Short 0.0069 c | 71% | +650 | x |

Short Put Vertical | Long 0.0062 p Short 0.0063 p | 91% | +87.50 | -1162.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.