Does Fed Chair Powell Have the Magic Words to Rescue Stocks?

Does Fed Chair Powell Have the Magic Words to Rescue Stocks?

By:Ilya Spivak

Can Fed Chair Powell calm the markets after key U.S. jobs data?

- Stocks and the dollar sank while bonds surged on President Trump’s tariff plan.

- The markets hoped for something that reduced uncertainty. They didn’t get it.

- U.S. jobs data, Fed Chair Powell speech now in focus to gauge the Fed response.

Financial markets crumbled in the wake of “Liberation Day”, the expansive tariff policy revamp announced by U.S. President Donald Trump. The plan appeared to be precisely the opposite of what investors were hoping for, in that it made for more uncertainty about on-coming trade policy rather than less.

U.S. stock index futures began to sink shortly after the news hit the wires. Bonds surged and the U.S. dollar lurched sharply lower. The panic follows the revelation of a schedule of tariff rates, with a base of 10% followed by additional levies that vary from one trading partner to another.

Stocks plunge as markets recoil from uncertainty in U.S. tariff plan

Taken together, this appears to be the opening bid for a flurry of bilateral negotiations that might take many months to complete. At the same time, President Trump’s penchant for swift policy reversals means the way to finalized results is likely to be bumpy. The on-then-off-again tariffs on Canada and Mexico this year are a case in point.

The bloodletting on Wall Street in the first trading session since the news has been nothing short of brutal. The bellwether S&P 500 is limping into the close with a loss of nearly 5% that has brought prices to a six-month low. The tech-tilted Nasdaq 100 shows similar results, while the small-cap Russell 2000 is now at its lowest in a year.

Crude oil and copper prices are sinking amid worries that trade disruption will hurt global growth and undermine demand. Even gold prices are lower amid broad-based liquidation. Treasury bonds are surging as traders scream out for the Federal Reserve to speed up rate cuts, hoping that cheap money will emerge as a shock absorber.

All eyes on U.S. jobs data and Fed Chair Powell speech

The key question now is whether the U.S. central bank is ready to comply. Speaking at the press conference after the March policy meeting, Powell said that the Fed is waiting for “hard data” to validate emerging signs of economic stress. He will have a chance to update that position in a scheduled speech tomorrow.

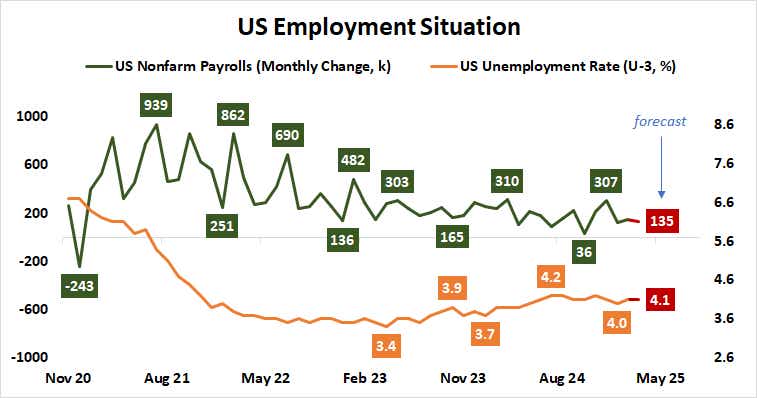

Helping to frame Powell’s remarks will be updated U.S. employment data. Job creation is seen slowing, with a rise of 135,000 in nonfarm payrolls in March. That’s down from 151,000 previously. It would also make the third quarter the slowest three-month period for job creation since mid-2020, when COVID-19 lockdowns led to mass layoffs.

Citigroup analytics suggest U.S. data outcomes are tending toward disappointment relative to forecasts. Stock markets may find a bit of solace if that translates into soggy jobs figures and Powell projects a sense of urgency on stimulus. If he maintains a “wait-and-see” approach however, another wave of heavy selling looms ahead.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.