S&P 500 in Holding Pattern as Traders Await January FOMC Decision

S&P 500 in Holding Pattern as Traders Await January FOMC Decision

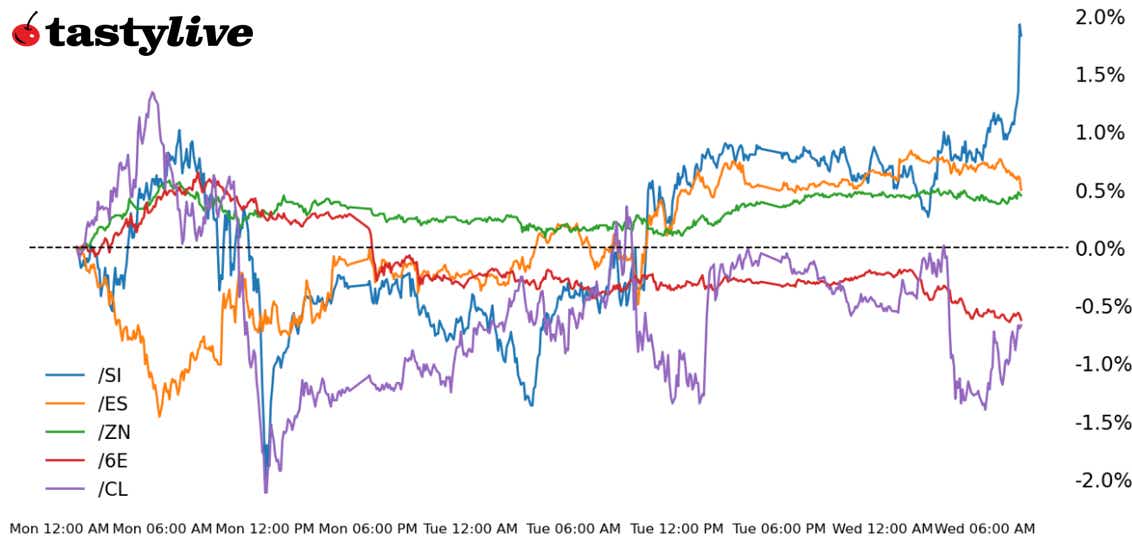

Also, 10-year T-note, silver, crude oil and euro futures

- S&P 500 E-mini futures (/ES): -0.25%

- 10-year T-note futures (/ZN): +0.14%

- Silver futures (/SI): +0.56%

- Crude oil futures (/CL): -0.58%

- Euro futures (/6E): -0.45%

What’s already been an interesting trading week will face its latest challenge in the form of the January Federal Open Market Committee (FOMC) meeting this afternoon. While markets are discounting no move (99.5% chance of a hold according to Fed funds futures), traders are worried about the path of inflation and how it may prevent the Federal Reserve from continuing its rate cut cycle.

Notably, Fed officials have expressed the opinion that tariffs could lead to higher inflation, but none been enacted. It can’t and won’t make policy changes in anticipation of a problem that has not yet materialized. Thus, the FOMC is stuck in a bit of a holding pattern; options markets are pricing in +/- 35 points in the S&P 500 by the end of the day.

Symbol: Equities | Daily Change |

/ESH5 | -0.25% |

/NQH5 | 0% |

/RTYH5 | -0.19% |

/YMH5 | -0.19% |

U.S. equity indexes remain lower on the week, but that’s more-or-less a story of Nvidia (NVDA): While the chipmaker (AI infrastructure or “the picks and shovels phase”) has shed $334 billion in market cap thus far this week, other Magnificent Seven names (application or “the gold rush phase”) for Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META) and Microsoft (MSFT) have added just under $300 billion in market cap.

While the reshuffling has continued into today, traders are decidedly focused on a Federal Reserve meeting that has a low bar of expectations; then again, so did the December FOMC meeting.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5725 p Short 5800 p Short 6375 c Long 6450 c | 60% | +750 | -3000 |

Short Strangle | Short 5800 p Short 6375 c | 65% | +2612.50 | x |

Short Put Vertical | Long 5725 p Short 5800 p | 82% | +425 | -3325 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.02% |

/ZFH5 | +0.09% |

/ZNH5 | +0.14% |

/ZBH5 | +0.27% |

/UBH5 | +0.32% |

Bonds were slightly higher this morning, with the 10-year T-note futures (/ZNH5) up about 0.14% in early trading. The Federal Reserve is expected to hold rates steady today, marking its first pause since September. That said, if the Fed holds, it could likely be inconsequential to the Treasury market. Investors will remain focused on tariffs and trade policy in between this meeting and the next. So far, President Trump has taken a mostly limited approach to tariffs, but it is still early days.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106.5 p Short 111.5 c Long 113 c | 66% | +296.88 | -1203.13 |

Short Strangle | Short 106.5 p Short 111.5 c | 70% | +515.63 | x |

Short Put Vertical | Long 105 p Short 106.5 p | 90% | +140.63 | -1359.38 |

Symbol: Metals | Daily Change |

/GCG5 | +0.12% |

/SIH5 | +0.56% |

/HGH5 | +0.28% |

Silver prices (/SIH5) rose 2.5% in early trading as investors await the Fed’s rate decision this afternoon. Today’s move brings prices into positive territory for the week, but they remain below the January swing high. Some recent tailwinds in the Chinese economy have helped to prevent more of the silver selling seen earlier this week, and traders expect more stimulus measures from policymakers there. That could help bolster silver’s position because China is the largest consumer of the metal.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.75 p Short 28.5 p Short 34.75 c Long 35.5 c | 62% | +1080 | -2665 |

Short Strangle | Short 28.5 p Short 34.75 c | 70% | +4185 | x |

Short Put Vertical | Long 27.75 p Short 28.5 p | 83% | +500 | -3250 |

Symbol: Energy | Daily Change |

/CLH5 | -0.58% |

/HOH5 | -0.33% |

/NGH5 | -10.2% |

/RBH5 | -0.54% |

Crude oil prices (/CLH5) slipped in this morning’s trading after the American Petroleum Institute reported an inventory build yesterday. Libya also announced that exports started again, which put more pressure on the global crude complex. Meanwhile, traders remain focused on tariffs after President Trump reaffirmed he would place a 25% tariff on Canadian imports. Those trade measures are expected to start this weekend, which could lead to higher gasoline and diesel prices. The Energy Information Administration (EIA) will report inventory figures later today.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 65 p Short 66.5 p Short 80.5 c Long 82 c | 62% | +380 | -1120 |

Short Strangle | Short 66.5 p Short 80.5 c | 69% | +1600 | x |

Short Put Vertical | Long 65 p Short 66.5 p | 78% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AH5 | -0.66% |

/6BH5 | -0.36% |

/6CH5 | -0.5% |

/6EH5 | -0.45% |

/6JH5 | +0.05% |

Euro futures (/6EH5) were weaker today despite a pullback in U.S. yields. Traders are concerned about growth prospects in Europe, especially as markets await news on how the new U.S. administration will impose tariffs. While economic growth has lagged in Europe, policymakers remain committed to cutting rates there amid strong expectations inflation will return to the 2% target. However, the European Central Bank seems more focused on stimulating economic growth than fighting inflation for the time being, meaning we could likely expect more rate cuts.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.00625 p Short 0.00675 c Long 0.0069 c | 65% | +400 | -1475 |

Short Strangle | Short 0.00625 p Short 0.00675 c | 69% | +700 | x |

Short Put Vertical | Long 0.0061 p Short 0.00625 p | 89% | +137.50 | -1737.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.