The S&P 500 May Do Something It Hasn’t Done Since the Great Depression

The S&P 500 May Do Something It Hasn’t Done Since the Great Depression

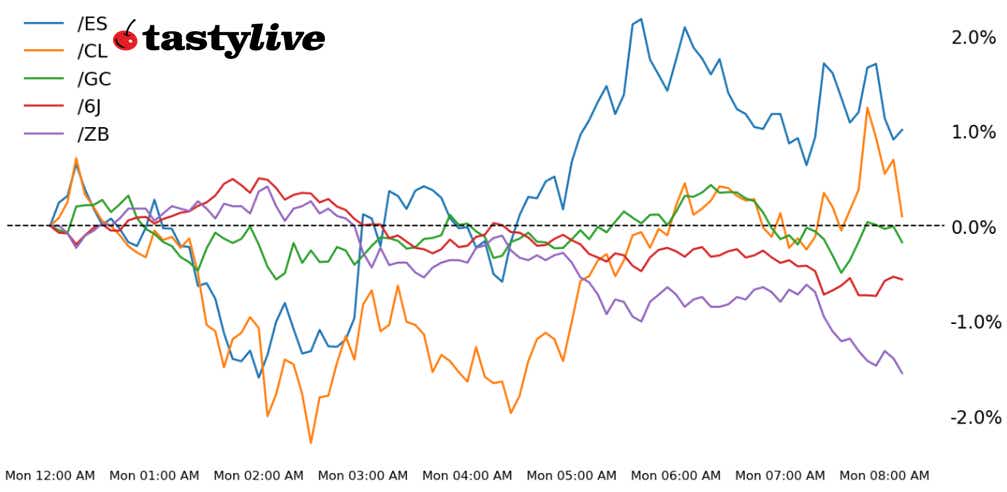

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): -3.66%

- 30-year T-bond futures (/ZB): -1.11%

- Gold futures (/GC): +0.01%

- Crude oil futures (/CL): -2.84%

- Japanese yen futures (/6J): +0.01%

Black Monday has arrived. Or maybe not. The S&P 500 experienced back-to-back losses of 4% or more to close last week, and is on the precipice of doing so for the third day in a row. That’s an exceptionally rare occurrence, having happened only three other times in history. Here’s the context: all three episodes occurred during the Great Depression in November 1929, September 1932 and July 1933. The good news is all three previous episodes represented short-term washout levels. The bad news is they all occurred during the Great Depression. We’re not in chartered territory; it’s just territory where you never want to find yourself. A sign of the times: The spot VIX traded above 50 at the open. The slightest bit of good news or signs of de-escalation could easily provoke a dramatic reversal.

Symbol: Equities | Daily Change |

/ESM5 | -3.66% |

/NQM5 | -3.75% |

/RTYM5 | -3.32% |

/YMM5 | -3.82% |

S&P 500 futures (/ESM5) fell around 3.5% this morning after a volatile overnight session in Asia, as traders priced in the impact of tariffs on the global economy. The White House signaled it wouldn’t walk back trade restrictions if the market sell-off continues, which leaves the prevailing sentiment unchecked. Companies are quickly moving to adapt business plans, which will likely include layoffs. It’s the worst-case scenario from the expected outcomes for the tariffs. Tesla (TSLA) fell 8% in early trading despite its business avoiding direct tariff impacts. Dollar Tree (DLTR) rose nearly 6% as investors expect the company to benefit during hard economic times for consumers.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4200 p Short 4300 p Short 5500 c Long 5600 c | 62% | +1525 | -3475 |

Short Strangle | Short 4300 p Short 5500 c | 69% | +7175 | x |

Short Put Vertical | Long 4200 p Short 4300 p | 83% | +712.50 | -4287.50 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.08% |

/ZFM5 | +0.07% |

/ZNM5 | -0.10% |

/ZBM5 | -1.11% |

/UBM5 | -1.8% |

30-year T-bond futures (/ZBM5) fell over 1% in early trading. Government debt rallied last week on expectations that tariffs would push inflation higher. Investors bought bonds across Asia in the session as yields fell, signaling an appetite for the safe-haven assets. The move in U.S. yields is causing concern because it signals hesitation at a time when the stock market is quickly dropping. The Treasury will auction 10- and 30-year notes and bonds later this week.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 113 p Short 115 p Short 123 c Long 125 c | 63% | +734.38 | -1281.25 |

Short Strangle | Short 115 p Short 123 c | 74% | +1968.75 | x |

Short Put Vertical | Long 113 p Short 115 p | 83% | +390.63 | -1609.38 |

Symbol: Metals | Daily Change |

/GCM5 | +0.01% |

/SIK5 | +2.62% |

/HGK5 | -3.21% |

Gold prices (/GCM5) to catch a bid despite the chaos engulfing global equity markets. Today’s price action, down 0.45%, shows that investors are likely liquidating cash, underscoring a state of panic in the market. The 3,000 level will have to hold to keep sentiment afloat following last week’s losses in the metal. Meanwhile, volatility in gold futures has quickly expanded since last week.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2810 p Short 2825 p Short 3250 c Long 3265 c | 66% | +400 | -1100 |

Short Strangle | Short 2825 p Short 3250 c | 73% | +4120 | x |

Short Put Vertical | Long 2810 p Short 2825 p | 83% | +210 | -1290 |

Symbol: Energy | Daily Change |

/CLK5 | -2.84% |

/HOK5 | -1.87% |

/NGK5 | -0.18% |

/RBK5 | -1.83% |

Crude oil futures (/CLK5) sank 2% this morning. The panic in financial markets and concern over the economy have driven crude prices sharply lower since last week. The commodity is trading just above $60 per barrel, which is just a couple dollars more than the breakeven price for many U.S. producers. If we don’t see a recovery, capital expenditure plans by U.S. producers could quickly be rolled back, along with some current production.

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 50.5 p Short 52 p Short 72.5 c Long 74 c | 63% | +430 | -1070 |

Short Strangle | Short 52 p Short 72.5 c | 71% | +2300 | x |

Short Put Vertical | Long 50.5 p Short 52 p | 78% | +290 | -1210 |

Symbol: FX | Daily Change |

/6AM5 | +0.6% |

/6BM5 | -0.58% |

/6CM5 | -0.15% |

/6EM5 | +0.15% |

/6JM5 | +0.01% |

The Japanese yen (/6JM5) cut some of its overnight gains to trade nearly flat this morning. The safe-haven currency rose during Asian trading hours as investors moved out of the dollar. Traders now expect a prolonged negotiation period between the U.S. and its trading partners. We may see a market theme where U.S. traders sell the yen and Asian traders buy it.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00645 p Short 0.0066 p Short 0.00715 c Long 0.0073 c | 66% | +575 | -1300 |

Short Strangle | Short 0.0066 p Short 0.00715 c | 73% | +1187.50 | x |

Short Put Vertical | Long 0.00645 p Short 0.0066 p | 84% | +312.50 | -1562.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.