S&P 500 Rebounds as Yen Pulls Back

S&P 500 Rebounds as Yen Pulls Back

Also, 10-year T-note, silver, crude oil and Japanese yen futures

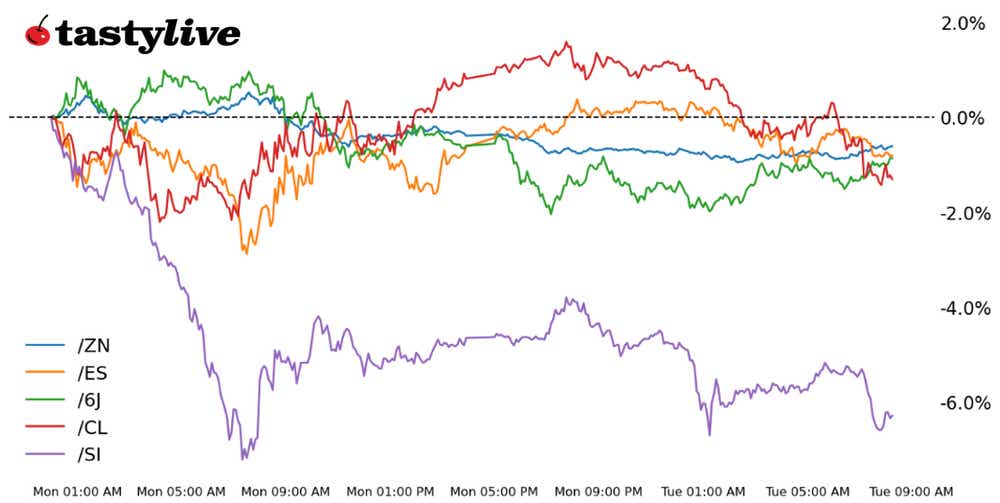

S&P 500 E-mini futures (/ES): +0.85%

10-year T-note futures (/ZN): -0.38%

Silver futures (/SI): -0.19%

Crude oil futures (/CL): +0.28%

Japanese yen futures (/6J): -0.72%

U.S. equity futures rose this morning following yesterday’s turbulent action across assets and markets. The VIX remains above 30, indicating demand for protection as markets grapple with a rising recession threat. The Japanese yen traded lower, offering some relief from an unwinding of carry trades—the practice of borrowing in a currency with low a low interest rate and reinvesting elsewhere. Crude oil prices fell along with gold and silver as the dollar strengthened. Caterpillar (CAT) rose 3% in early trading after the construction equipment company posted a strong set of numbers for its second quarter.

Symbol: Equities | Daily Change |

/ESU4 | +0.85% |

/NQU4 | +0.38% |

/RTYU4 | +0.17% |

/YMU4 | +0.38% |

S&P 500 futures (/ESU4) moderated overnight following yesterday’s nearly 3% drop. Traders are cautiously stepping in to buy, but sentiment remains fragile, and the threat of volatility is a clear and present danger with the VIX above 30. Uber Technologies (UBER) rose over 7% in pre-market trading after the rideshare company posted better-than-expected results.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5120 p Short 5125 p Short 5340 c Long 5350 c | 58% | +332.50 | -167.50 |

Short Strangle | Short 5125 p Short 5340 c | 46% | +12700 | x |

Short Put Vertical | Long 5120 p Short 5125 p | 57% | +72.50 | -177.50 |

Symbol: Bonds | Daily Change |

/ZTU4 | -0.1% |

/ZFU4 | -0.2% |

/ZNU4 | -0.3% |

/ZBU4 | -0.52% |

/UBU4 | -0.63% |

Treasuries are down across the curve as prices come off levels not traded on since last year. The 10-year T-note futures contract (/ZNU4) fell 0.3% ahead of the New York open. Some active investors are calling on the Federal Reserve to cut interest rates before its next meeting, but that is unlikely to happen, according to market-based bets. An inter-meeting Fed cut could inject more volatility into the bond market and decrease the premium that U.S. debt yields trade at vs. Japanese bonds. The Treasury is scheduled to auction off three-year notes today.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 113 p Short 113.5 p Short 115 c Long 115.5 c | 26% | +359.38 | -140.63 |

Short Strangle | Short 113.5 p Short 115 c | 53% | +1734.38 | x |

Short Put Vertical | Long 113 p Short 113.5 p | 70% | +203.13 | -296.88 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.37% |

/SIU4 | -0.19% |

/HGU4 | -0.38% |

Silver prices (/SIU4) aren’t seeing any relief today, with prices down 0.19% this morning. Active investors sold the metal at a faster pace compared to gold over the last week, which pushed the gold-silver ratio to 89.79, the highest level since early April. This means active investors may see silver trading at a discount vs. gold, as the average for the ratio of the past year is 83.68. The underperformance compared to gold is likely due to recession fears in the market, given that silver has more industrial applications than gold.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 26.5 p Short 26.75 p Short 28.5 c Long 28.75 c | 22% | +790 | -460 |

Short Strangle | Short 26.75 p Short 28.5 c | 54% | +9050 | x |

Short Put Vertical | Long 26.5 p Short 26.75 p | 58% | +550 | -700 |

Symbol: Energy | Daily Change |

/CLU4 | +0.28% |

/HOU4 | -0.65% |

/NGU4 | +2.27% |

/RBU4 | -0.89% |

Crude oil prices (/CLU4) rebounded at the New York open, with traders quickly buying the commodity and bringing prices out of the red from earlier trading. Demand in Asia remains light, which is the primary concern for crude. China imported 1.47 million barrels per day (bpd) from Saudi Arabia last month, according to LSEG data. That was down from the month before. Saudi Aramco increased its official selling price (OSP) for Asian September cargoes by 20 cents a barrel, bringing the total premium over Oman/Dubai to $2 a barrel. That is a smaller increase than expected and while it may encourage some buying from Chinese refiners it also underscores the weakness in the Asian market. Crude stocks from the American Petroleum Institute (API) are in focus today.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70 p Short 70.5 p Short 74.5 c Long 75 c | 18% | +390 | -110 |

Short Strangle | Short 70.5 p Short 74.5 c | 50% | +5180 | x |

Short Put Vertical | Long 70 p Short 70.5 p | 56% | +210 | -190 |

Symbol: FX | Daily Change |

/6AU4 | -0.15% |

/6BU4 | -0.6% |

/6CU4 | -0.06% |

/6EU4 | -0.41% |

/6JU4 | -0.72% |

Japanese yen futures (/6JU4) are finally taking a break, with prices down 0.81% this morning. Stocks in Japan haven’t been spared from the volatility that was arguably caused by the yen’s rapid ascent. The moderation suggests that carry trade unwinds might be easing, which could help to cool volatility across assets. If the yen returns to its fundamentals, we should see some downside over the short term amid a pullback in crude oil prices and slightly higher Treasury yields.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00685 p Short 0.0069 p Short 0.00705 c Long 0.0071 c | 27% | +462.50 | -162.50 |

Short Strangle | Short 0.0069 p Short 0.00705 c | 56% | +2162.50 | x |

Short Put Vertical | Long 0.00685 p Short 0.0069 p | 64% | +275 | -350 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.