Nvidia Earnings Preview—Up Over 200% This Year

Nvidia Earnings Preview—Up Over 200% This Year

By:Mike Butler

An 8% stock price move is expected, but is another beat in store?

- Nvidia is scheduled to report quarterly earnings after the market closes on Nov. 20.

- The company has a strong earnings history, beating estimates four quarters in a row.

- Its expected to report $0.74 earnings per share on $33.03 billion in revenue.

Nvidia earnings preview

Nvidia (NVDA) is the poster-child for success this year, with a stock price increase that now exceeds 200% after opening the year at $49.24 and currently sitting around $148 per share. After falling sharply with the rest of the market in early August, the stock is up over 50% from that low.

It seems everyone wants to get their hands on NVDA stock, but that puts pressure on the company to continue to perform—can it beat earnings estimates for a fifth time in a row next week?

In case you missed it, the company did execute a 10-1 stock split, which is why the price of the stock seems much lower than earlier this year.

On the Nov. 20 earnings call, Nvidia is expected to report earnings per share (EPS) of $0.74 on $33.03 billion in revenue. Both figures are significantly higher than last quarter's estimates.

As reported in the press release last quarter, Nvidia posted record quarterly revenue of $30.0 billion, up 15% from the previous quarter and up 122% compared to last year. Quarterly Data Center revenue is also through the roof: $26.3 billion is 16% higher than the previous quarter and 154% higher than a year ago.

Nvidia seems to be executing the same move for AI that Tesla did for EV—make sure to dominate the parts that everyone needs to continue to boost their market share in the booming space. Tesla focused on making the best batteries and charging stations at the lowest price, and it made less sense for competitors to create their own. NVIDIA dominates the chips required to enhance AI software, and as long as the other Magnificent 7 stocks continue to battle for AI market share, Nvidia is in a great spot to benefit.

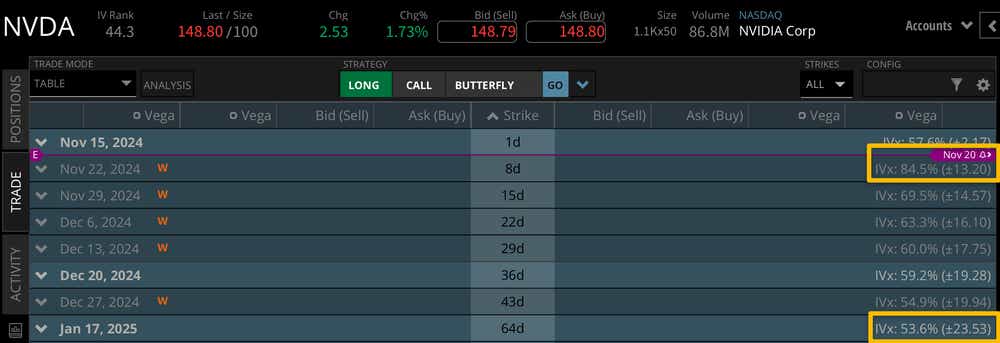

Looking at the implied volatility of the options market can help us understand the potential magnitude of the move for next week. We can also compare that expected move to further-dated cycles to get a feel for how much weight the market is putting on this earnings announcement. Looking at next week, the market is pricing in a +/- $13.20 stock price move for NVDA. This is over 8% of the notional value of the stock price, so the market is expecting a big move next week considering most earnings announcements fall in the 5%-10% range.

Looking through the end of the year, we see a +/- $23.53 expected move for the JAN ’25 cycle. This tells us that even though implied volatility is high, the market is expecting even more volatility through the holidays and into next year. If this figure were smaller and closer to the expected move for next week, it would tell us the market is placing a ton of weight on the earnings report. We're not really seeing that.

Bullish on NVDA stock for earnings

If you're bullish on NVDA stock for earnings, you're certainly looking for an EPS and revenue beat, even though estimates are higher. It almost feels like this is required for a bullish move, as NVDA has had such a strong year and there isn't much room for error with such massive increases year-over-year in performance. There are a lot of positive things happening for NVIDIA, but the AI and tech giant still needs to post stellar numbers if we're to expect a rally at all-time highs.

Bearish on NVDA stock for earnings

If you're bearish on NVDA stock for earnings, you're looking for a tempering of success and a slower forecast relative to what we've seen this year. If NVDA misses on EPS or revenue, I think the market will have a hard time pushing this stock price higher. Competitors are still vying for market share, so the pressure is on for NVDA to perform.

Tune in to Options Trading Concepts Live on Wednesday, Nov. 20 for an options trading strategy deep-dive session ahead of the earnings announcement for Nvidia!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.