Trading VIX Options Based on IV Ranks

Trading VIX Options Based on IV Ranks

By:Kai Zeng

How to trade the VIX without large P/L swings

- Current VIX and volatility of volatility (VVIX) are above historical averages

- There are two main strategies for selling VIX using options.

- Selling VIX call spreads is more effective in markets with higher IVR.

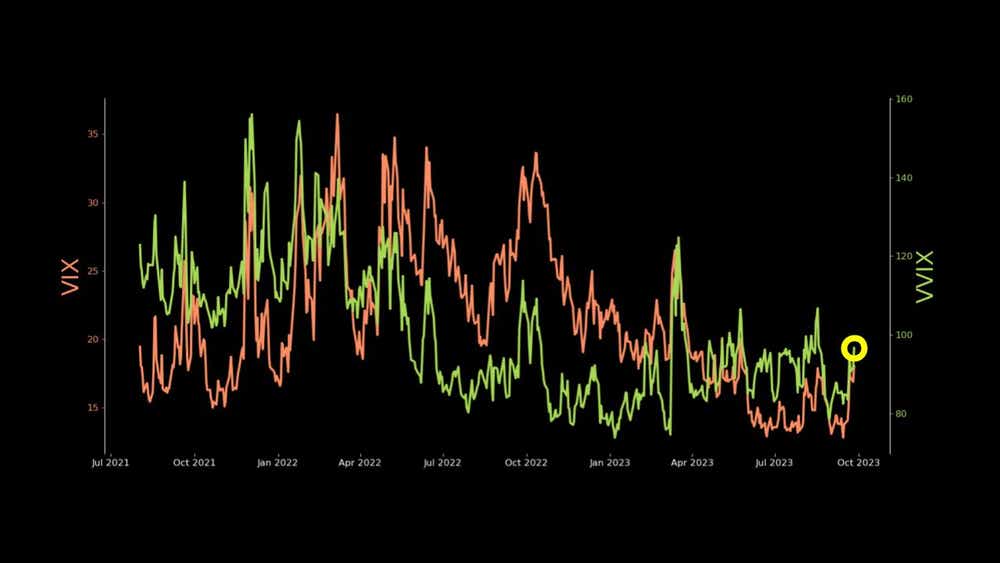

Recently, the volatility index (VIX) has experienced a sharp increase to around 20%, significantly above its historical average.

This has been mirrored by a parallel rise in the implied volatility of the VIX (also referred to as the volatility of volatility, or VVIX), thereby presenting a broader range of opportunities for contrarian traders interested in selling options directly on the volatility index.

Since VVIX is a measure of the implied volatility of the VIX, the two measures tend to show a positive correlation, which differs from the typical negative correlation between stocks and implied volatility (IV).

The VIX is renowned for exhibiting a strong call skew, implying that the prices of options are higher on the call side. The degree of this skew tilts so strongly in favor of the call side that selling put options becomes an impractical choice.

Two strategies for selling VIX

So, there are two main strategies traders can employ to sell VIX using options. They are selling naked calls or call spreads. Selling a naked call can yield the highest premium, but the risk could theoretically be unlimited. To define the risk, traders can opt for a call spread. However, the premium for a call spread becomes less attractive as it involves a relatively more expensive long-call option.

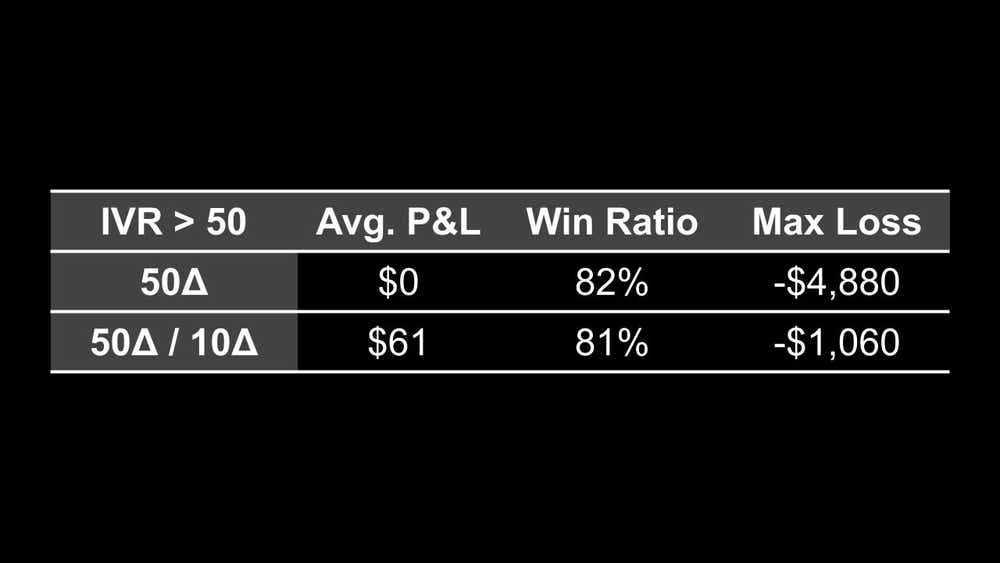

To understand the performances of these two strategies more closely, let's compare short 50Δ calls and 50Δ /10Δ call spreads over the past decade based on various IV Ranks.

In low IVR markets (lower than 25%), the returns are similar for both naked calls and call spreads. However, defining the risk can reduce the maximum loss by over 50%.

A higher IVR can boost profits

Interestingly, a higher IVR (between 25% and 50%) can boost the profitability and win ratio of both strategies while simultaneously reducing the risks.

However, when the IVR is at an elevated level (above 50%), a rare occurrence, both strategies yield lesser profit as the risk of substantial losses rapidly escalates. Despite this, the risk-defined strategy remains the superior choice. This makes sense for most traders, as no one wants to take on excessive risk.

In summary, selling naked VIX options can involve considerable risk. Therefore, to mitigate potential losses and enhance profitability, it is advisable to use risk-defined strategies. Typically, selling VIX call options is more effective in markets with higher IVR. However, traders should be cautious of extreme levels of volatility, which can significantly impact overall profitability when trading the volatility product itself.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.