Fed Rate Decision, U.K. and Japan Inflation, BOE and BOJ Meetings: Macro Week Ahead

Fed Rate Decision, U.K. and Japan Inflation, BOE and BOJ Meetings: Macro Week Ahead

By:Ilya Spivak

Stock markets may have set an impossibly high bar for Fed rate cuts as the FOMC meets

The Federal Reserve may struggle to satisfy stock markets’ dovish demands.

The British pound’s gains may follow on a CPI data uptick and a neutral Bank of England.

The yen may weaken on underwhelming inflation and a gradualist Bank of Japan.

Wall Street perked up last week. The bellwether S&P 500 stock index added nearly 4% while the tech-tilted Nasdaq 100 climbed almost 6%. Treasury yields continued to fall across maturities as bonds pushed higher while gold prices surged 3.4%. The U.S. dollar traded lower.

All this seems to reflect dovish pre-positioning as traders wait at the edge of their seats for what the Federal Reserve will do this week. The markets seemingly waited to get past U.S. inflation data to make their move. The numbers printed broadly in line with forecasts and offered little in the way of a dovish lead.

From here, these are the macro waypoints likely to shape what’s next.

U.S. retail sales data

August’s update on retail activity will mark the last bit of opportunity for the markets to fine-tune their assessment of the U.S. economy before the Fed has its say. It is expected to show receipts rose 0.2%, a marked step down from the 1% rise of the previous month.

Analytics from Citigroup suggest U.S. economic news flow has cautiously steadied relative to baseline forecasts in recent weeks, but surprise risk remains tilted to the downside. A soft result might encourage hopes for a more dovish message from the Fed, but lasting conviction is unlikely before the central bank has had its say.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Federal Reserve monetary policy meeting

All eyes are firmly focused on Fed Chair Jerome Powell and the Federal Open Market Committee (FOMC) as it gears up for the start of a long-awaited interest rate cut cycle. That much has been fully priced in by the markets, according to benchmark Fed Funds futures.

Speculation is focused on whether officials will deliver a standard-sized 25-basis-point (bps) reduction or a jumbo 50bps one. An updated Summary of Economic Projections (SEP) will be scrutinized for how it lines up with policy path implied by the markets. A post-meeting press conference with Mr. Powell may add helpful context or muddy the waters.

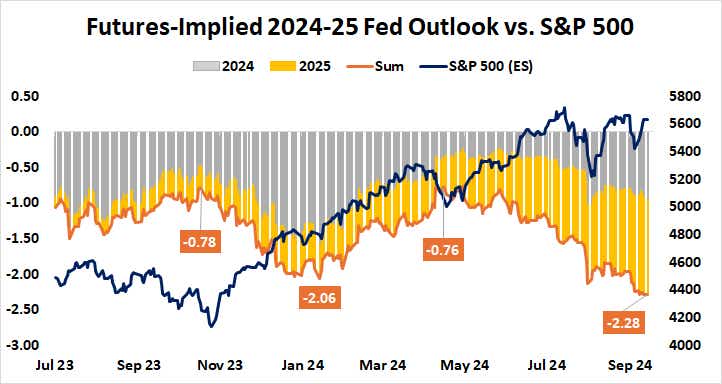

As it stands, the probability of a 50bps cut stands at a commanding 61%. The total stimulus tally for 2024 stands at 95bps, suggesting at least one of the Fed’s three remaining policy meetings this year will bring a double-sized adjustment. Markets price in 134bps in cuts for next year.

The U.S. central bank has a large adjustment to make if it is to catch up to such dovish positioning. Relative to its most recent forecast update in June, it would need to pencil in two additional rate cuts for this year and one more for 2025. All that, and it would still need to imply more may be on the way to surprise with generosity.

On balance, this seems to set a relatively low bar for disappointment. While Powell has pledged to do what it takes to avoid further weakening the labor market, stock markets may slump in disapproval if they conclude officials are not moving fast enough. The U.S. dollar stands to gain in such a scenario.

Bank of England monetary policy meeting

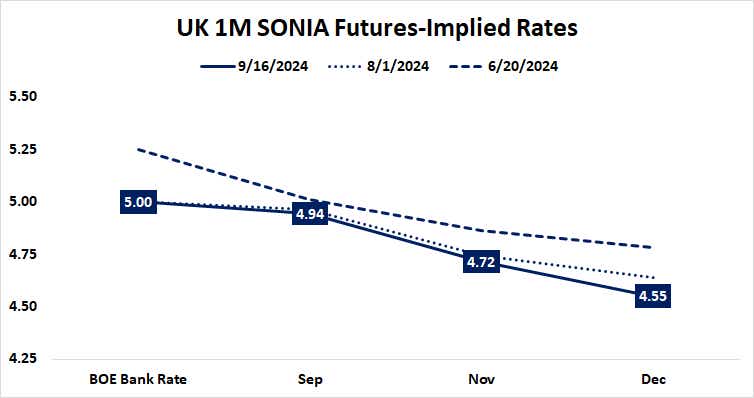

For its part, the Bank of England (BOE) is expected to hold fire this month after starting its easing cycle with a 25bps rate cut in August. Benchmark SONIA interest rate futures price in 45bps further in 2024, implying standard-sized cuts are seen as nearly certain at the U.K. central bank’s meetings in November and December.

In the run-up to the policy meeting, August consumer price index (CPI) data is due to show core inflation quickened for the first time since May 2023, rising to 3.5% year-on-year. If that inspires the BOE to push back on rate cut speculation, the British pound may find support as the likelihood of a December’s decrease is marked down.

Bank of Japan monetary policy meeting

A pause is also expected in Japan, where the only major central bank that is raising instead of cutting interest rates is seen in wait-and-see mode this month. Another 10bps in tightening is priced in over the coming 12 months, pushing the BOJ benchmark rate to 0.35%.

As with the U.K., local CPI data will precede the central bank. The headline inflation rate is seen rising to 3% year-on-year, the highest since October 2023. Leading purchasing managers’ index (PMI) data hinted that firms are reluctant to pass through rising input costs, which may set the stage for a downside surprise that weighs on the Japanese yen.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.