Download This ETF Cheat Sheet for Free!

Download This ETF Cheat Sheet for Free!

See how your favorite exchange-traded fund’s volatility stacks up against the S&P 500

Free download this week of our ETF guide.

We've also added a "tasty Volatility Score" to compare ETF volatility with the S&P 500:

MUCH Less Volatile than the S&P 500

Slightly Less Volatile than the S&P 500

As Volatile as the S&P 500

Slightly More Volatile than the S&P 500

More Volatile than the S&P 500

MUCH More Volatile than the S&P 500

Results of the Q1 Contest

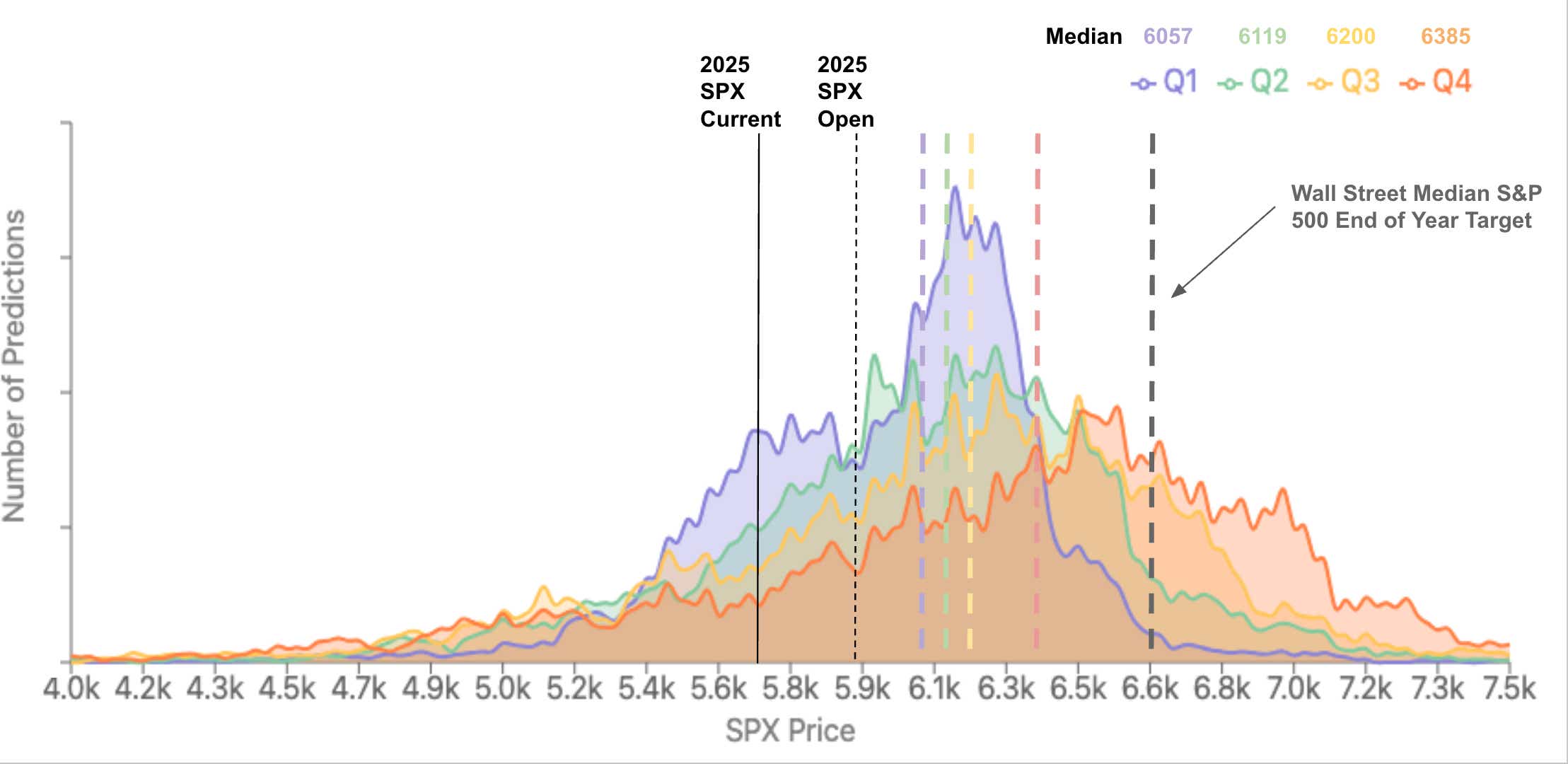

Earlier this year, we invited our readers and tastylive viewers to participate in our "Guess the Market" contest for each quarter of 2025. The chart below displays the distribution of predictions across all four quarters.

Below, we show the distribution for each quarter.

A few things that we noticed:

Contestants leaned bullish. While they predicted a modest 2.7% gain by Q1's end, the market has actually declined by 3% — a significant 5.7% gap between expectations and reality.

Wall Street Experts were even more bullish. Professional analysts proved even more optimistic than our audience. Contestants projected an 8% year-end increase, but Wall Street's median target sits substantially higher at 12%.

Math. Just 22% of participants accurately forecasted the market at or below its current level ($5,750). The one standard deviation range in SPX suggests a Q1 finish, as of today, between 5650 and 5875.

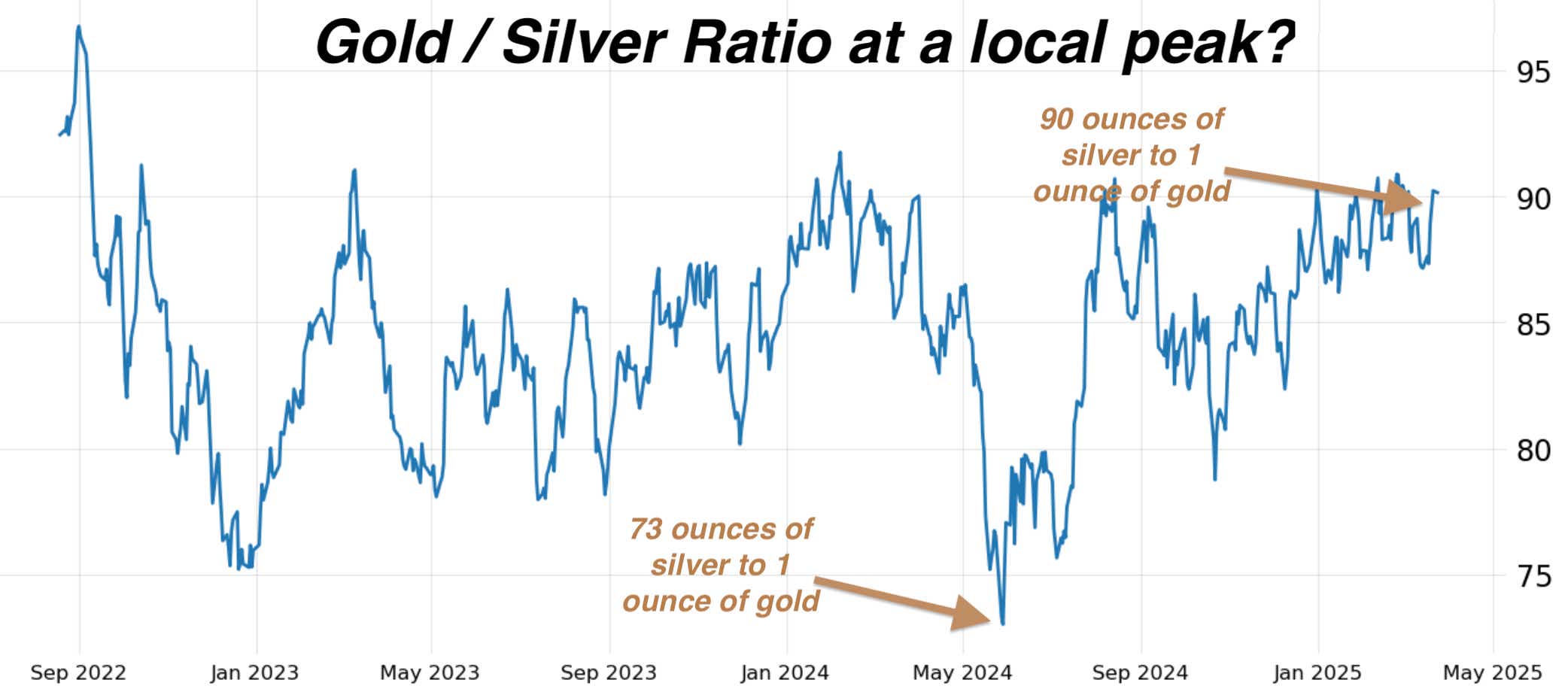

Gold / Silver Ratio at a high?

Check out the visual below: Gold has increased in price considerably more than silver.

The Gold to Silver ratio in May 2024 was 75 ounces of silver to 1 ounce of gold. Today, it is 90 ounces of silver to 1 ounce of gold. That means gold has been strong compared to silver.

Do you think the ratio is too high? If you do, consider this trade: buy silver and sell gold.

Two Trade Ideas

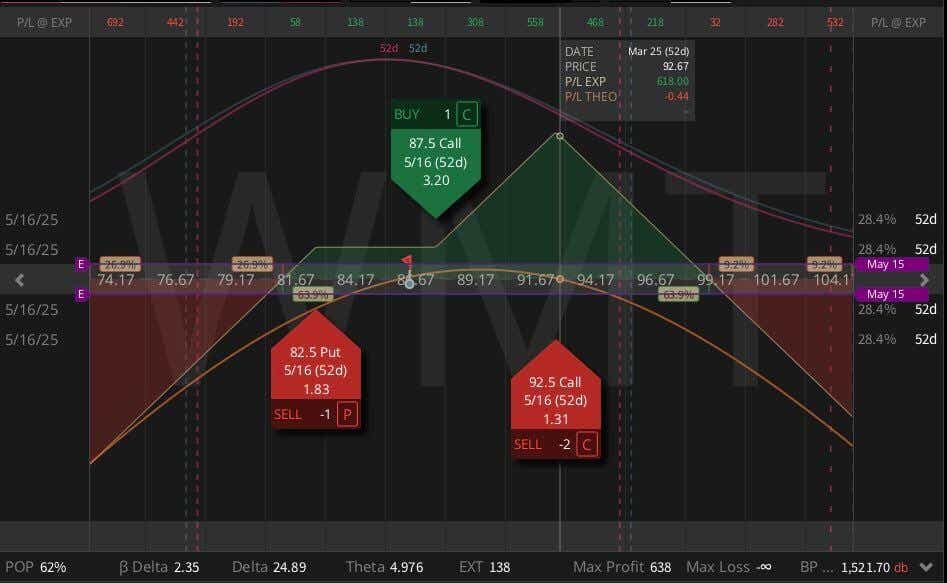

WMT ($86.36) Naked Put + Call Ratio (MAY) $1.38 Credit

Walmart has taken a 10%-20% hit over the last month or so, with the 200 day moving average around $83, this might be a time to consider some long delta. With implied volatility rank (IVR) still high at 55, it pays to sell some premium. Selling the 82.5 put on the downside, to finance the upside call ratio spread for a net credit of $1.38, provides some added upside to 92.5 with risk roughly below 81 and above 100.

SLV ($30.67) Poor Man's Covered Call/Ratio (JUN/APR) $2.21 Debit

Silver has had a nice run, but the Gold/Silver ratio has continued to hit highs with Gold surging. If you think there might be a catchup trade, getting some long delta in SLV would fit the assumption. With silver up almost 3% today, maybe we cap out a bit higher in the short term, buying a 28 call in June provides the delta, while selling 2x the 31.5 calls in APR provides some positive decay, with a net small upside delta skew.

Subscribe to Cherry Picks. We are okay with grifters, but to be on our good side subscribe to our newsletter. Please share with your friends—and if you don't have friends—our condolences.

We love new subscribers! We’re okay with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.