DraftKings Earnings Preview: Can the Stock Beat Dark Expectations?

DraftKings Earnings Preview: Can the Stock Beat Dark Expectations?

By:Mike Butler

Analysts anticipate high volatility with a price move of over 10%

- DraftKings will report quarterly earnings after the market closes on

- Thursday.

- The popular sportsbook is expected to announce an earnings-per-share loss of ($0.25) on $1.11 billion in revenue.

- A stock price move of more than 10% is priced into this week's options expiration.

- DraftKings has had spotty earnings recently, and states are cracking down on taxation—sure to be a topic of conversation during the earnings call this week.

DraftKings earnings preview

DraftKings (DKNG) has made waves in the past few years, becoming a household name in the world of sports entertainment and sports betting. The company is now legal in almost every state, and its ads are appearing alongside televised sports. It’s set to announce quarterly earnings after the stock market closes on Thursday.

DraftKings is expected to report an earnings-per-share (EPS) loss of $0.25 on $1.11 billion in revenue. Both figures are lower than last quarter's expectations.

In a letter to shareholders, DraftKings offered some context around earnings expectations: “We are increasing our fiscal year 2024 revenue guidance to $5.05 billion to $5.25 billion from the range of $4.80 billion to $5.00 billion, which we previously announced on May 2. Our updated 2024 revenue guidance range equates to year-over-year growth of 38% to 43%.”

The letter went on to say that “the increase in revenue guidance is driven by strong customer acquisition, engagement and retention trends, as well as the inclusion of Jackpocket and the launch of our Sportsbook product in Washington, D.C."

Jackpocket, a digital lottery company, was acquired by DraftKings in late May.

DKNG stock has had a bumpy ride in 2024, opening the year at $34.62 and currently sitting around $35.75 per share. This modest annual gain has not been without some big swings, as the stock reached a high of $49.57 earlier this year and has had trouble staying elevated ever since.

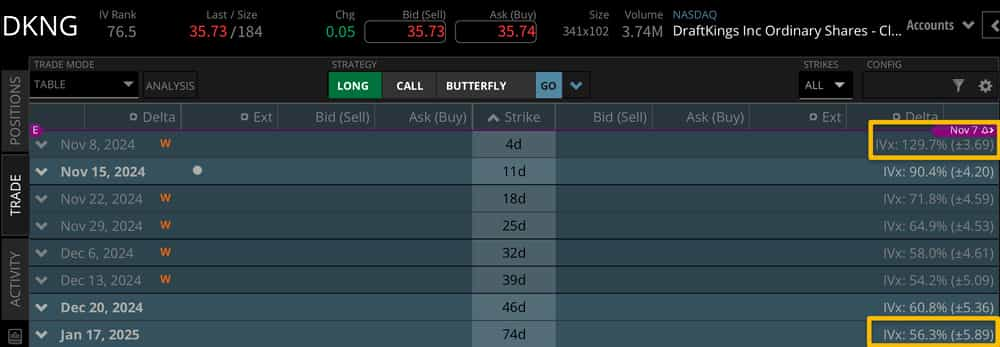

Analyzing the implied volatility of the weekly options cycle that contains the earnings announcement, we can see a +/- $3.69 expected stock price move through this week.

This is over 10% of the current stock price, which makes DraftKings earnings a high implied volatility event. Most companies report earnings between the 5%-10% implied volatility range in relation to the notional value of the stock price before reporting.

Looking through the end of the year, we see a +/- $5.89 expected stock price move in the January 2025 options cycle. With this week's projected move accounting for over 50% of the January cycle, we can expect some volatility after the announcement on Thursday.

Bullish on DKNG stock for earnings

If you're bullish on DKNG stock for earnings, you want to see a big EPS surprise. If they can post a smaller loss than expected, or even post a gain on the quarter, we could see a bullish move in the stock price. As stated in the shareholder letter, the company raised annual 2024 revenue targets to over $5 billion, so there are some bright spots within the turbulence of the stock price so far this year.

Bearish on DKNG stock for earnings

If you're bearish on DKNG stock for earnings, you're looking for a result worse than expected this quarter in terms of EPS losses at the very least. Teetering between positive and negative EPS expectations is a tough spot to be in for any company, and pairing that with a high implied volatility this week could mean trouble for DKNG stock if it cannot exceed expectations.

Tune in to Options Trading Concepts Live on Thursday at 11 a.m. CDT for a live look at earnings strategies ahead of the DraftKings announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.