Dollar Aims Higher, Stocks at Risk on FOMC Meeting and U.S. Jobs Data

Dollar Aims Higher, Stocks at Risk on FOMC Meeting and U.S. Jobs Data

By:Ilya Spivak

The U.S. dollar is aiming higher if the Federal Reserve tries to talk down the markets’ rate cut expectations. Meanwhile, stock markets are at risk.

- Euro may suffer deeper losses if GDP, CPI data fuels ECB rate cut bets.

- Stocks at risk if the Fed pushes back against traders’ dovish speculation.

- Upbeat U.S. jobs data may continue to eat into stimulus expectations.

Stock markets continued to inch higher last week. The bellwether S&P 500 added 0.96%, scoring a third consecutive week on the upside and hitting a record high. The tech-heavy Nasdaq rose 0.51%. The yield curve steepened a bit, with the front end a touch weaker while longer-dated rates moved up. Gold fell and the U.S. dollar rose.

Crude oil prices were a key standout. The WTI contract jumped 6.5% after six weeks of near standstill. Escalating tensions along the key Red Sea shipping route through the Suez Canal and better-than-expected U.S. economic data may have come together to flag supply risks alongside a firmer demand outlook.

Here are the macro waypoints that are likely to shape price action in the week ahead:

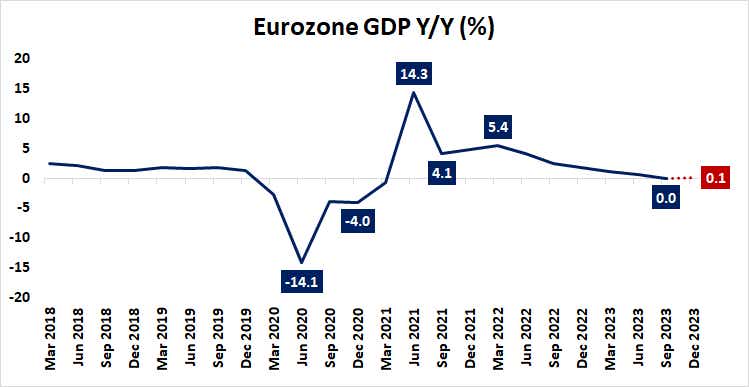

Eurozone gross domestic product (GDP) and consumer price index (CPI) data

Economic growth is expected to have returned to the Eurozone in the fourth quarter of 2023. GDP is seen growing 0.1% year-on-year after idling in the three months to September. The currency bloc’s largest economy has become an outsized headwind. German output is expected to shrink 0.4% year-on-year for a second consecutive quarter.

Data due later in the week is expected to see inflation receding in January after a pop in the prior month. The benchmark CPI gauge is projected to post a rise of 2.8% year-on-year. That’s down from 2.9% in December, but still north of the cycle low at 2.4% in November as base effects from energy price subsidies play out.

Eurozone economic data outcomes have mostly converged on market-watchers’ consensus forecasts according to analytics from Citigroup, albeit with a slight lingering bias toward underperformance. Leading purchasing managers index (PMI) surveys show economic activity has been contracting for seven consecutive months as of January.

This seems to set the stage for broadly as-expected weakness, with a modest tilt toward the risk of a downside surprise. The euro fell after last week’s European Central Bank (ECB) monetary policy meeting, with traders seemingly concluding that officials’ resistance cutting rates is waning. Soft GDP and CPI data may inspire more of the same.

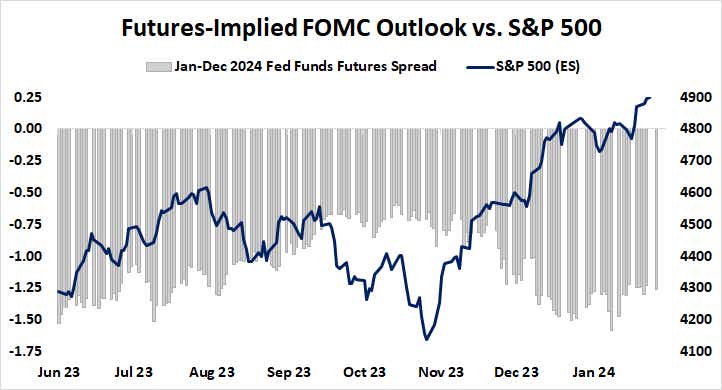

Federal Reserve monetary policy meeting

Wall Street has been flying high since financial markets moved to price in expectations of a brisk Federal Reserve easing cycle in November and December of last year. Fed Funds futures are implying that traders anticipate five 25-basis-point (bps) rate cuts to be issued in 2024, with the first one arriving no later than May.

Investors see about a 50/50 probability of an earlier move in March. Parsing through policymakers’ signaling to set the stage for that meeting is likely in focus this time, with much attention being paid to the language of the statement from the Federal Open Market Committee (FOMC) and the post-meeting presser with Chair Jerome Powell.

Fed officials have steadfastly argued that policy is “data dependent” as the central bank tries to smooth over the transition from fighting inflation to underpinning economic growth. To that end, last week’s unexpectedly strong PMI and GDP numbers seem to demand at least some pushback on the markets’ ultra-dovish tilt.

Stocks have managed to stay well-supported since the beginning of the year even as rates markets nixed bets on a sixth rate cut. Their resilience will be tested if traders are pushed to trim back easing expectations further after this week’s conclave.

Meanwhile, the U.S. dollar has found fuel a rebound, and may continue to reclaim lost ground.

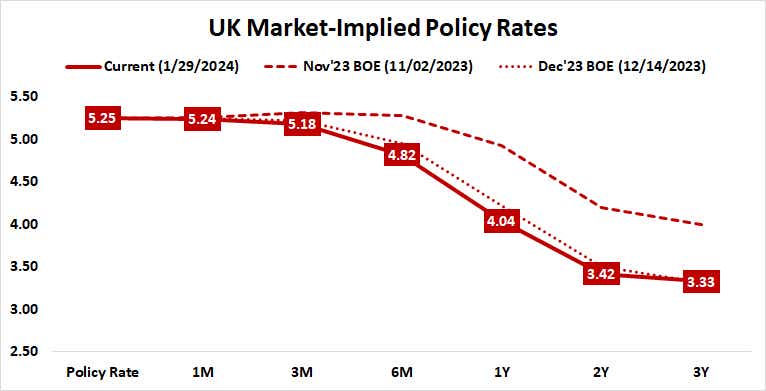

Bank of England (BOE) monetary policy meeting

No policy changes are expected from the United Kingdom’s central bank this month. A rate-cut program set to begin no later than June, according to the priced-in policy path reflected in the swaps market. Traders have penciled in 100bps or 1% in easing for this year.

Leading PMI data suggests that the UK has picked up some momentum in the past three months, with economic activity expanding at the fastest pace in seven months in January. Meanwhile, market-based measures of inflation expectations have pushed higher in recent weeks. The British pound may rise if this inspires hawkish pushback at the BOE.

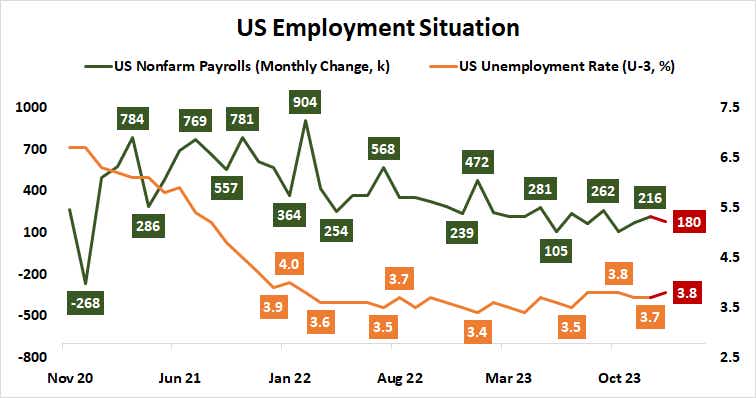

U.S. employment report

January’s official U.S. employment report will mark the first big test for financial markets after the Fed’s latest guidance exercise earlier in the week. Nonfarm payrolls are seen adding 180,000 jobs while the unemployment rate ticks up a bit to 3.8%, marking a three-month high.

On balance, such outcomes would fall broadly in line with recent trends. Analytics from Citigroup show that realized results on U.S. economic data have tended to outperform relative to baseline forecasts by a growing margin in past two weeks. This implies that surprise risk is tilted toward better-than-expected results.

A rosier view of the labor market may dilute rate cut expectations further. It remains to be seen where the policy path consensus lands after the FOMC meeting, and if risk appetite holds up despite any backsliding on investors’ dovish mythmaking. Nevertheless, evidence arguing against urgent rate cuts is a threat for stocks and bonds alike.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday.@Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.