Trading China Weakness: Australian Dollar Looks Better vs. Stock Market

Trading China Weakness: Australian Dollar Looks Better vs. Stock Market

By:Ilya Spivak

China’s economy slowed to its weakest point this year, and more pain appears likely

- November PMI data says China’s economy has slowed to its weakest point in 2023.

- More pain looks likely as a global recession could be on the horizon in 2024.

- The Australian dollar looks like a better vehicle to trade this trend vs. Chinese stocks.

It has been almost a year since China began reopening after scrapping its restrictive “zero-COVID” policy of mass lockdowns. The results have underwhelmed, to say the least.

Investors were filled with optimism as Beijing began loosening the reins in December 2022, hoping for a big-splash recovery. It happened just as the Federal Reserve and other major central banks were seen nearing the end of a blistering rate hike program sometime by mid-2023. A lucrative year of meaty returns seemed to be just on the horizon.

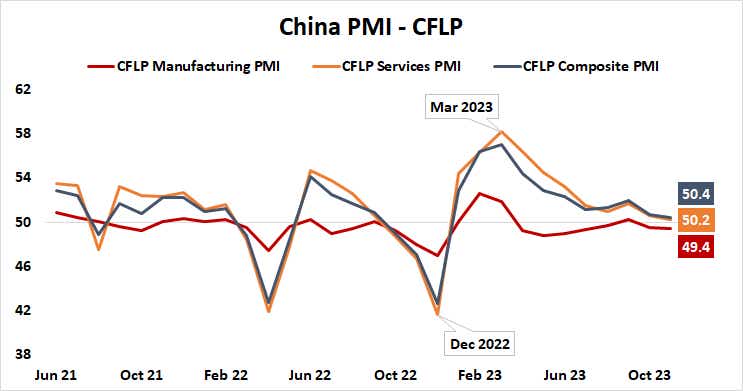

This exuberance proved short-lived. A brief surge in service-sector demand powered by the unshackling of Chinese consumers crested by March. An anemic reopening push on the manufacturing side had already run out of steam a month earlier. It has been all downhill from there.

China’s economy: going from bad to worse

November’s official set of purchasing managers’ index (PMI) readings from the China Federation of Logistics and Purchasing (CFLP) painted a dismal picture. The factory sector shrank for a second consecutive month while services eked out a barely-there expansion. In all, it was the slowest month for economic growth this year.

China shook off pandemic restrictions over a year after its main customers in the U.S. and Europe. By then, the customers were busy diversifying away from China-dependent supply chains. They’d also come down from a pop of sharp catch-up economic growth linked to their own reopening, exhausting most of the stimulus money left in consumers’ pockets.

The way back to prosperity looks tenuous. China looks to have suffered lasting damage to its role as the go-to middle step in the global supply chain. It will be difficult to win back lost market share as key trading partners bristle at Beijing’s sharp-elbowed approach to geopolitics in recent years. Diplomatic efforts at mending fences are off to a slow start.

Meanwhile, demand will be hard to come by even if everyone decides to play nice again. PMI data from S&P Global and JPMorgan tracking worldwide economic activity showed that it came to a standstill in October. More pain is likely ahead as the full impact of dramatic interest rate hikes is absorbed.

The Federal Reserve has estimated that the economy can take 12 to 18 months to totally reflect a single rate hike. Assuming an average lag of 15 months on that basis, it looks as though less than half of the U.S. central bank’s tightening cycle has been accounted for. That leaves plenty of pain to be suffered through in 2024.

Trading China’s economic weakness: the Australian dollar

Finding the trade to capture this trajectory in Chinese stock markets seems challenging, at least for now. They’ve vastly underperformed. Wall Street is nearly 20% on the year and emerging markets excluding China have added 11.4%. China’s benchmark CSI 300 index is down 12.3%.

Chasing prices lower from here seems to demand that some sort of narrative-altering negativity needs to emerge. That has been hard to come by. Data from Citigroup reveals Chinese economic data outcomes have started to outperform relative to expectations because the forecasts themselves have been sharply downgraded.

The Australian dollar may be a better vehicle. It has roared higher against its U.S. counterpart since late October, echoing an upswell of risk appetite across global financial markets animated by hopes for the start of a Fed rate cut cycle. As the prospect of global recession appears increasingly likely, support may fade.

The so-called “Aussie” is especially sensitive to China’s business cycle. The East Asian giant edged out Japan as Australia’s top trading partner in 2007 and has retained its perch ever since, despite an upswell in tensions between Beijing and Canberra over recent years. The currency may be quick to rediscover gravity as growth concerns retake center stage.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.