September Seasonality

September Seasonality

Sure, September has been consistently bearish for equities in recent years but for one market it has been consistently bullish

September is historically the worst month for stocks.

Over the past five years, it has been the best month for Treasuries.

September is also a bullish month for /VX.

The unofficial end of summer has arrived, opening the door to the worst month of the year for stocks: September.

When harvest season arrives, investment sentiment has soured in financial markets (mutual funds’ fiscal year end in October may have to do with it). We remain in the two-month window of the year when volatility has spiked the most, over the past ten years. And while this has been good news for bonds, September has typically been defined as a decline marked by a reach for liquidity. That might help explain why gold underperforms and the U.S. dollar succeeds.

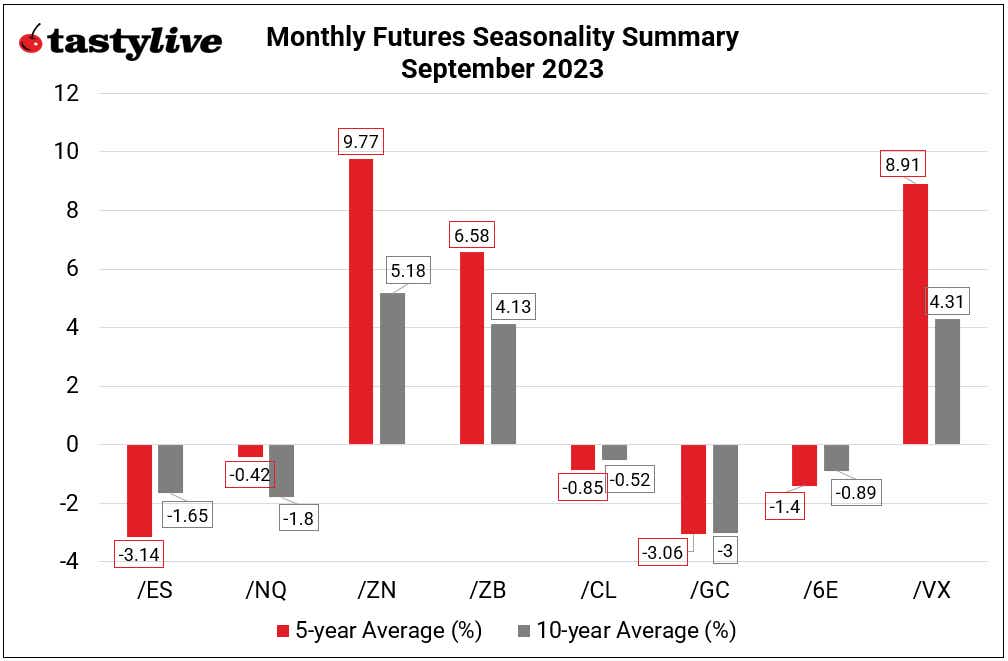

Monthly futures seasonality summary – September 2023

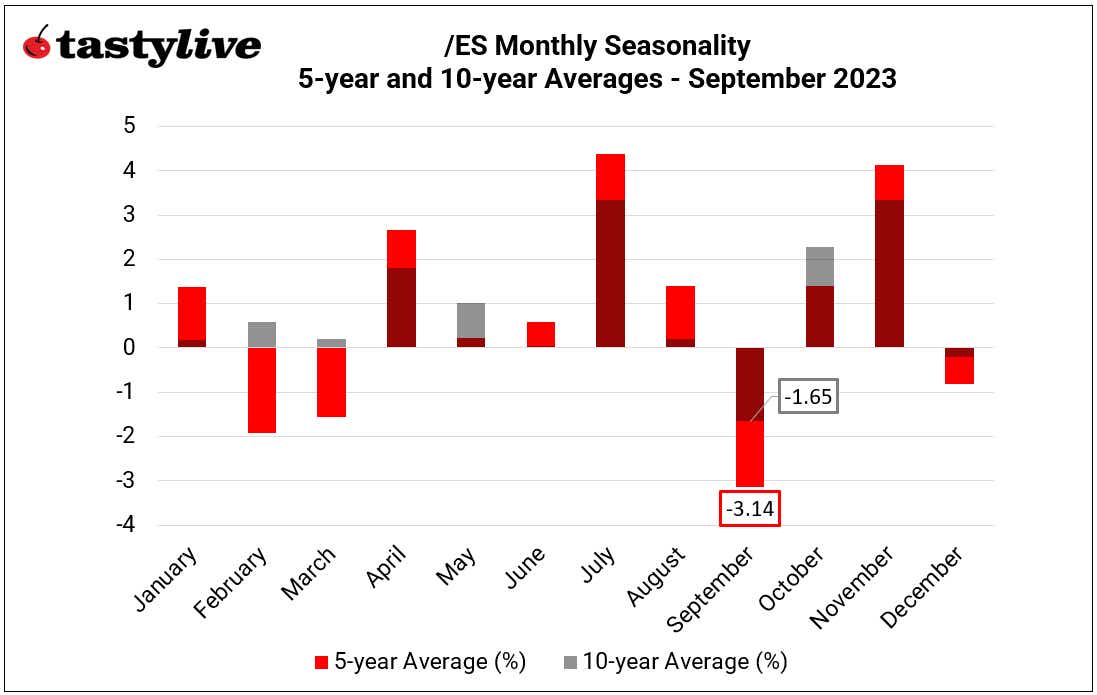

Monthly seasonality in S&P 500 (/ES)

September is a bearish month for /ES, on a seasonal basis. Over the past five years, it has been the worst month of the year for the index, averaging a loss of 3.14%. Over the past 10 years, it has been the worst month of the year, averaging a loss of 1.65%.

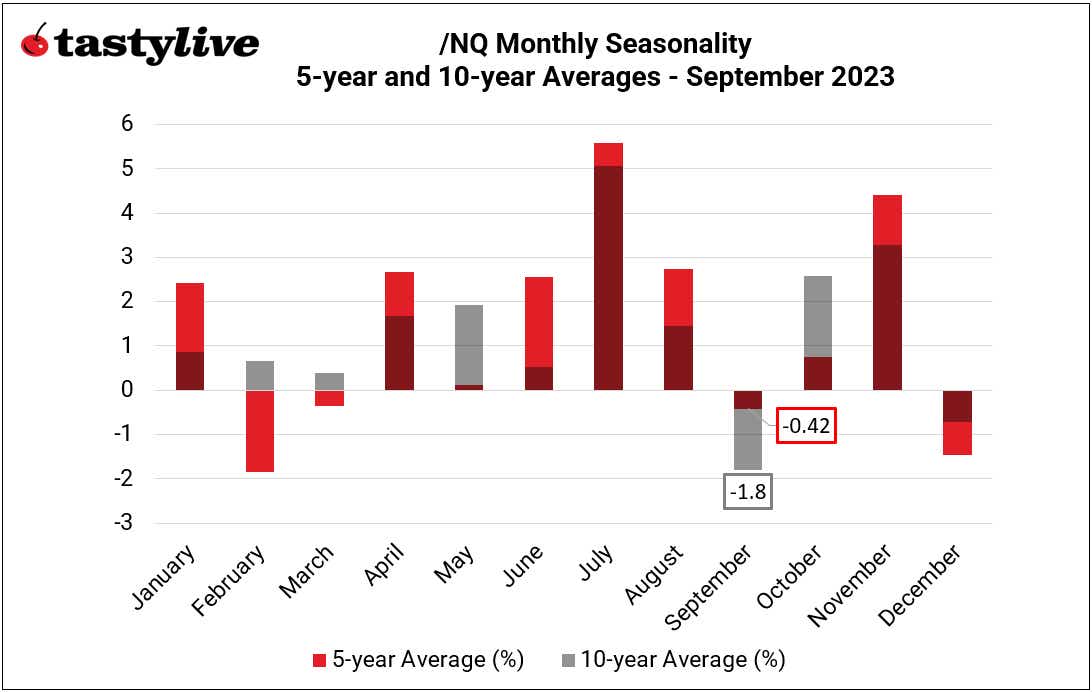

Monthly seasonality in NASDAQ 100 (/NQ)

September is a bearish month for /NQ, on a seasonal basis. Over the past five years, it has been the third-worst month of the year for the index, averaging a loss of 0.42%. Over the past 10 years, it has been the worst month of the year, averaging a loss of 1.8%.

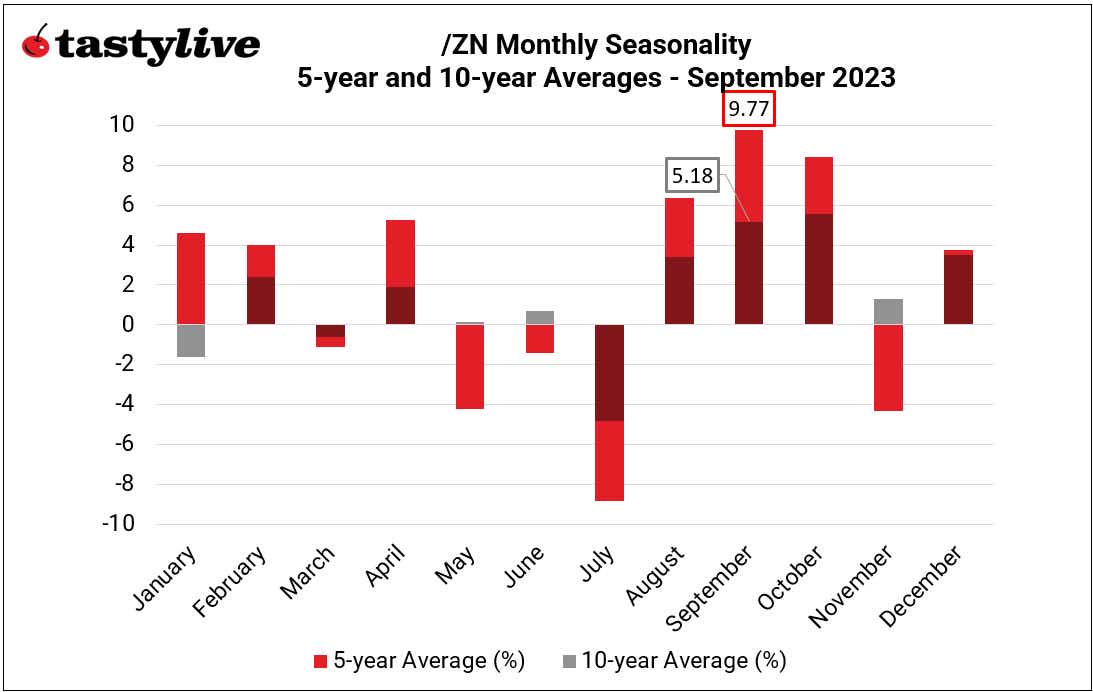

Monthly seasonality in Treasury notes (/ZN)

September is a bullish month for /ZN, on a seasonal basis. Over the past five years, it has been the best month of the year for the notes, averaging a gain of 9.77%. Over the past 10 years, it has been the second-best month of the year, averaging a gain of 5.18%.

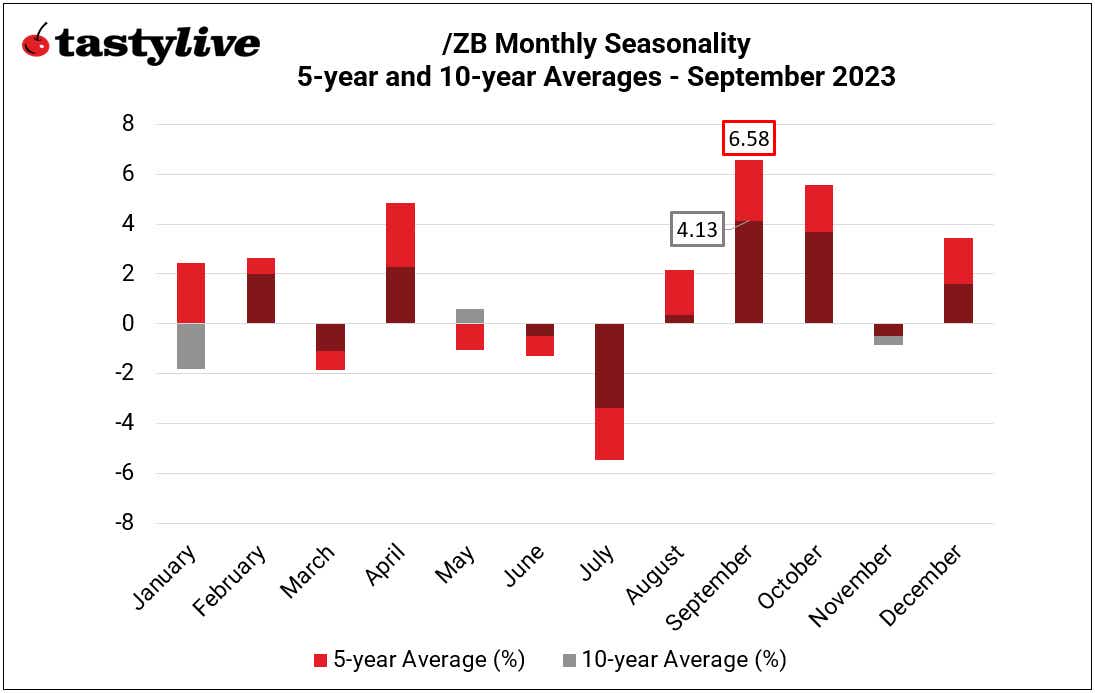

Monthly seasonality in Treasury bonds (/ZB)

September is a bullish month for /ZB, on a seasonal basis. Over the past five years, it has been the best month of the year for the bonds, averaging a gain of 6.58%. Over the past 10 years, it has been the best month of the year, averaging a gain of 4.13%.

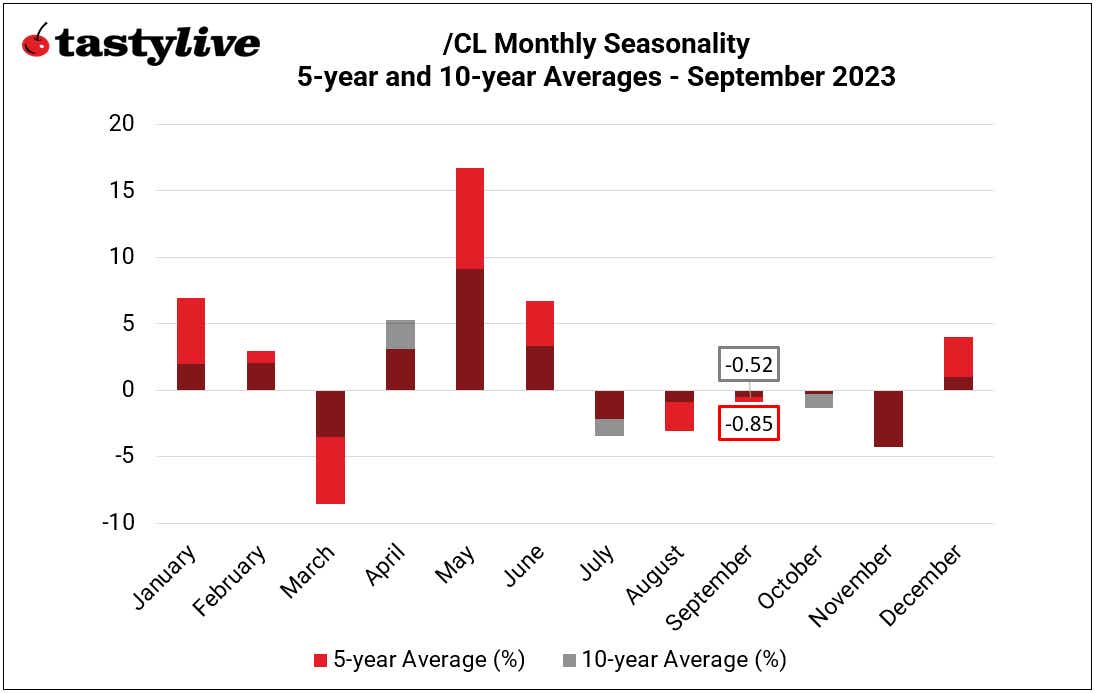

Monthly Seasonality in Crude Oil (/CL)

September is a bearish month for /CL, on a seasonal basis. Over the past five years, it has been the fifth-worst month for the energy product, averaging a loss of 0.85%. Over the past 10 years, it has been the sixth-worst month of the year, averaging a loss of 0.52%.

Monthly seasonality in gold (/GC)

September is a bearish month for /GC, on a seasonal basis. Over the past five years, it has been the worst month for the precious metal, averaging a loss of 3.06%. Over the past 10 years, it has been the worst month of the year, averaging a loss of 3%.

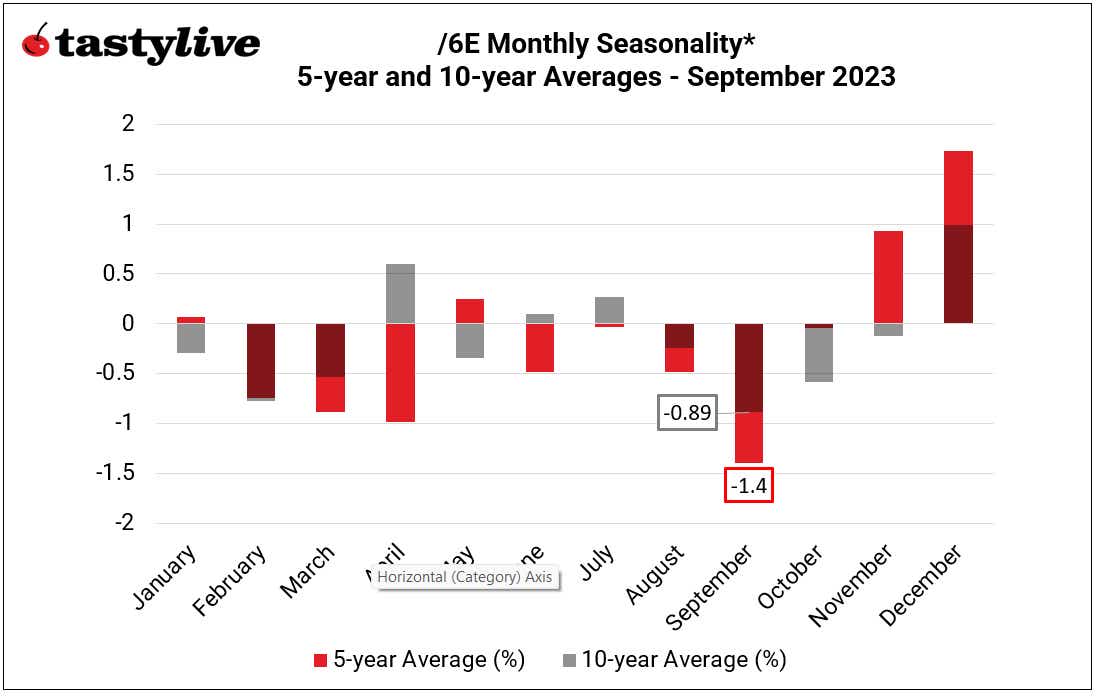

Monthly seasonality in euro (/6E)

September is a bearish month for /6E, on a seasonal basis. Over the past five years, it has been the worst month for the pair, averaging a loss of 1.4%. Over the past 10 years, it has been the worst month of the year, averaging a loss of 0.89%. Note: the time series for euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

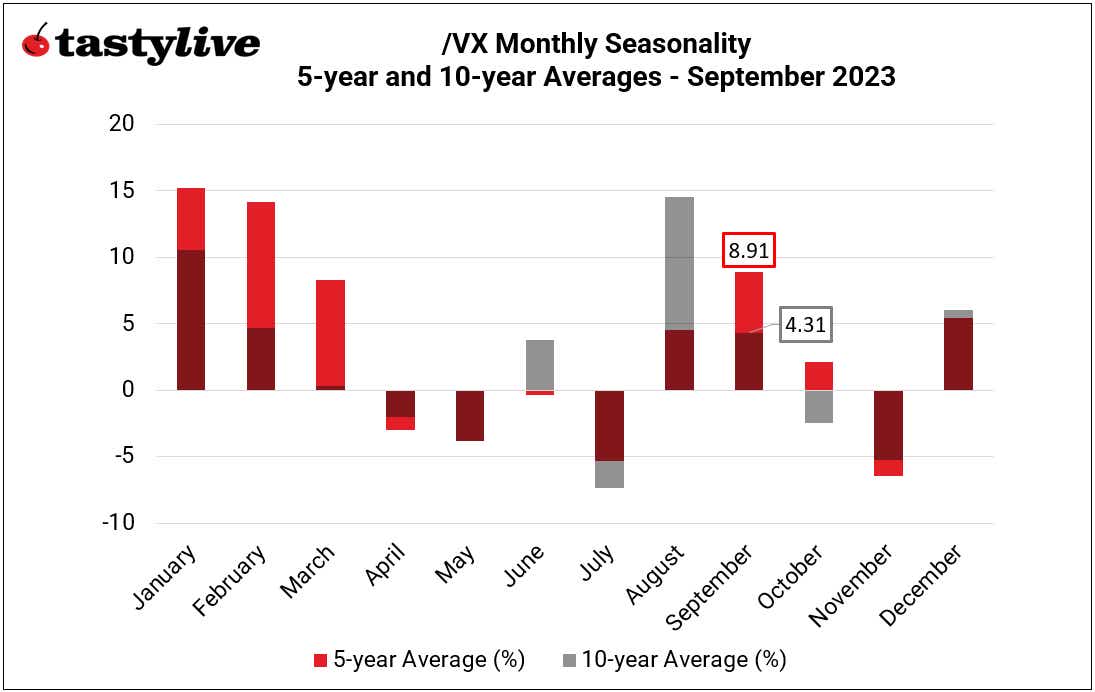

Monthly seasonality in VIX (/VX)

September is a bullish month for /VX, on a seasonal basis. Over the past five years, it has been the third-best month for volatility, averaging a gain of 8.91%. Over the past 10 years, it has been the fifth-best month of the year, averaging a gain of 4.31%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.