How Do Futures Historically Perform in August?

How Do Futures Historically Perform in August?

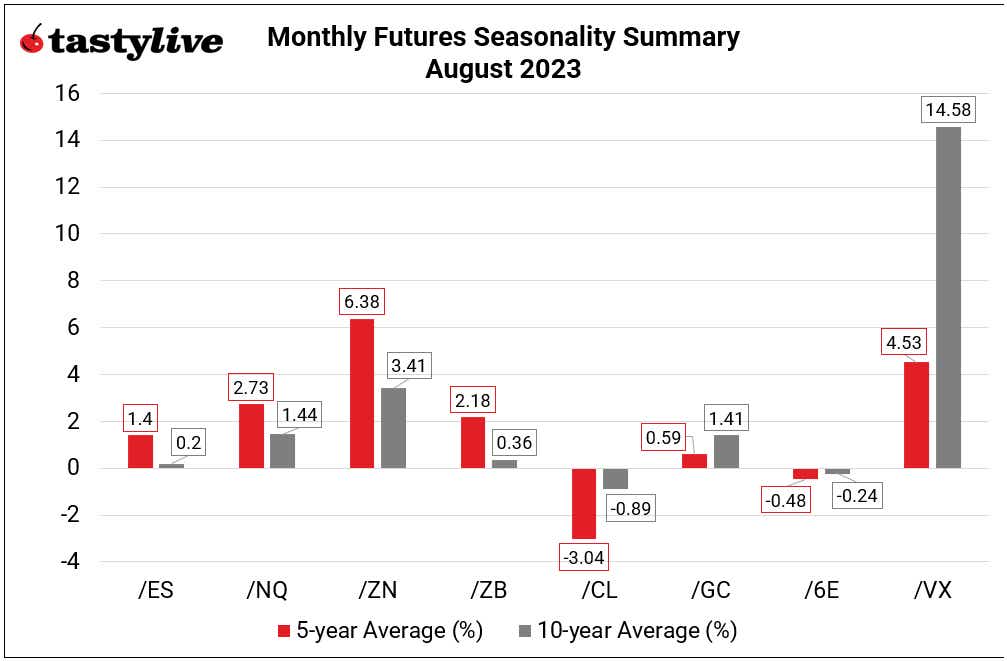

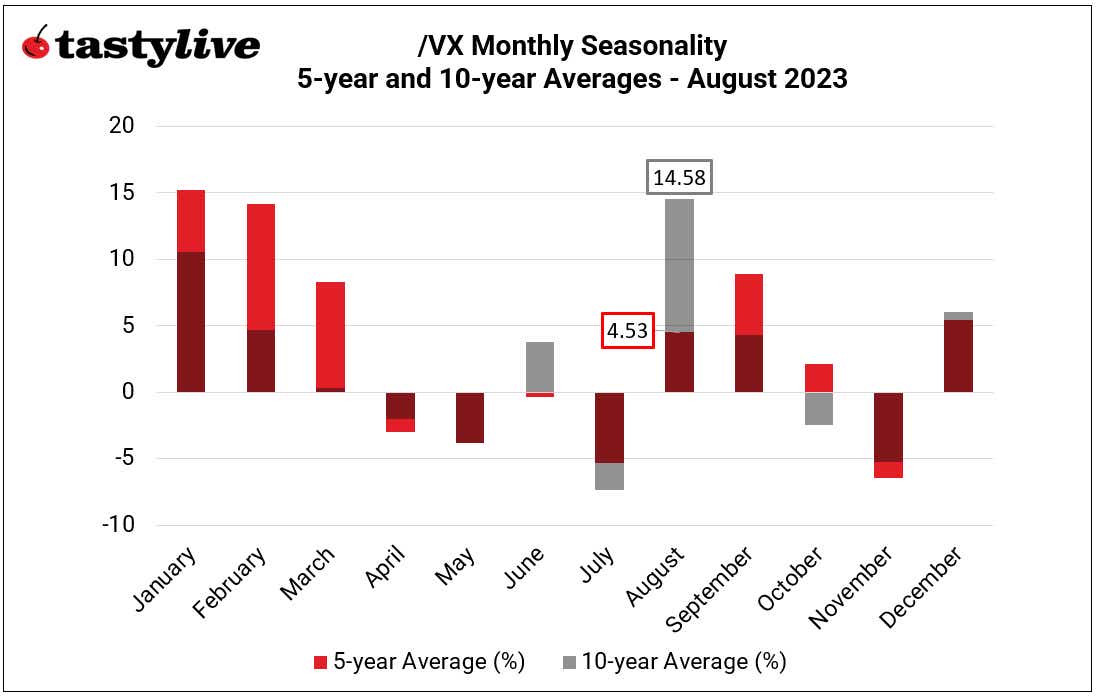

What history tells us to expect in stock, bond, crude oil, gold, Euro and VIX price movements this month. Note: One of these markets has averaged +15% in August over the past 10 years!

- History shows August tends to produce solid returns in the markets.

- August and September see more volatility than any other two-month period of the year.

- A mix of bulls and bears grace the historical record from Augusts past.

It’s the start of August, which means it’s time to review seasonality among the most widely traded futures products. Given differences in monetary and fiscal regimes on longer time horizons relative to contemporary times, our review covers the past five years and 10 years.

The good news for bulls, who continued to run rampant through the early part of the summer: August had produced solid returns across equity markets. The same goes for bonds and precious metals. Better yet, many of the futures products covered in this report no longer see their five-year average performances eclipsed by their respective standard deviation of returns, suggesting seasonality data are becoming more reliable as the year presses forward.

More volatility ahead?

The bad news: We’ve reached the low point of the year, seasonally speaking, for volatility. Over the past decade, August and September have produced the largest combined spike in volatility for any two-month period of the year.

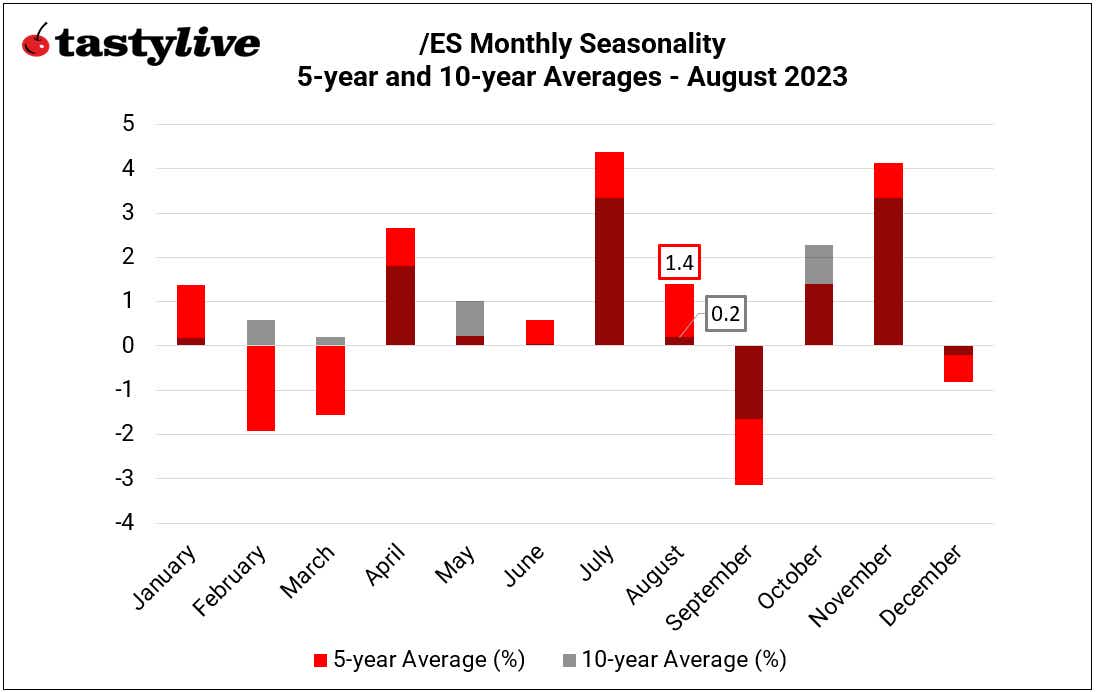

August is a bullish month for /ES, on a seasonal basis. Over the past five years, it has been the fourth-best month of the year for the index, averaging a gain of 1.4%. Over the past 10 years, it has been the fifth-worst month of the year, averaging a gain of 0.2%.

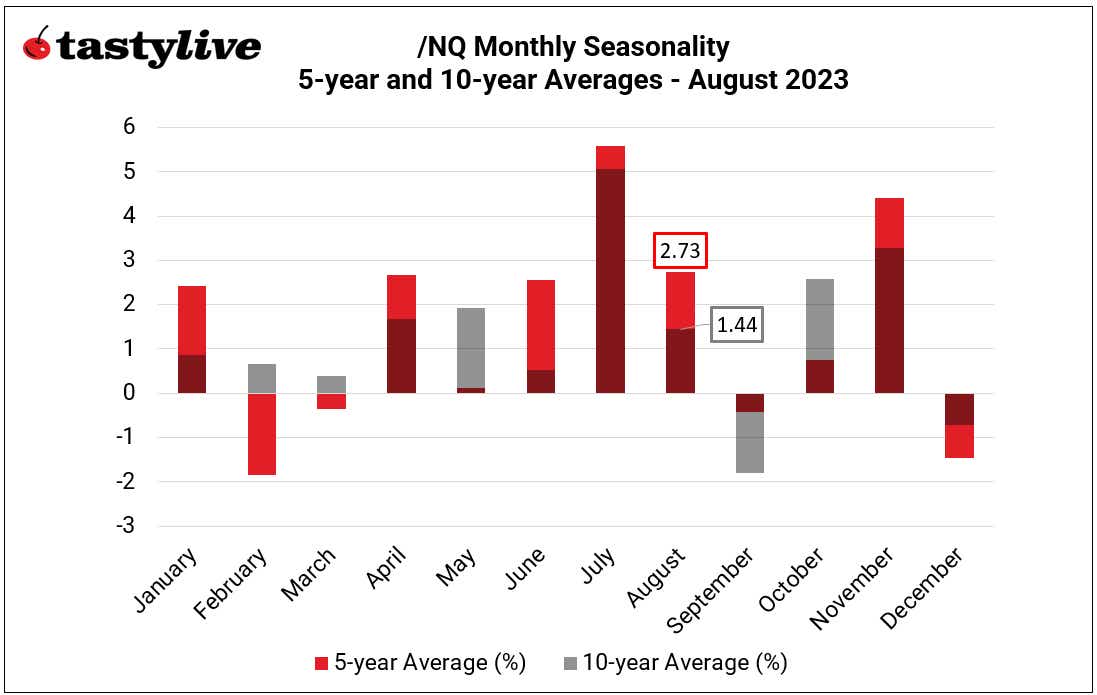

August is a bullish month for /NQ, on a seasonal basis. Over the past five years, it has been the third-best month of the year for the index, averaging a gain of 2.73%. Over the past 10 years, it has been the fifth-best month of the year, averaging a gain of 1.44%.

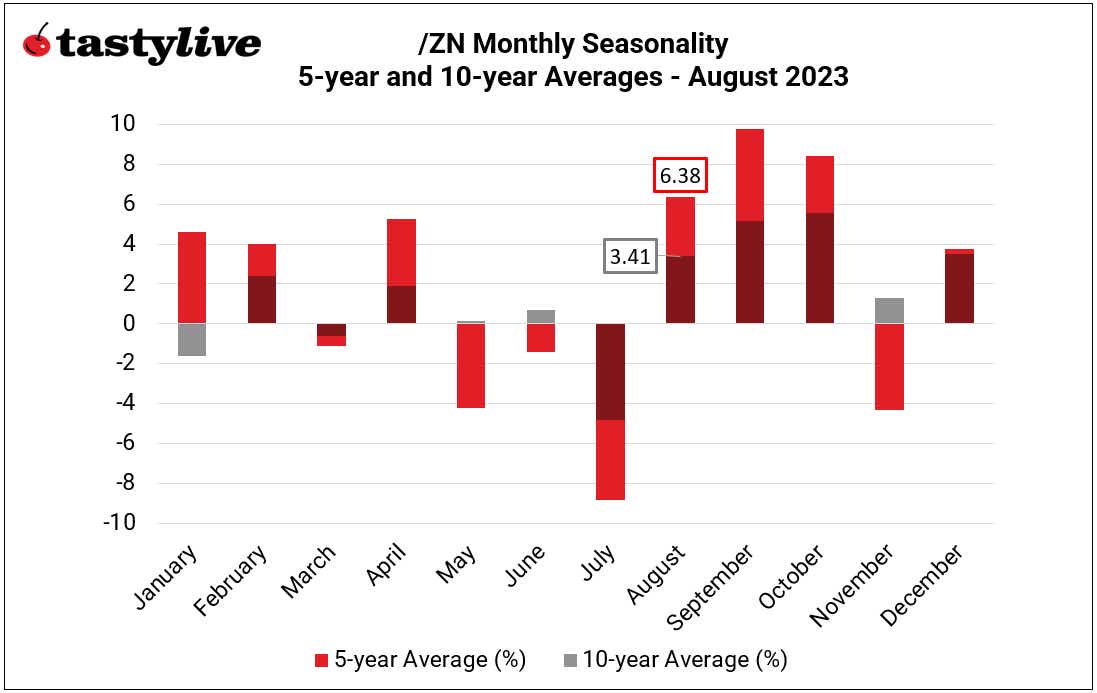

August is a very bullish month for /ZN, on a seasonal basis. Over the past five years, it has been the third-best month of the year for the notes, averaging a gain of 6.38%. Over the past 10 years, it has been the fourth-best month of the year, averaging a gain of 3.41%.

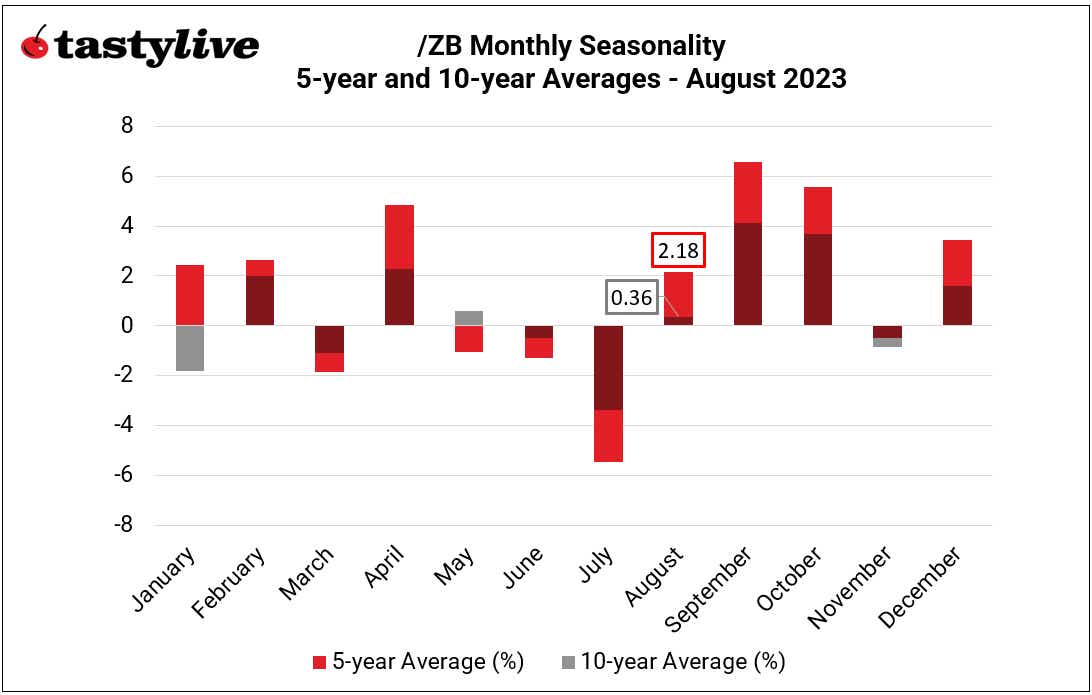

August is a bullish month for /ZB, on a seasonal basis. Over the past five years, it has been the sixth-worst month of the year for the bonds, averaging a gain of 2.18%. Over the past 10 years, it has been the sixth worst month of the year, averaging a gain of 0.36%.

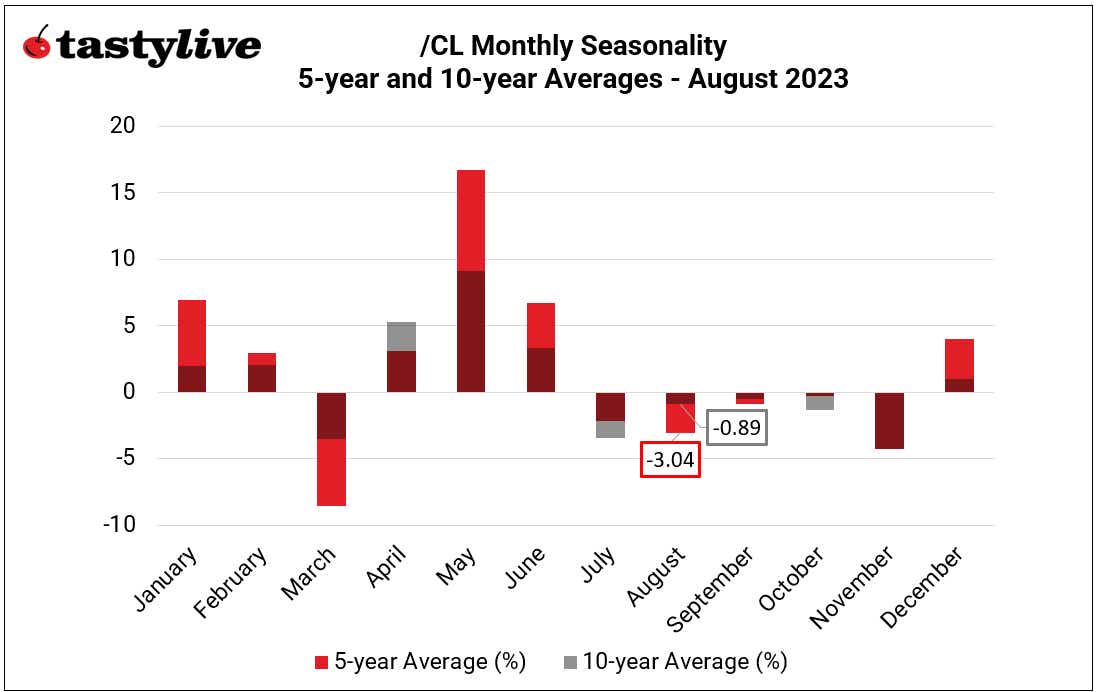

August is a bearish month for /CL, on a seasonal basis. Over the past five years, it has been the third-worst month of the year for the energy product, averaging a loss of 3.04%. Over the past 10-years, it has been the fifth worst month of the year, averaging a loss of 0.89%.

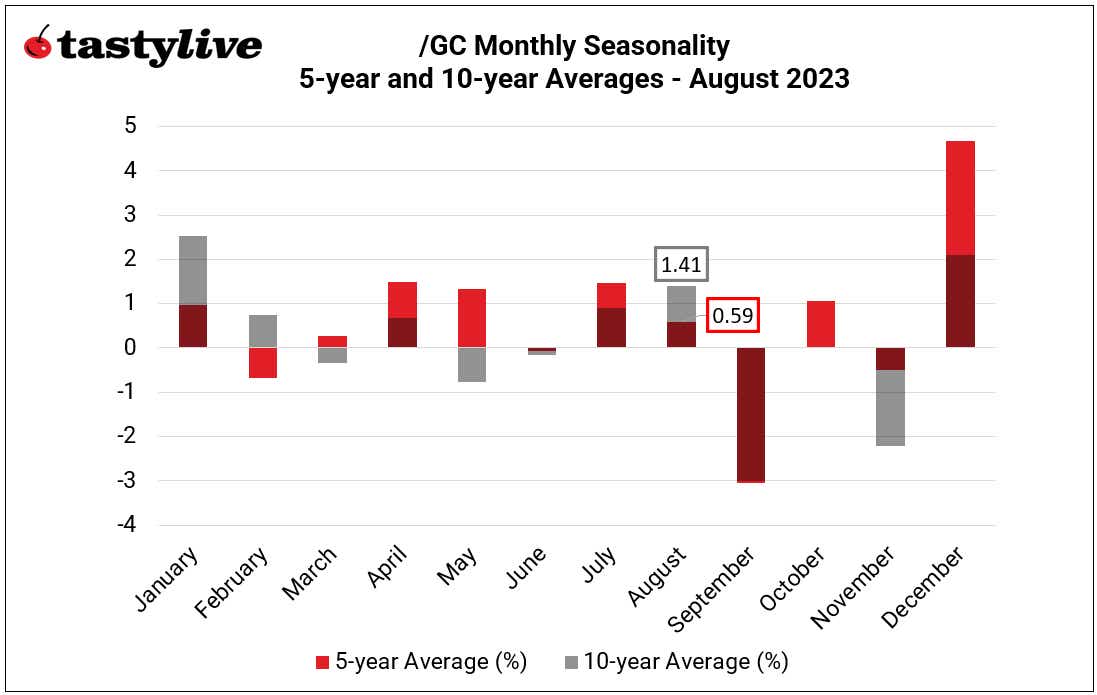

August is a bullish month for /GC, on a seasonal basis. Over the past five years, it has been the sixth-worst month of the year for the precious metal, averaging a gain of 0.59%. Over the past 10 years, it has been the third best month of the year, averaging a gain of 1.41%.

Bearish in August

August is a bearish month for /6E, on a seasonal basis. Over the past five years, it has been the sixth-worst month of the year for the pair, averaging a loss of -0.48%. Over the past 10 years, it has been the sixth-best month of the year, averaging a loss of 0.24%. Note: the time series for euro futures does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.