Do Stocks Even Care About the Fed's Jackson Hole Meeting?

Do Stocks Even Care About the Fed's Jackson Hole Meeting?

Or, will August seasonality have a bigger impact?

- August tends to be quiet with light volume and sometimes higher volatility.

- All eyes will be on the Federal Reserve's Jackson Hole retreat that is set for August 24-26.

- Look for Jerome Powell to echo the message heard at the July policy meeting as the Fed remains committed to bringing inflation down to the 2% target.

August is usually a sleepy month on Wall Street. Historically, it's the time when most traders take a vacation. It's also second worst to September in terms of average return going back to 1980. But it's not all bad. There have been some good times. For example, in August 2020, the S&P 500 popped 7.3% in a pandemic rebound. That was a fun one.

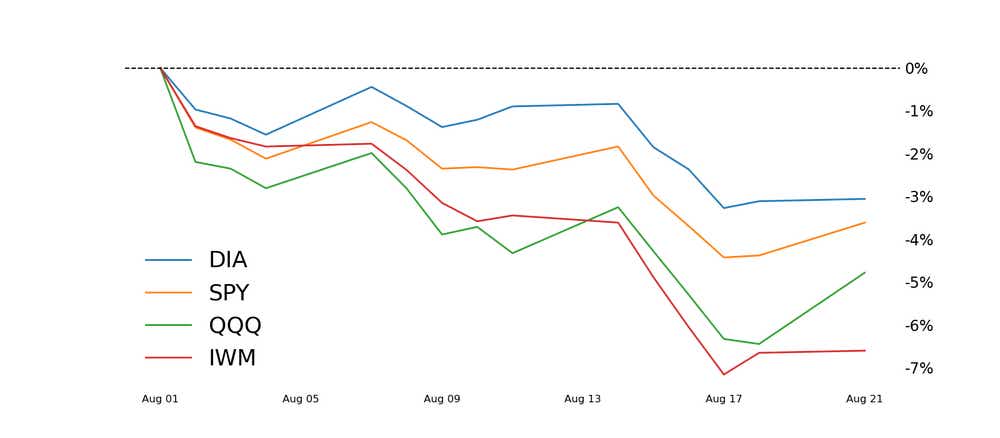

However, there have been some ugly Augusts: 1990 (-9.4%), 1998 (-14.6%), 2001 (-6.4%), 2015 (-6.3%) and 2022 (-4.2%).

So far in August 2023, the S&P 500 is down 3.9%, and looking more like one of the not-so-pretty times. There hasn't been much to get excited about this month. Second-quarter earnings reports are mostly finished, with a few retail and tech stragglers still left to announce results. Volume has been mostly light—which is the perfect environment for higher volatility.

Now, with nothing else to look forward to, all eyes will be on Jackson Hole, Wyoming, as the Federal Reserve debates changes to policy at its annual retreat.

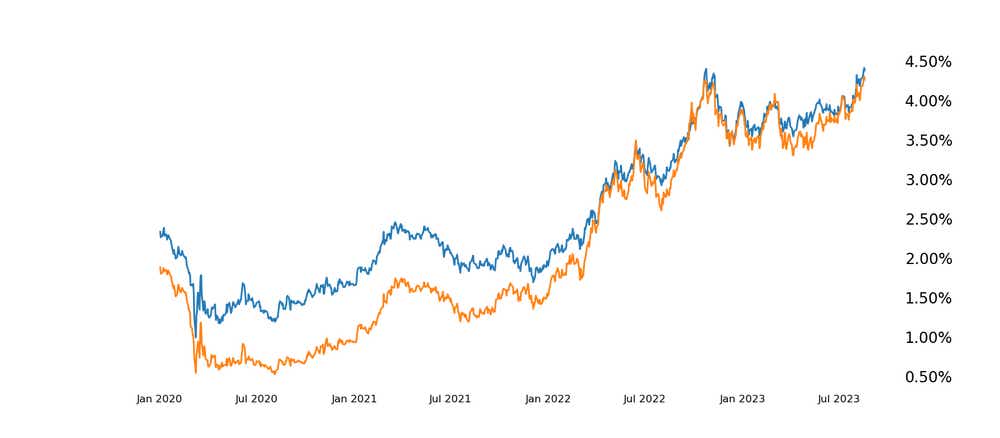

Traders remain unsure whether the central bank can guide the economy to a soft landing or if they will accidentally usher in a recession between now and the end of 2024. Treasury yields are trading at their highest levels in fifteen years. Additionally, the Federal Open Market Committee (FOMC) meeting minutes last week showed that most Fed officials were in favor of further rate hikes. They still feel that inflation is a risk.

It is for these reasons that most expect Fed chair Jerome Powell to echo his message from the July meeting. You know, the one where he says, "Inflation is too high and the Fed remains committed ...", yada, yada, yada.

Everyone knows the Fed is still attempting to bring inflation down to its 2% target. However, there are lots of questions. Are they content with the recent string of cooler inflation reports? Did the slight jump in the July CPI report bother them? Will they keep attacking inflation with one or two more rate hikes? Or will the institute an extended pause?

Either way, don't expect rates to go down anytime soon.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday. @jermalchandler

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.