Nasdaq 100 Slammed, Russell 2000 Enters Bear Market as Tariffs Upend Everything

Nasdaq 100 Slammed, Russell 2000 Enters Bear Market as Tariffs Upend Everything

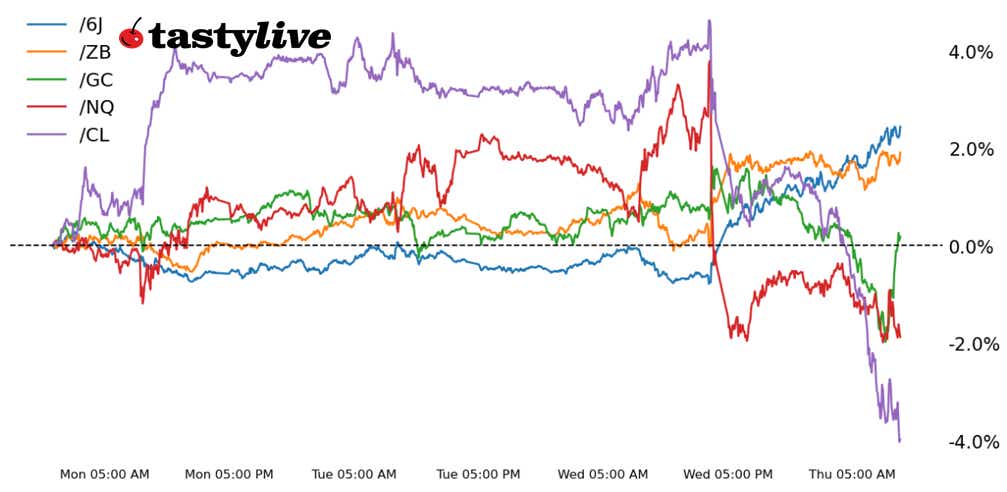

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): -5.01%

- 30-year T-bond futures (/ZB): +1.69%

- Gold futures (/GC): -0.32%

- Crude oil futures (/CL): -7.78%

- Japanese yen futures (/6J): +3.11%

This is proving to be one of the more difficult days for traders in months, if not years. The Trump administration’s tariff announcement bewildered even the most ardent supporters of tariffs. The unveiling of the plan—and the subsequent explanations offered by various Trump surrogates—sowed more confusion than clarity. U.S. tariff rates, if permanent, will be at their highest levels since the 19th century, overtaking rates seen during the Great Depression. Anything and everything growth-sensitive is being hit hard. The Nasdaq 100 is down by more than 5% and the Russell 2000 has officially dropped by more than 20% from its recent 52-week high.

Symbol: Equities | Daily Change |

/ESM5 | -4.35% |

/NQM5 | -5.01% |

/RTYM5 | -6.64% |

/YMM5 | -3.7% |

Nasdaq futures (/NQM5) sank about 5% in early trading as yesterday’s tariff announcement injected chaos into the stock market. The market was hoping for a measured response on trade restrictions, but it got something else. The White House plan is on the more aggressive side of what many had expected. Some Asian countries now face a tariff of over 50% for most goods. Meanwhile, nations have vowed to retaliate, casting additional uncertainty on how this will play out. Apple (AAPL) was down 9% in early trading, which would mark the worst daily performance since 2020. Nike (NKE), which produces most of its goods in Asia, fell over 14% this morning.

Strategy: (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18400 p Short 18500 p Short 19400 c Long 19500 c | 19% | +1605 | -395 |

Short Strangle | Short 18500 p Short 19400 c | 53% | +23090 | x |

Short Put Vertical | Long 18400 p Short 18500 p | 58% | +680 | -1320 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.39% |

/ZFM5 | +0.96% |

/ZNM5 | +1.29% |

/ZBM5 | +1.69% |

/UBM5 | +1.62% |

Bonds rose across the curve, but the inflation-sensitive long-end of the curve outpaced gains vs. its shorter-term counterparts. 30-year T-bond futures (/ZBM5) rose 1.62%, reaching the highest levels traded since December. Tariffs are expected to increase inflation, which benefits long-term bonds. The safe-haven flight away from equities also benefited the bond market, as traders sought out safety.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 117 p Short 118 p Short 122 c Long 123 c | 37% | +625 | -375 |

Short Strangle | Short 118 p Short 122 c | 59% | +2609.38 | x |

Short Put Vertical | Long 117 p Short 118 p | 69% | +343.75 | -640.63 |

Symbol: Metals | Daily Change |

/GCM5 | -0.32% |

/SIK5 | -6.22% |

/HGK5 | -3.36% |

Gold prices (/GCM5) trimmed overnight gains to trade negative this morning despite a pullback in the dollar and yields. The trade signals liquidation in the market, with investors likely fleeing to cash—the ultimate safe-haven asset. The economic uncertainty injected by yesterday's tariff announcement has cast uncertainty over the outlook for much of the market, gold and silver included. However, a disappointing economic outlook may start to work in gold’s favor once some of the volatility cools off.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3085 p Short 3090 p Short 3195 c

| 21% | +410 | -90 |

Short Strangle | Short 3090 p Short 3195 c | 57% | +11920 | x |

Short Put Vertical | Long 3085 p Short 3090 p | 61% | +230 | -270 |

Symbol: Energy | Daily Change |

/CLK5 | -7.78% |

/HOK5 | -6.56% |

/NGK5 | +2.37% |

/RBK5 | -7.88% |

Crude oil (/CLK5) sank over 7%, which marks the deepest daily percentage loss since 2022. The tariffs are expected to hit global growth, which is being immediately reflected in crude prices. Geopolitical tensions were bolstering the commodity before today as the U.S. strengthens its military posture around the Middle East, but fears quickly permeated into the backdrop and sent traders fleeing out of the trade. The outlook will likely remain subdued until trade restrictions ease or a major escalation occurs in the Middle East. OPEC+ countries also announced they will release more output starting in May, which surprised markets and added to the negative sentiment for the commodity.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 64.5 p Short 65 p Short 68.5 c Long 69 c | 25% | +380 | -120 |

Short Strangle | Short 65 p Short 68.5 c | 62% | +4200 | x |

Short Put Vertical | Long 64.5 p Short 65 p | 59% | +200 | -300 |

Symbol: FX | Daily Change |

/6AM5 | +1.33% |

/6BM5 | +1.49% |

/6CM5 | +1.99% |

/6EM5 | +2.47% |

/6JM5 | +3.11% |

The dollar is getting crushed today—it’s down sharply vs. most of its peers. Japanese yen futures (/6JM5) surged nearly 3% overnight as traders moved quickly into the safe-haven currency following yesterday's announcement. A sharp contraction in yield differentials between the U.S. and Japan underscored the move, with differentials trading near the lows of the year. The tariffs on Japan’s export-focused economy may limit the Bank of Japan’s ability to raise interest rates, but rate cut expectations for the U.S. are the focus of the trade for now.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0068 p Short 0.00685 p Short 0.007 c Long 0.00705 c | 25% | +475 | -150 |

Short Strangle | Short 0.00685 p Short 0.007 c | 57% | +2475 | x |

Short Put Vertical | Long 0068 p Short 0.00685 p | 66% | +275 | -350 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.