U.S. CPI, Consumer Confidence, FOMC Minutes: Macro Week Ahead

U.S. CPI, Consumer Confidence, FOMC Minutes: Macro Week Ahead

By:Ilya Spivak

Will dreams of Fed interest rate cuts buoy markets after withering Trump tariff drama?

- Investors are awaiting the March FOMC meeting minutes to gauge Fed officials’ rate cut pain point.

- Soft U.S. CPI data might help convince the central bank to begin easing monetary policy.

- Markets may welcome a gloomier U.S. consumers report if it anchors bets on inflation.

Stock markets cratered last week, and bond yields swung sharply lower as the markets reacted to “Liberation Day,” an expansive tariff plan from President Donald Trump. The bellwether S&P 500 shed 9.1% while the tech-tilted Nasdaq 100 lost nearly 10%. The rates on 10- and two-year Treasury paper fell 5.9% and 6.9%, respectively.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

Federal Open Market Committee meeting minutes

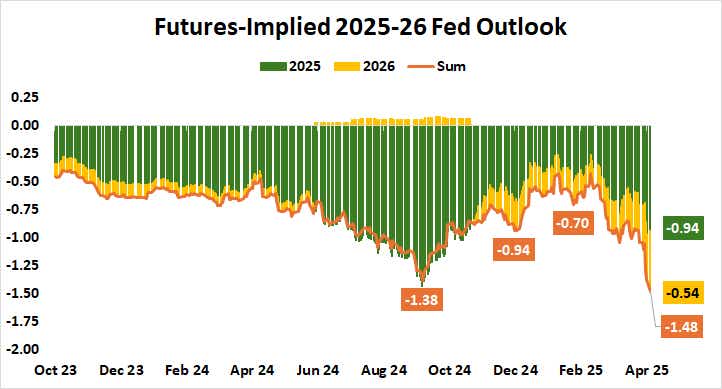

The markets have understandably shifted toward a more dovish setting for U.S. monetary policy expectations amid last week’s blistering sell-off. Fed Funds interest rate futures now price in 148 basis points (bps) in rate cuts by the end of next year. That amounts to four standard-sized 25bps reductions this year and two more in 2026.

This overshoots policymakers’ own forecast calling for 100bps in cuts over the same period. Traders will be keen to gauge how readily officials might be willing to embrace a more dovish perspective as they parse the minutes of the March meeting of the rate-setting Federal Open Market Committee (FOMC).

Federal Reserve Chair Jerome Powell signaled the Fed needs to see signs of economic stress appear in so-called “hard” data—as opposed to “soft” survey-based indicators—to pull the trigger on rate cuts. The markets may find a modicum of relief if investors judge that officials’ pain point is closer in this context and given last week’s bloodletting.

U.S. consumer price index data

Inflation in the U.S. is expected to have slowed in March. Headline price growth is seen ticking down to 2.6% year-on-year, the lowest since October. The core consumer price index (CPI) measure, excluding volatile food and energy prices—a focal point for Fed officials—is penciled in for a return to 3% for the first time since April 2021.

The markets seem to be concluding the Trump administration’s latest tariff shock translates into recession risk. Expectations for inflation priced into the bond market—so-called “breakeven rates”—have moved sharply lower, suggesting traders see any price uplift from new levies overwhelmed by a disinflationary growth slump.

If soft CPI figures beckon central bank officials to pick up the markets’ lead and gear up to fight back a growth scare, stock markets may take heart as rate cuts appear closer. Bonds may push higher as Treasury yields come down alongside the U.S. dollar against such a backdrop.

.png?format=pjpg&auto=webp&quality=50&width=758&disable=upscale)

University of Michigan consumer confidence data

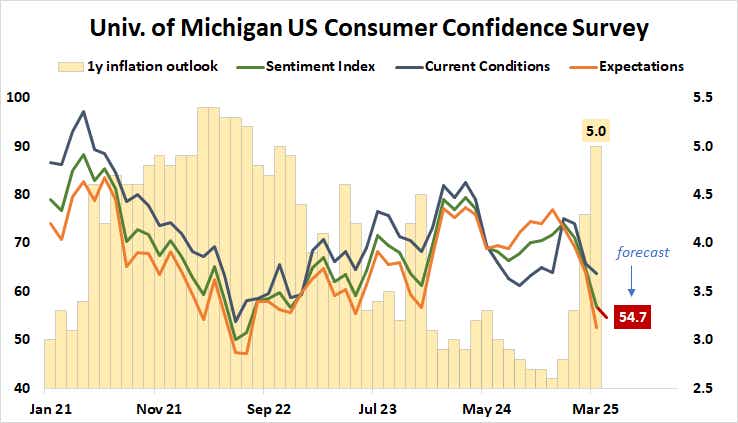

It seems hardly surprising that U.S consumers are expected to appear gloomier when April’s sentiment survey from the University of Michigan (UofM) comes across the wires. The topline tracker, which will take in an assessment of current conditions and the outlook for what’s next, is expected to slide to the lowest level since July 2022.

Polling data aggregated by RealClearPolitics shows President Trump losing ground with voters in April, so weaker consumer confidence is to be expected. However, the trend in survey respondents’ one-year expectations for inflation might well be a more potent indicator than the sentiment gauge itself.

Worries about the impact of tariffs drove bets on the growth of prices to a blistering 5% in March, the highest since October 2022 and within a hair of the post-COVID high at 5.4%, recorded exactly three years ago. If there is some anchoring here as consumers hesitate to extrapolate too much farther for the time being, the Fed may find it easier to act.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.