MARA Earnings Preview: 14% Stock Price Move Expected This Week

MARA Earnings Preview: 14% Stock Price Move Expected This Week

By:Mike Butler

Marathon Digital Holdings has posted spotty earnings recently but is expected to bounce back into positive territory

- Marathon Digital Holdings is set to report quarterly earnings on Wednesday, Feb. 28, at 3:25 p.m. CDT.

- Marathon has had spotty earnings history recently, but the crypto mining company is expected to post positive earnings per share of $0.02 on $145.43 million in revenue.

- MARA stock has a large expected move for this week, exceeding 15% of the stock price.

Marathon earnings preview

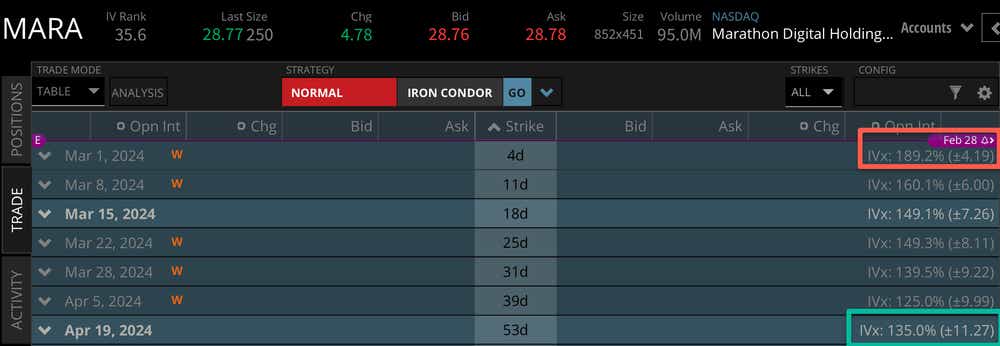

Marathon Digital Holdings (MARA) is a popular crypto stock that has been flying around to start 2024. The company is known for efficient Bitcoin mining, and it’s one of the largest holders of Bitcoin. There are plenty of narratives surrounding the company ahead of the Bitcoin halving set for April 2024. Marathon will report Q4 ’23 earnings on Feb. 28 at 3:25 p.m. CST, and the stock's expected move is over 15% this week based on current implied volatility.

Marathon opened the 2024 trading year at $26.64, dropped to an annual low of $14.62 and currently sits at $28.73 after a near 20% rally on Monday, Feb. 26. Looking at the chart of MARA stock, we can see that volatility has been realized, which is one of the reasons the implied volatility is so high for this crypto stock this week.

Fred Thiel, Marathon's chairman & CEO, gave a positive outlook for 2024 in the previous earnings call: “Looking ahead, we should reach 26 exahash by year-end 2023, and we expect to grow our hash rate by approximately 30% in 2024. We expect to continue strengthening Marathon’s position as one of the largest and most energy-efficient bitcoin mining operations globally.”

For the upcoming earnings announcement, the markets are expecting big movements in MARA stock. Generally speaking, we've seen some high expected moves ranging between 5%-10% this quarter for big name tech stocks. MARA's expected move sits at just over 15% of the stock price, with an expected move this week of +-$4.19 on a $29 stock price. This makes up just under half of the expected stock price move through the April 2024 options cycle.

Bullish on Marathon for earnings

Many traders and investors have used Marathon to trade as a proxy for itcoin exposure in a leveraged way. As we've seen recently, when Bitcoin moves, products likbe MARA tend to move at a higher percentage rate in the same direction. Marathon boasts one of the largest holdings of bitcoin, so this could be seen as a big positive for those who think Bitcoin's price is moving much higher this year. If Marathon can post a strong earnings report and guidance for 2024, this could be bullish for the stock price that's already moving significantly higher this week as of today.

Bearish on Marathon for earnings

When the bitcoin halving takes place in April, the reward for mining bitcoin will be cut in half. With the bitcoin reward currently at 6.25 for each block successfully mined, the new rate moving forward will be 3.125. This will put more pressure on Marathon to produce strong mining numbers, which will make efficiency of the utmost importance. If the price of bitcoin chops around, and Marathon takes a hit when it comes to revenue and bitcoin production post-halving, we may see the stock price take a bearish hit as well.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on Feb. 28 for a full breakdown of options strategies ahead of the announcement at 3:25 p.m. CDT!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.