Bitcoin ETFs and NVDA Earnings Moves: What to expect

Bitcoin ETFs and NVDA Earnings Moves: What to expect

We look at historical movements of Nvidia stock after earnings announcements and the most liquid bitcoin ETFs

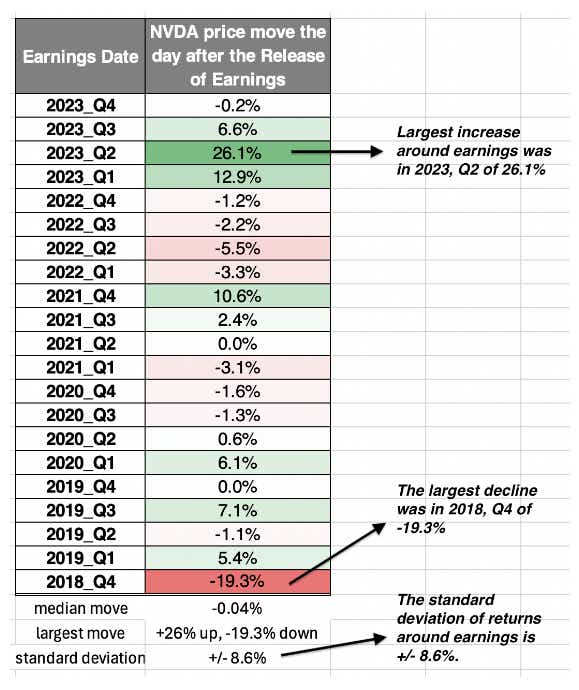

- The standard deviation of earnings moves in NVDA have been +/- 8.6% since 2018.

- Current NVDA Implied volatility is priced to a roughly +/- 11% move though the end of the week.

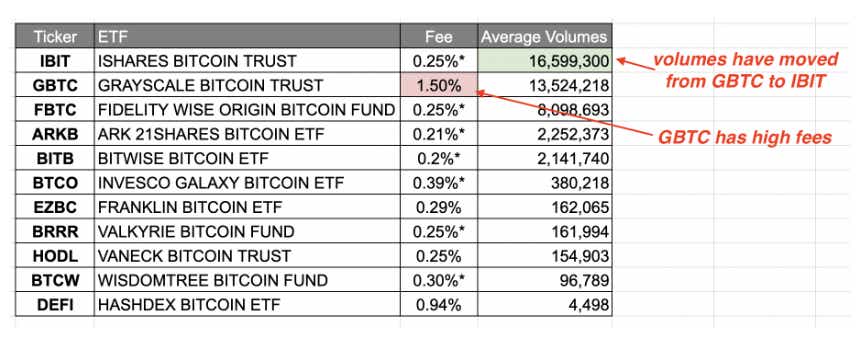

- IBIT has distanced itself as the most liquid bitcoin ETF.

This week's cherry picks we dove into the bitcoin ETFs to see which where the most liquid. We also pulled past data on Nvidia (NVDA) earnings to provide some color to the upcoming earnings report on Feb. 21. View the full email here!

What to expect from Nvidia earnings

NVDA has been a key catalyst to the recent market highs, year to date it's up nearly 41% and over 230% over the last year. The semiconductor space has been on fire. For example, VanEck Semiconductor ETF (SMH), a semiconductor ETF, is up nearly 66% in the past year.

The current implied volatility (IV) in NVDA represents the market pricing in a roughly +/- 11% move through the end of this week.

A historical perspective

We looked at the past moves in NVDA to see where that stands.

Quantifying these moves, we see that the standard deviation of the past moves has been +/- 8.6%—which means current IV is pricing in greater price movement expectations. In other words, current implied volatility is priced much higher than the past—meaning that options prices are inflated vs historical prices.

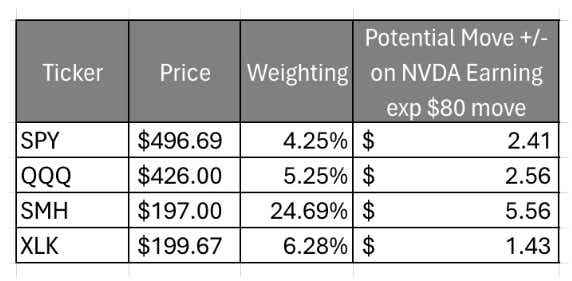

It's not a shock that volatility has increased in many of the ETFs that hold NVDA—including SMH which has a weighting to NVDA of just under 25%. If the current expected move of +/- $80 holds, we could see a 2% to 3% move in SMH.

If the sector experiences a sympathy move—meaning they move similarly to NVDA after earnings—it wouldn't be shocking to see 3% to 5% on SMH

For more color, check out Mike Butler's NVDA Earnings Preview here!

Bitcoin ETFs: Which is the most liquid?

Over the last couple of weeks, volumes in the new bitcoin ETFs continued to increase. One big reason is the liquidation of Grayscale Bitcoin Trust ETF (GBTC)—a higher-fee trading vehicle compared to the new lower-fee products hitting the market. All else equal, moving out of GBTC saves 100 to 150 basis points in fees.

As for liquidity, iShares Bitcoin ETF (IBIT) has maintained the highest average volumes since launch. These ETF launches are a race for liquidity—as the cost of maintaining these products is substantial. It wouldn't be a shock to see many of these ETFs discontinue in the coming years. For liquidity purposes it seems investors have chosen IBIT, Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB) and Bitwise Bitcoin ETF (BITB) as the market leaders.

Sign up for the cherry picks report HERE!

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.