GBP/USD: The Fed Hurt the U.S. Dollar, and the Bank of England May Help

GBP/USD: The Fed Hurt the U.S. Dollar, and the Bank of England May Help

By:Ilya Spivak

The U.S. dollar may keep falling as the Bank of England updates policy after the Fed.

- Stock markets embrace a modest dose of dovish signaling from the Federal Reserve.

- The Bank of England is now in focus, with markets probing for a slightly hawkish edge.

- The U.S. dollar may fall against the British pound as yield spreads continue to shift.

The U.S. dollar lurched lower alongside Treasury bond yields as the markets extrapolated a dovish message from a much-anticipated Federal Reserve monetary policy announcement. The central bank said “uncertainty around the economic outlook has increased” as it lowered its outlook for growth even as it raised inflation projections.

Traders interpreted officials’ signaling to mean that they are attentive to the ominous signs appearing in markets since mid-February about a gathering threat to economic growth amid fiscal policy uncertainty. Stock markets showed signs of relief, with the bellwether S&P 500 and Nasdaq 100 moving higher. Gold prices rose in tandem.

Is the Bank of England ready for a hawkish pivot?

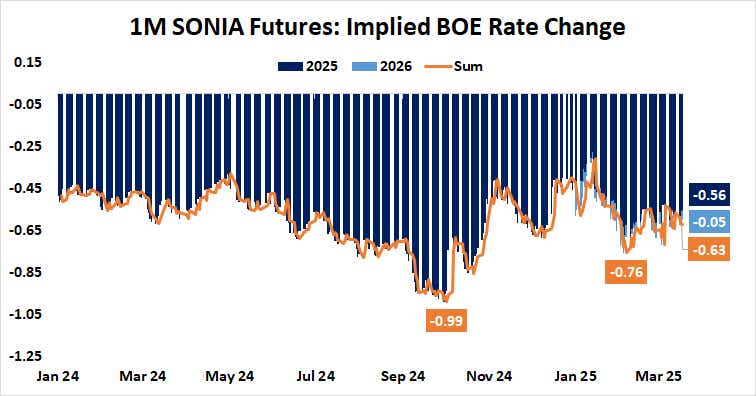

The greenback may be in for another jolt lower as the spotlight turns to a monetary policy decision from the Bank of England (BOE). It is widely expected to keep its target rate unchanged at 4.5%. The markets price in 56ps in cuts this year, implying that two standard-sized 25bps reductions along with a 20% probability of a third one.

Traders will be keen to hear what policymakers see from here as Europe gets set to ramp up defense spending. London, Paris and Berlin have signaled that the continent will re-arm in a hurry as worries emerge about the reliability of the U.S. security blanket. The BOE may strike a hawkish chord as it weighs what this may mean for inflation.

As it happens, U.K. inflation has already moved higher. The headline consumer price index (CPI) grew 3% year-on-year in January, marking the fastest rise March 2024. Moreover, pockets of sticky price growth in recreation and hospitality have stubbornly held up despite a sluggish economy that might have undermined discretionary spending.

The U.S. dollar may keep falling against the British pound

With this in mind, the BOE may itself locked in wait-and-see mode, keeping the bias toward easing later in the year intact in a nod toward anemic economic growth even as it holds back further dovish intent. However, acknowledging the possibility of a fiscal tailwind may reshuffle expectations for next year and give them a more hawkish flavor.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

This puts the U.S. dollar in the line fire anew. It has been falling against the British pound in lockstep with Treasury bond yield since late January as the markets began to pivot to a more dovish view of the Fed’s rate cut trajectory. That understandably eroded the dollar’s yield advantage. The BOE may open the way for more of the same.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.