S&P 500 Bounces Back, and Bonds Churn Ahead of March FOMC Meeting

S&P 500 Bounces Back, and Bonds Churn Ahead of March FOMC Meeting

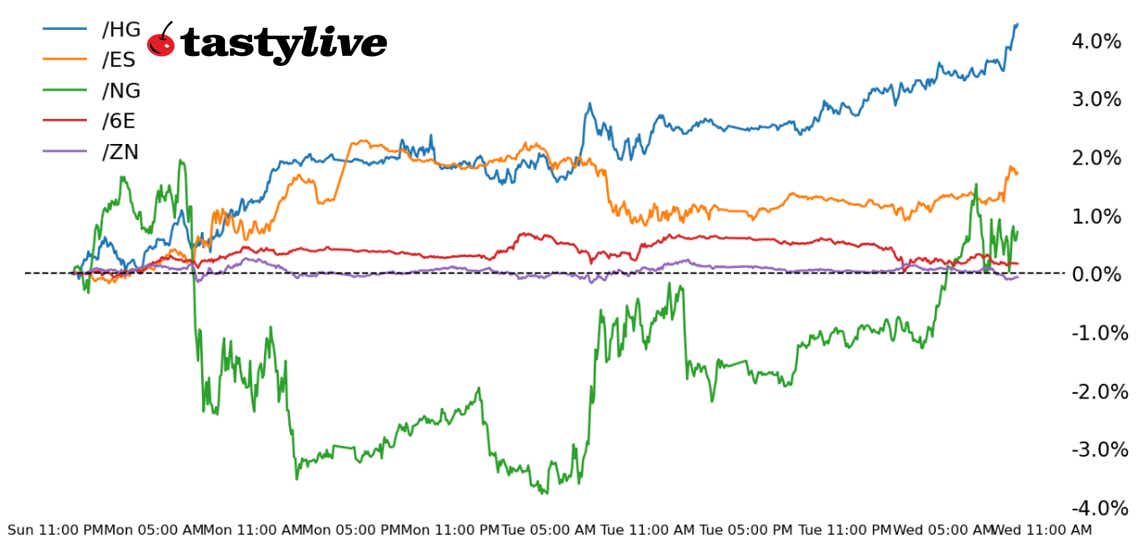

Also, 10-year T-note, copper, natural gas and euro futures

- Nasdaq 100 E-mini futures (/NQ): +0.78%

- 10-year T-note futures (/ZN): -0.17%

- Copper futures (/HG): +1.44%

- Natural gas futures (/NG): +2.94%

- Euro futures (/6E): +0.45%

It’s Wednesday, which means the week has officially begun: the March Federal Open Market Committee (FOMC) meeting day today begins a three-day window of elevated activity in markets, with vixpiration and quad witching looming around the corner. Stocks are proving hopeful ahead of time, although that’s a statement that can be made about risk broadly speaking given the sharp move higher in cryptocurrencies. Bonds are modestly weaker, as are precious metals, further confirmation that traders are feeling optimistic. But they may want to curb their enthusiasm: Fed Chair Jerome Powell has been consistent in his suggestions that the FOMC is in “wait-and-see” mode.

Symbol: Equities | Daily Change |

/ESM5 | +0.63% |

/NQM5 | +0.78% |

/RTYM5 | +1.55% |

/YMM5 | +0.61% |

S&P 500 futures (/ESM5) rose this morning as investors prepared for the Federal Reserve’s interest rate decision and updated economic and inflation projections. Williams-Sonoma (WSM) fell over 12% this morning after the company provided weak guidance on margin for its full-year outlook. Nvidia (NVDA) rose over 1% after UBS Group (UBS) added the stock to its “global Top List,” noting that this is a good spot to enter following the recent sell-off.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5600 p Short 5625 p Short 5800 c Long 5825 c | 20% | +950 | -300 |

Short Strangle | Short 5625 p Short 5800 c | 59% | +9525 | x |

Short Put Vertical | Long 5600 p Short 5625 p | 59% | +407.50 | -842.50 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.07% |

/ZFM5 | -0.16% |

/ZNM5 | -0.17% |

/ZBM5 | -0.13% |

/UBM5 | -0.13% |

The 10-year T-note futures (/ZNM5) fell ahead of the Federal Reserve decision expected later today. Markets anticipate two more cuts in the second half of the year, but the Fed’s updated projections on the economy and inflation may inject some volatility into bond markets. /ZNM5 prices are holding above the 21-day exponential moving average (EMA), which has offered support for prices over the last five trading sessions.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109.5 p Short 110 p Short 111.5 c Long 112 c | 37% | +312.50 | -187.50 |

Short Strangle | Short 110 p Short 111.5 c | 59% | +1078.13 | x |

Short Put Vertical | Long 109.5 p Short 110 p | 72% | +187.50 | -312.50 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.07% |

/SIK5 | -1.66% |

/HGK5 | +1.44% |

The macro backdrop for copper continued to support prices today, with prices (/HGK5) rising over 1% to push it further above the $5 per pound level. Inventory movements in London and Shanghai continue to decline, suggesting the market is tightening. China is expected to provide more economic support this year, bolstering the demand view for the world’s top copper consumer. Meanwhile, the U.S. is investigating possible tariffs on the metal, providing additional support. The May 2024 swing high at 5.1990 is now in focus as bulls remain in firm control.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.98 p Short 4.99 p Short 5.2 c Long 5.25 c | 65% | +525 | -725 |

Short Strangle | Short 4.99 p | 65% | +5850 | x |

Short Put Vertical | Long 4.98 p Short 4.99 p | 61% | +125 | -125 |

Symbol: Energy | Daily Change |

/CLK5 | +0.31% |

/HOJ5 | +0.93% |

/NGJ5 | +2.94% |

/RBJ5 | +0.19% |

Natural gas futures (/NGJ5) rose over 2% this morning. The commodity is taking higher ground as production in the U.S. drops while liquefied natural gas (LNG) flows reach a record high level. Those bullish drivers are directing prices despite an expected drop for natural gas demand domestically amid a mild weather outlook for the rest of March. LSEG expects gas demand to rise to nearly 110 billion cubic feet per day (bcf/d) next week, which would result in an inventory decline because it is above the current production figure of about 105 bcf/d.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.05 p Short 4.1 p Short 4.5 c | 30% | +390 | -110 |

Short Strangle | Short 4.1 p Short 4.5 c | 70% | +4360 | x |

Short Put Vertical | Long 4.05 p Short 4.1 p | 67% | +250 | -250 |

Symbol: FX | Daily Change |

/6AM5 | -0.42% |

/6BM5 | -0.27% |

/6CM5 | -0.13% |

/6EM5 | -0.45% |

/6JM5 | -0.47% |

Euro futures (/6EM5) fell about half a percent today. The pullback comes as prices trade near the highest levels since early November after Germany boosted plans for fiscal spending. That spending could help Europe’s economy and potentially limit the rate that the European Central Bank (ECB) can cut rates in the future. Prices are nearing the 21-day EMA, which could offer some support for buyers to step back into the currency.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.08 p Short 1.085 p Short 1.105 c Long 1.11 c | 32% | +412.50 | -212.50 |

Short Strangle | Short 1.085 p Short 1.105 c | 59% | +2062.50 | x |

Short Put Vertical | Long 1.08 p Short 1.085 | 71% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.