Big Movers, ETF Volatility and a Look at the Final Round of Upcoming Earnings Releases

Big Movers, ETF Volatility and a Look at the Final Round of Upcoming Earnings Releases

Sign up to receive Cherry Picks in your inbox!

- Download the earnings spreadsheet for the earnings reports through Nov. 24.

- Download the futures and ETF equivalents PDF for up-to-date notional values.

- Market volatility has hit lows but there’s opportunity in some of the higher volatility ETFs.

Subscribe to the cherry picks research report and receive it in your inbox every Tuesday morning!

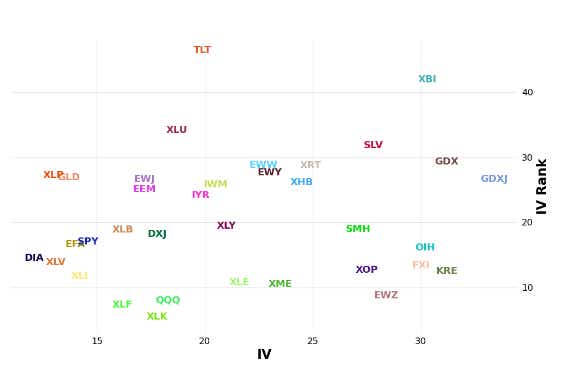

This week we took a look at some of the most liquid exchange-traded funds (ETFs) to see where volatility was highest. Bonds have been in focus recently with the expectation that rate hikes are now off the table at least through early 2024.

TLT volatility has continued to stay bid with current implied volatility roughly 30% higher than the SP500. Interest rates have an effect on commodities as well, leading to some added volatility in GLD and SLV as well as the miners GDX and GDXJ.

International markets, such as EEM, EWY and EWJ, have also seen increased volatility during the last couple of weeks.

Retailing is in focus for the last leg of earnings season. Through Nov. 24, we will receive earnings from Macy’s (M), Ross Stores (ROST), Lowe's (LOW), Abercrombie & Fitch (ANF), Best Buy (BBY), Dick’s Sporting Goods (DKS), and Nordstrom (JWN). This morning, Target (TGT) and TJX (TJX) reported earnings before the opening bell.

Download the Earnings Spreadsheet HERE.

XRT is an exchange-traded fund (ETF) that holds many of these retailers. If you think it is time for a bounce, the long call diagonal January 63 long call and the short December 65 call provides around 20 long delta for $1.29 debit. That’s a cheap way to get 20 long delta in the retail space.

Futures and futures options are a great way to take directional trades in the market. But the notional value of these products can be daunting. Here is a full breakdown of the tick sizes, notional values and corresponding ETFs for all the futures available on tastytrade.com

Check out this weeks email HERE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.