When is the Best Time to Buy Utility Stocks?

When is the Best Time to Buy Utility Stocks?

By:Kai Zeng

Economic uncertainty and diversification benefits draw attention to utility stocks

Utility stocks have long been appreciated by investors for their defensive capabilities, particularly during times of market volatility. These stocks are renowned for their higher dividends and reduced volatility compared to growth stocks.

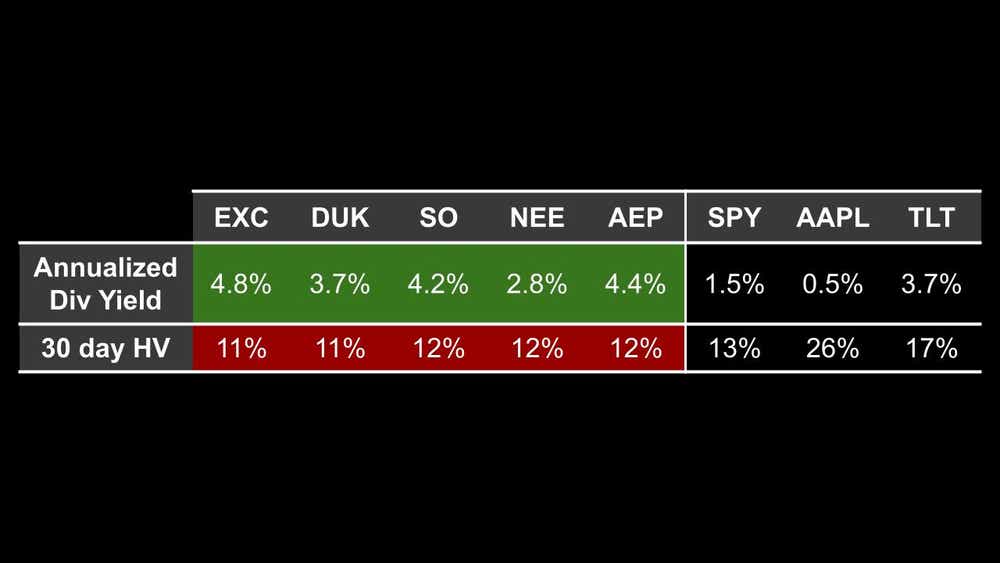

Let's examine the five largest U.S. utility companies: Exelon Corp (EXC), Duke Energy (DUK), Southern Co. (SO), NextEra Energy (NEE), and American Electric Power (AEP). The current average dividend yield for these five companies is almost 4%, significantly higher than that of SPY (S&P 500 ETF), Apple Inc. (AAPL), and TLT (iShares 20+ Year Treasury Bond ETF), which offer 1.5%, 0.5%, and 3.7% respectively. Their average volatility is 11.6%, also considerably lower than these three underlyings, which are considered low-volatility ETFs and stocks.

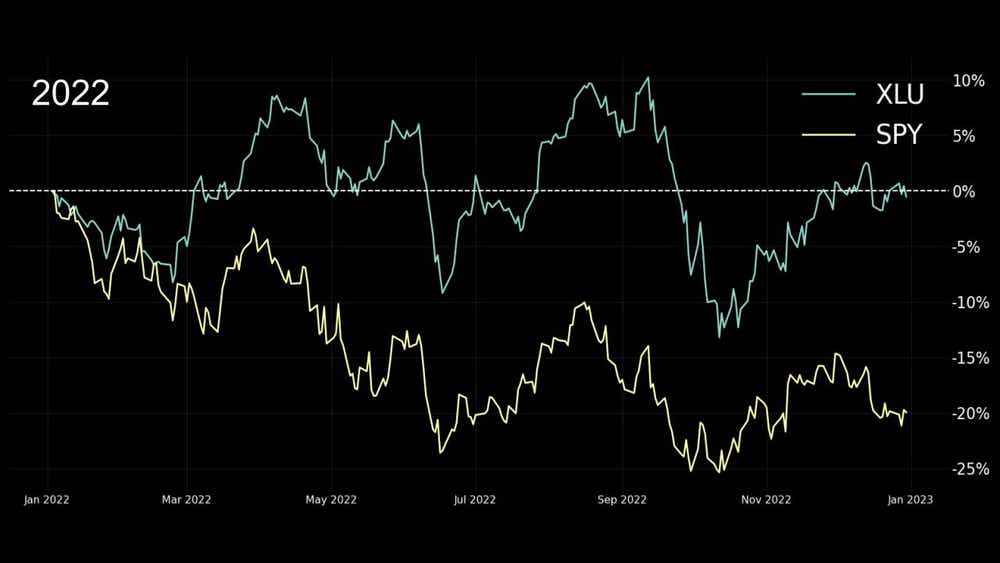

During the recent market downturn in 2022, the S&P 500 (SPY) experienced a significant drop of over 20%. In contrast, the Utilities Select Sector SPDR Fund (XLU) gained 1%.

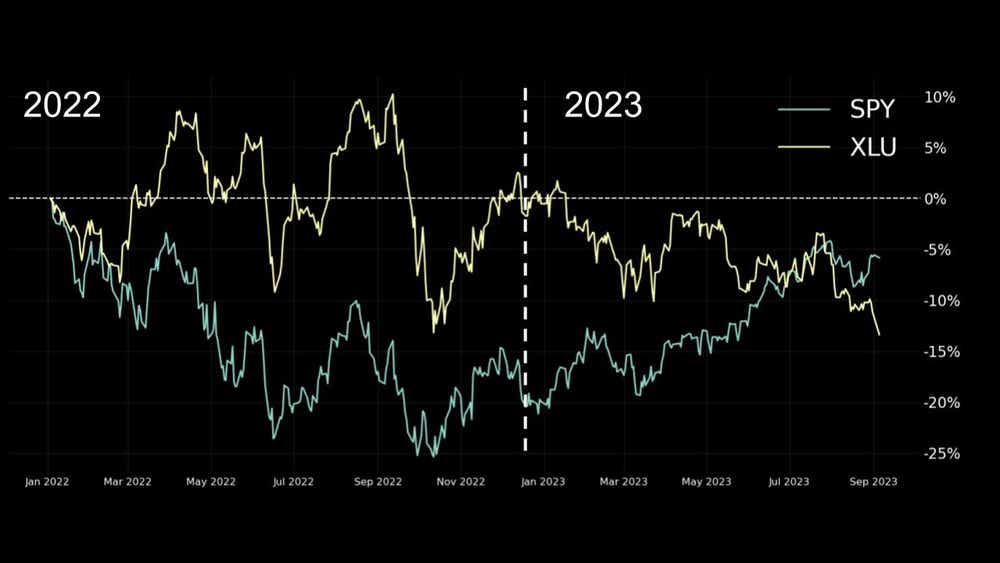

However, the performance of utility stocks this year has been somewhat subdued compared to the broader market.

This is largely due to a rapid rebound in stocks and a surge in interest rates. The impact of rising interest rates on utility stocks can be twofold. Firstly, higher interest rates can exert downward pressure on utility stocks, which often carry elevated levels of debt. Secondly, an increase in interest rates can make alternative investments, such as bonds, more appealing to conservative investors.

Is investing in utility stocks still a promising idea, despite the equity market being near its all-time high and interest rates reaching their highest levels in the last 15 years?

One key advantage of utility stocks is their low correlation with other stocks. This makes them excellent candidates for diversifying your portfolio. Especially when the market starts to turn south, volatility will kick in. Utilities will have a better chance to attract more capital inflow or at least less risk to the downside compared to growth stocks like Nvidia (NVDA) or Tesla (TSLA). This can help reduce the overall directional risk in our portfolio.

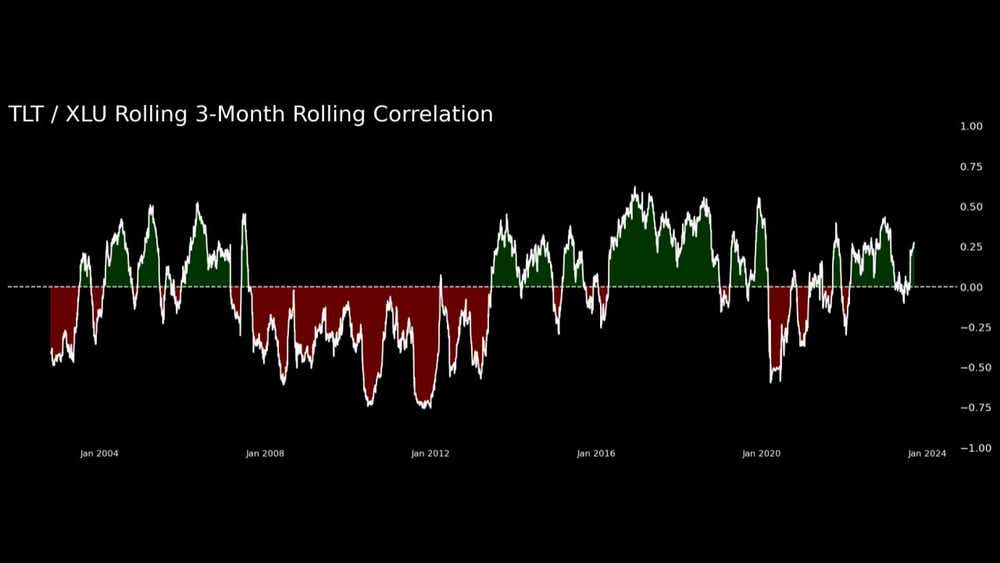

Furthermore, the Utilities Select Sector SPDR Fund (XLU) and the iShares 20+ Year Treasury Bond ETF (TLT) have shown random correlation over the long term. This means that even if we already hold equities and bonds, adding utility stocks can further diversify our investments and reduce risk.

So, is there an opportunity to trade utilities now? As contrarians, we should always be on the lookout for market extremes. With both equity prices and interest rates near their peak, any market pullback or change in the Federal Reserve's inflation capping plans could potentially trigger a recovery in utilities.

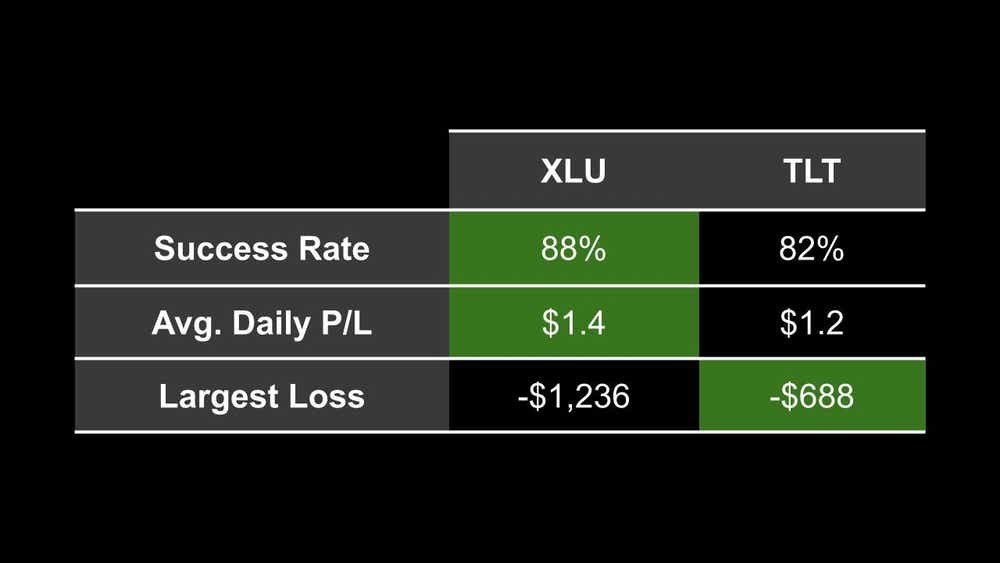

We also conducted a study to test if it is profitable to trade a bullish option strategy in XLU. We would like to compare the past performance of the 45-day, 30-delta puts in XLU and TLT, both managed at 21 DTE. The results show that XLU outperformed TLT in terms of success rate and average daily P/L, making it a great candidate other than TLT.

In summary, high-interest rates can negatively impact utility stocks, reducing their dividend yields and making alternative investments like bonds more appealing. However, the low correlation of utility stocks with equity and bond products makes them an excellent choice for portfolio diversification. Adding a bit of long delta in utility stocks could be a good contrarian play if the stock or bond market starts to turn around.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.