Is Volatility Flattening?

Is Volatility Flattening?

The VIX has dropped but volatility remains elevated—plus two trade ideas

The sharper drop in the VIX at the beginning of this month (March 10) suggests traders expected more short-term volatility, but that expectation moderated by March 17.

With the curve flattening, short-term volatility expectations have become more stable, but the overall level of volatility across the curve remains high relative to the average.

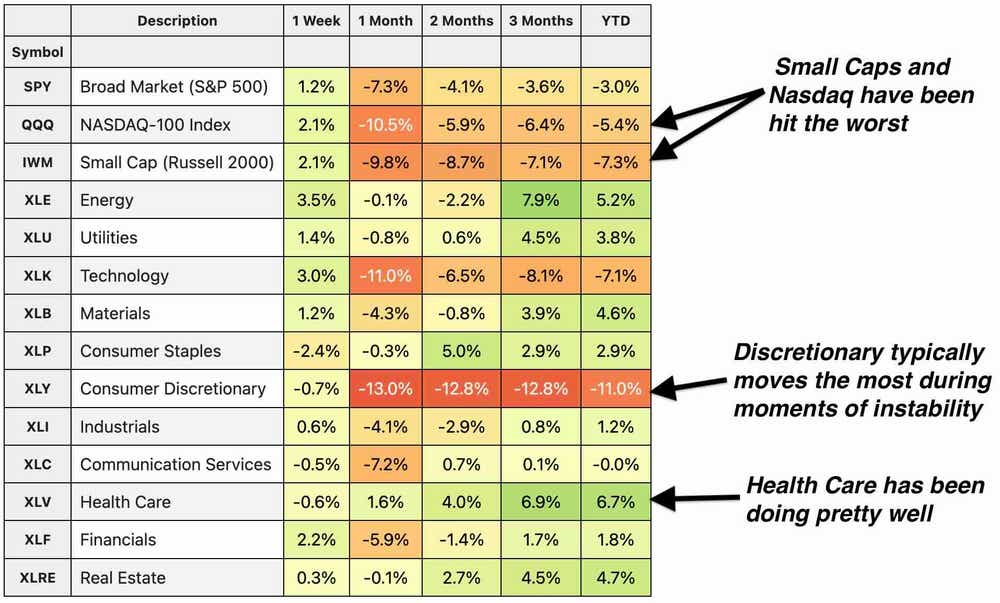

Not all sectors have been hit

Looking at the table below, we see small caps and the Nasdaq have been the indices hit hardest. The sector taking the biggest hit has been Consumer Discretionary (XLY), which makes sense because it is what consumers can do without.

Here’s the definition: ”Consumer discretionary refers to goods and services that consumers want but don't necessarily need, and whose purchases are influenced by disposable income and economic conditions."

So, it makes sense that non-necessary items would be subject to the worst in down markets. But this index also has a tendency to go up first in booms.

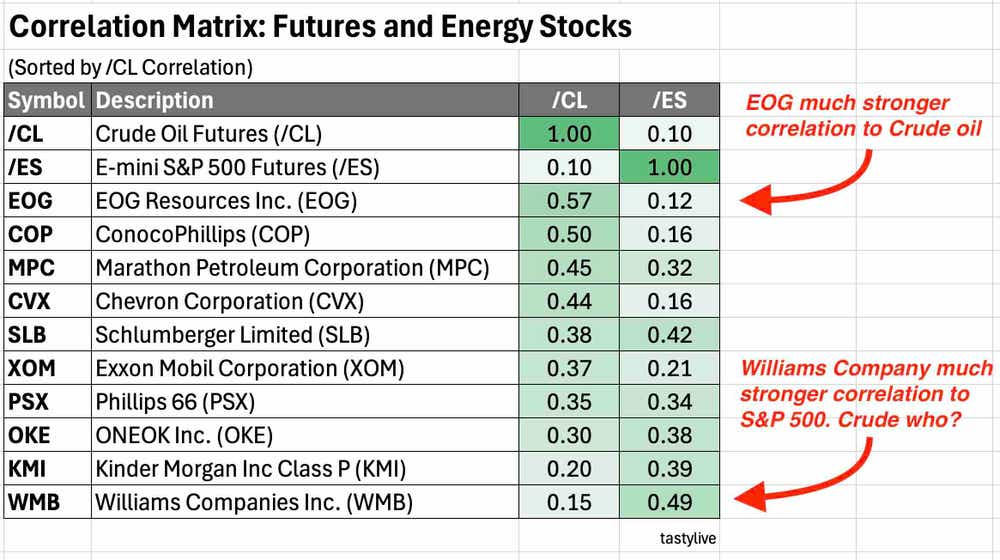

Correlation of energy stocks

We examined the XLE, which is the Energy Select Sector Exchange-Traded Fund, to find components that would rise and fall the most with the price of oil.

We also calculated each with the price of the S&P 500 (/ES) and the price of crude oil futures (/CL). For you nerds, we use the Spearman correlation of log returns.

As you can see below, not everything is strongly correlated with the price of oil. We were surprised these numbers weren't higher.

Two Trade Ideas

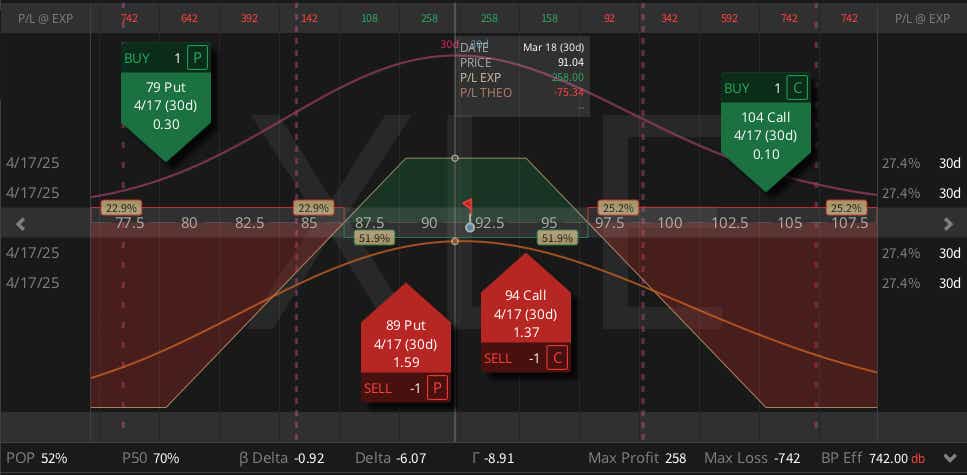

XLE ($91.72) Iron Condor (APR) $2.58 Credit

Energy has been one of the strongest sectors to start the year, with the XLE up more than 5% compared to SPY down 3%. XLE is an energy sector ETF heavily weighted toward Exxon Mobil (XOM) and Chevron CVX (roughly 39% combined), and is currently in the middle of the 2025 range of roughly $83 - $94. If you think it might stay rangebound from here, a wide iron condor takes advantage of the 71 IVR, selling the 89/79 put spread and the 94/104 Call spread for just under 1/3rd the width of the strikes.

AMZN ($191) Iron Condor (APR) $4.34 Credit

The Magnificent Seven stocks have been smacked to start the year with Amazon (AMZN) down 13% from the start of the year and down roughly 20% from highs. Volatility has continued to expand, with an IVR of 60 and monthly IV around 38%. If you think it might bounce or stay rangebound from here, an iron condor plays into short volatility potential. Short the 180/165 put spread and the 205/220 call spread trades at roughly 1/3rd the width of the strikes with only 30 DTE.

Subscribe to Cherry Picks. We are okay with grifters, but to be on our good side subscribe to our newsletter. Please share with your friends—and if you don't have friends—our condolences.

We love new subscribers! We’re okay with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.