Gold Rush: These Mining Stocks and ETFs Are Benefiting from Record Prices

Gold Rush: These Mining Stocks and ETFs Are Benefiting from Record Prices

Gold has shined even brighter in 2024 with stocks notching fresh highs

- Gold prices are up 29% in 2024, driven by concern about inflation, geopolitical tensions and a weaker U.S. dollar.

- Major gold miners like Kinross Gold (KGC) and Harmony Gold (HMY) have soared over 60%, while gold-focused ETFs have also benefited from gold’s strong performance.

- The gold/silver ratio currently trades about 84, showcasing gold’s relative strength, although both have benefited from current market conditions.

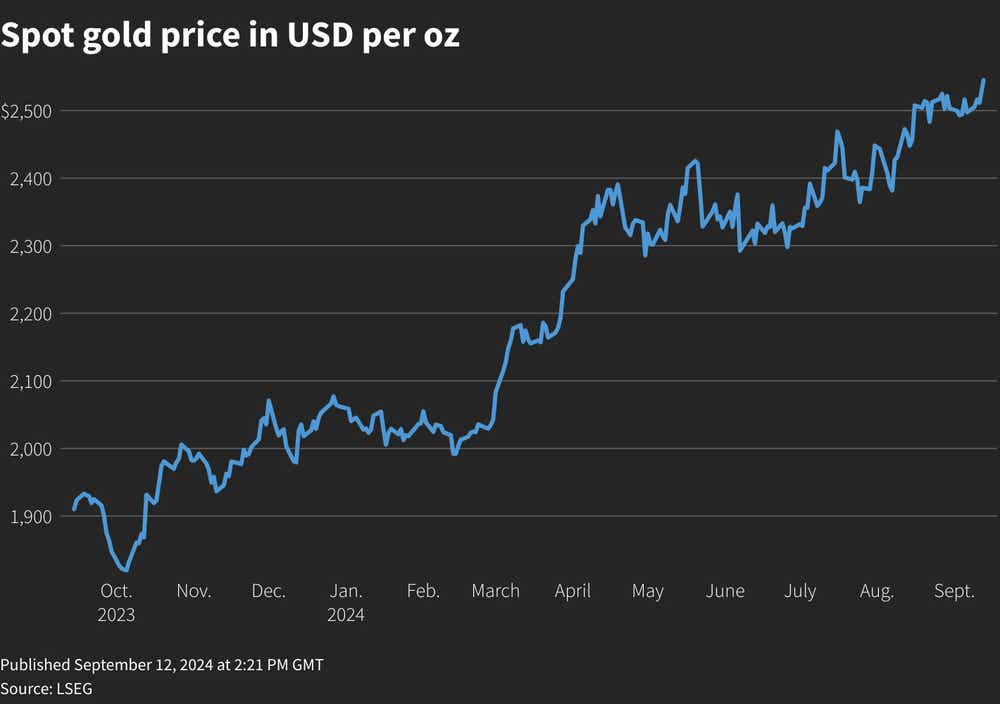

Gold has been on an extraordinary run, surging roughly 29% year-to-date. A remarkable third-quarter performance, with prices climbing 13%, marked its best quarter since the pandemic-driven market turmoil of 2020. Over the past year, the rally looks even more impressive, with gold up roughly 42% since October 2023.

This surge has been fueled by a mix of geopolitical tensions, persistent inflation worries and a weakening U.S. dollar. Together, these factors have drawn investors into the gold market, propelling the metal to fresh all-time highs. Gold prices reached as high as $2,685 per ounce in 2024, underscoring the asset’s appeal in a diverse range of market environments.

Demand for gold mining stocks is increasing

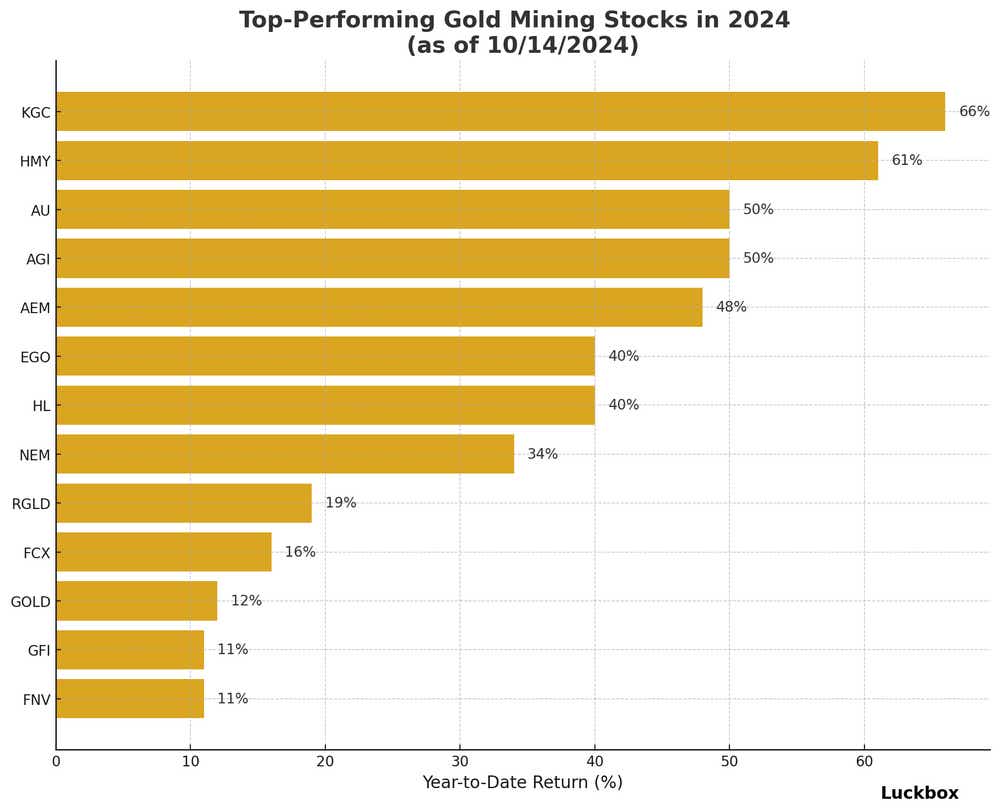

As gold trades near its all-time high, mining companies are riding the wave as well. Investors have flocked to gold miners, driving up shares of major companies. Below are some of the largest-capitalized gold miners, ranked by year-to-date performance.

Not all gold miners benefit equally from rising gold prices—some are better-positioned to capitalize on the gains. For example, miners with lower production costs, known as all-in sustaining costs (AISC), can often achieve higher profit margins as gold prices climb because a larger portion of each price increase translates directly into profit. Companies with high-quality, high-grade mines are typically more efficient and profitable, extracting more gold per ton of ore.

Geography also plays a role because some mining regions offer more favorable regulatory and operational environments than others, which can increase a company’s stability and prospects for growth. Financial health is important because miners with strong balance sheets are positioned to seize new opportunities, such as expanding production or acquiring new assets when market conditions are favorable.

Among the companies listed, AngloGold Ashanti (AU), Agnico Eagle Mines (AEM) and Hecla Mining (HL) are particularly well-positioned to capitalize on higher gold prices, based on their strong performance so far this year.

2024 performance in gold-focused ETFs

Gold-focused exchange-traded funds (ETFs) are often simpler to evaluate than gold mining stocks because their value typically hinges on the price of gold. Many of these ETFs are structured to closely track the gold market, making it easy for investors to understand their exposure based on the underlying holdings.

As a result, the year-to-date returns of many gold ETFs align closely with gold's performance. Here’s how some of the most prominent have performed in 2024:

- SPDR Gold Shares (GLD) +29%

- iShares Gold Trust (IAU) +29%

- SPDR Gold MiniShares Trust (GLDM) +29%

- abrdn Physical Gold Shares ETF (SGOL) +29%

- iShares Gold Trust Micro ETF of Benef Interest (IAUM) +29%

- VanEck Merk Gold ETF (OUNZ) +29%

- Goldman Sachs Physical Gold ETF (AAAU) +29%

- GraniteShares Gold Trust (BAR) +29%

- Invesco DB Precious Metals Fund (DBP) +29%

- Franklin Responsibly Sourced Gold ETF (FGDL) +29%

The above ETFs provide a straightforward way for investors to participate in gold’s price movements, with performance that closely mirrors the price of gold itself. For those looking to amplify their exposure, leveraged ETFs are also available. ProShares Ultra Gold (UGL), for instance, is designed to deliver twice the daily performance of gold. As a result, it has risen 53% this year, capitalizing on the metal’s strong gains.

While leveraged ETFs like UGL can deliver outsized returns, they also come with heightened risk and volatility because of the magnified impact of daily price movements. Ultimately, investors and traders have a broad range of options to consider when seeking exposure to gold, from standard ETFs and leveraged funds to gold mining stocks and futures contracts. Each option offers a different risk profile and potential return, enabling market participants to tailor their approach based on their specific investment goals.

Silver prices are also surging, limiting gains in the gold/silver ratio

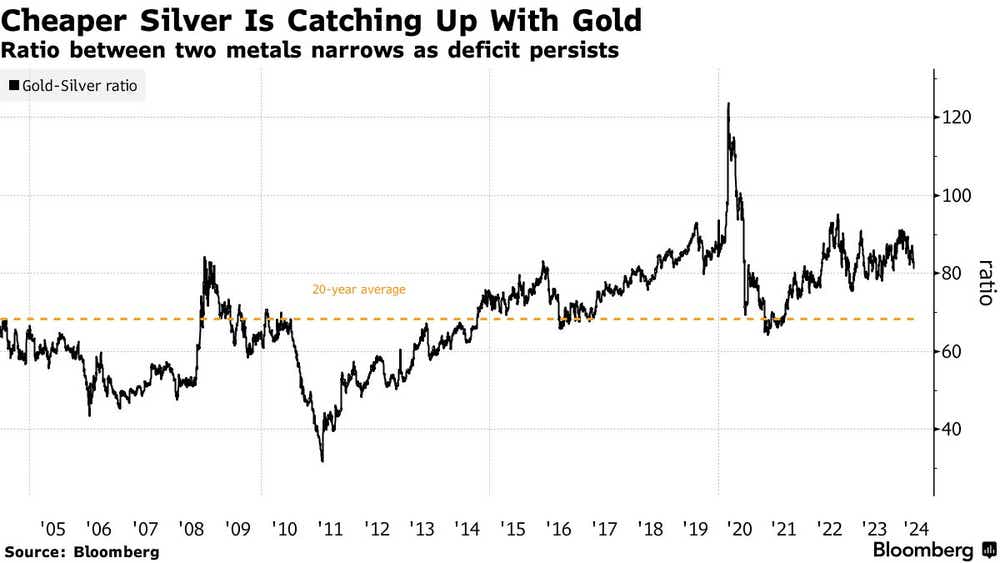

Gold has surged nearly 29% this year, with silver increasing in price at about 32%. Both have been driven higher by inflation, geopolitical tension and a weakening U.S. dollar. This close performance is reflected in the gold/silver ratio, now about 84.

That’s a popular measure of the relative value of gold to silver. By dividing the price per ounce of gold by the price per ounce of silver, the ratio shows how many ounces of silver are needed to buy one ounce of gold. For example, with gold priced at $2,000 and silver at $33, the ratio would be 60, indicating it takes 60 ounces of silver to match the value of one ounce of gold.

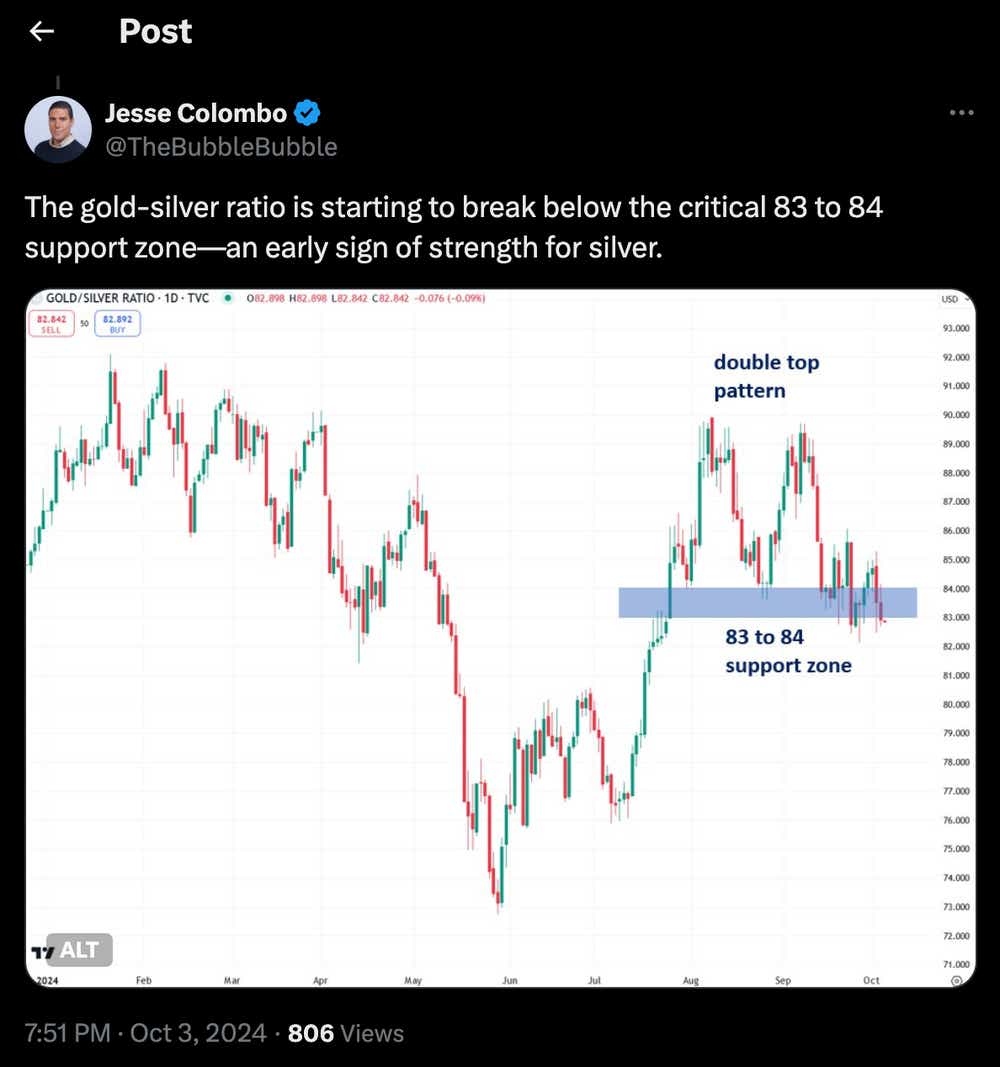

Currently, the ratio is trading around 84 ($2,675/$31.75 = 84), which is above the historical average of about 58, but not at a historical extreme (illustrated below).

When the gold/silver ratio trades above 100, some investors view it as an opportunity to favor silver, anticipating its price might catch up with gold. They could pair the two metals by selling gold exposure and buying silver exposure. A ratio below 50 could signal the reverse trade.

At 84, however, there’s no clear impetus to favor one metal over the other. The two have been moving nearly in tandem, which limits the scope for a potential pairs trade. That said, the market situation is evolving, and more attractive opportunities may arise in the weeks ahead. Investors should keep an eye on the correlation because a breakdown in this relationship could push the ratio closer to an extreme, potentially presenting a compelling entry point.

Takeaways

Gold has enjoyed a remarkable year as investors flock to the metal. Gold-focused ETFs have reflected the gains, while leveraged options like ProShares Ultra Gold have delivered amplified returns, up 53% year-to-date.

At the same time, the gold/silver ratio stands at 84, suggesting gold remains relatively more expensive compared to silver, though both metals have seen substantial gains. With the ratio still well below its 2020 peak above 120, there hasn’t been an extreme divergence, indicating both gold and silver are benefiting from the current market.

Monitoring the gold/silver ratio remains crucial for active participants in the precious metals market. A significant shift in the ratio could reveal new insights into market sentiment and potentially signal the next opportunity in this sector.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.