The King Dollar...is Hurting Everyone Else

The King Dollar...is Hurting Everyone Else

A look at central banks and technical indicators

- Elevated Treasury yields and central banks in retreat are helping the U.S. dollar.

- It’s not just a U.S. dollar story, though: Rate hike odds for other major central banks have shifted meaningfully.

- Technical indicators indicate the potential for a short-term rebound by the U.S. dollar; it’s too early to say if it has bottomed.

Market update: Dollar index (DXY) up 0.67% month-to-date

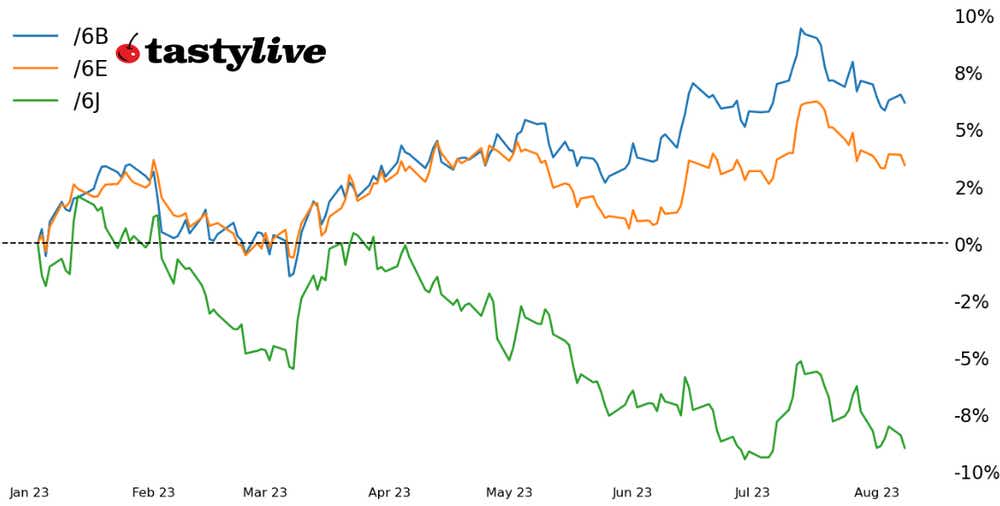

The aggressive move higher in U.S . Treasuries yields since the start of the month may be hurting risk appetite in general, but there’s been at least one beneficiary: the U.S. dollar. Since mid-July, the U.S. dollar has been exhibiting signs of a short-term bottom, which have only been reinforced over the ensuing period. As much as we’d like to attribute this to a resurgent King Dollar, it’s maybe more about the constituents of the DXY Index underperforming than anything else.

The fact is that while the Federal Reserve has signaled its intention to keep interest rates elevated for a significant period of time—potentially “years” in Fed Chair Jerome Powell’s words—other major central banks have signaled that dovish policy intentions.

The Bank of Japan (BoJ), for example, failed to adjust its QQE with YCC policy; the European Central Bank is no longer promising additional rate hikes as data hinting at recession becomes more prevalent; and even down under, calls for the Reserve Bank of Australia to stop hiking and to start thinking about rate cuts are growing louder.

While some of the U.S. dollar strength is due to organic reasons—such as rising U.S. Treasury yields, particularly at the long-end of the curve—a major part is due to interest rate differentials widening out in favor of the U.S. dollar because of the perceived dovishness growing among the ranks of other major central banks. As a result, King Dollar is sitting on the precipice of a more meaningful technical turnaround that could signal additional gains over the coming weeks and months.

/6B British Pound Technical Analysis: Daily Chart (August 2022 to August 2023)

The drop by /6B in August has yet to achieve a meaningful technical breakdown, as the uptrend from the October 2022 and March 2023 swing lows remains intact. Accordingly, it’s too soon to say that a top is being carved out—although we are getting close.

The momentum profile has weakened considerably, with /6B struggling to return above its daily-EMA (exponential moving average) envelope (5-, 13- and 21-EMAs). MACD (moving average convergence/divergence) continues to decline toward falling below its signal line, while slow stochastics have recently moved into oversold territory for the first time since late May. A drop below 1.2600 by the end of August would be a strong confirmation signal that /6B has topped out for the foreseeable future.

/6E Euro Technical Analysis: Daily Chart (August 2022 to August 2023)

Much like /6B, the technical damage levied against /6E is not material—yet. For /6E, the uptrend from the September 2022 and May 2023 swing lows remains intact. But MACD is declining toward its signal line, and slow stochastics are in oversold territory for the first time since late May. The daily EMA envelope, which was treated as support starting in mid-June, is now behaving as resistance. A move below 1.0900 by the end of the month would offer increased confidence that the euro has topped, and the U.S. dollar (via DXY, whose largest component is the euro) has bottomed.

/6J Japanese Yen Technical Analysis: Daily Chart (November 2022 to August 2023)

Thanks to the lack of BOJ action in late July, traders have been gradually pushing /6J back toward the yearly lows carved out at the end of June. For now, the downtrend that defined price action from March through early June has not been reactivated, and it may be the case that /6J tests its yearly low once more without having to return into the downtrend.

Nevertheless, an environment with surging energy prices is bad for the yen, further undercutting already weak real yields. The path of least resistance is lower, for now; although we’re beginning to get back into the territory where the Japanese Ministry of Finance may begin saber rattling about a potential intervention to prop up the yen.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.