Stocks Struggle as Hot U.S. Data Cools Fed Rate Cut Bets

Stocks Struggle as Hot U.S. Data Cools Fed Rate Cut Bets

By:Ilya Spivak

Upcoming FOMC meeting minutes and CPI data may indicate more of the same ahead

- A rally on Wall Street continued to slow for a fourth week straight as yields surged.

- Upbeat U.S. economic data has cooled Fed rate cut bets and sent the dollar higher.

- FOMC meeting minutes and CPI inflation data may show more of the same is on the way.

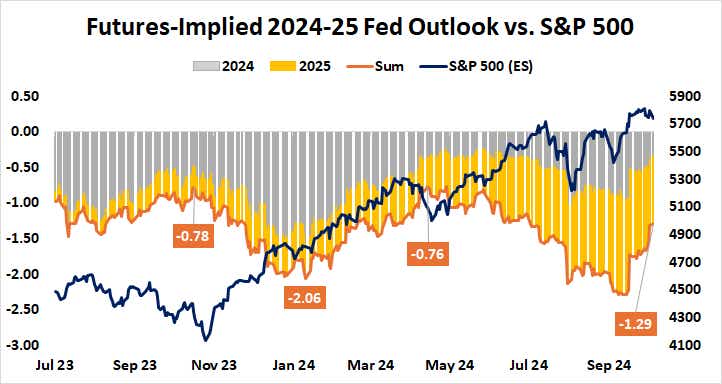

Wall Street continued to lose momentum last week, with the bellwether S&P 500 adding a meager 0.15%. That’s the smallest increase in five weeks. The tech-tilted Nasdaq 100 stalled altogether. The loss of vigor came as hotter-than-anticipated U.S. economic data ate into the Federal Reserve interest rate cut outlook, as expected.

A hearty 245,000 rise in nonfarm payrolls in September dwarfed expectations for a meager 140,000. The jobless rate unexpectedly fell to 4.1%, the lowest since June, and wage growth accelerated to a four-month high of 4% year-on-year. Meanwhile, the Institute of Supply Management (ISM) said the service sector grew at the fastest rate in 19 months.

All this pushed bond yields sharply higher as traders reconsidered the dovish pathway for Fed monetary policy that officials and markets seemed to agree upon as recently as three weeks ago, when the U.S. central bank issued the first cut of the cycle on Sept. 18. The U.S. dollar soared against most of its peers.

The markets now price in 129 basis points (bps) in further easing between now and the end of next year. That’s down from 164bps a week ago and 223bps on the day of last month’s Fed announcement. At least one standard-sized 25bps rate cut is still on the menu before the calendar turns to 2025, but the likelihood of a second one is down to 32%.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

Federal Open Market Committee (FOMC) meeting minutes

Minutes from last month’s fateful meeting of the Fed’s policy-steering committee may help traders decipher whether the central bank is truly on dovish autopilot (as they seem to hope). After all, it opted for a double-sized 50bps rate cut to kick off its easing cycle.

While last week’s cheery economic data wouldn’t have factored into the equation, a speech from Fed Chair Jerome Powell ahead of those outcomes suggests the U.S. central bank is not in a hurry to declare victory over inflation and stands ready to pivot if need be. More evidence to this effect may extend last week’s trade dynamics as yields and the dollar rise.

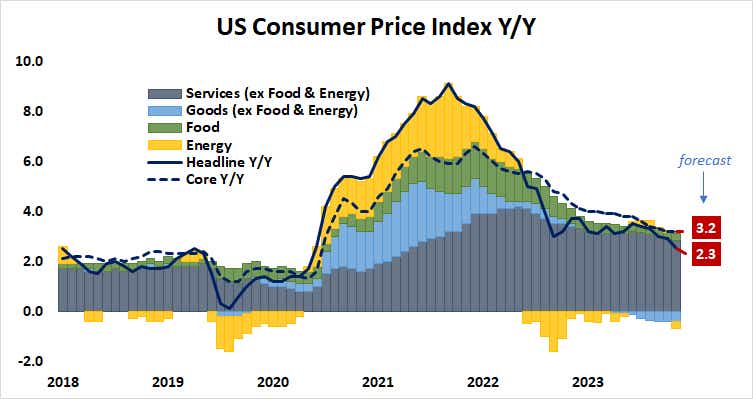

U.S. consumer price index (CPI) inflation data

Headline inflation in the U.S. is expected to tick down to 2.3% year-on-year, the lowest since February 2021. Falling energy prices may be the biggest driver at play for a second month however, which is cold comfort for Fed officials since they don’t have much influence on such things and so can’t hope to ensure they keep trending favorably.

Rather, the central bank is focused on the core measure that excludes energy and food costs. That is expected to hold stubbornly unchanged at 3.2% for third consecutive month. Similar stalling on the path to disinflation forced Fed officials to delay rate cuts in the first half of 2024. More of the same may be interpreted from this week’s data.

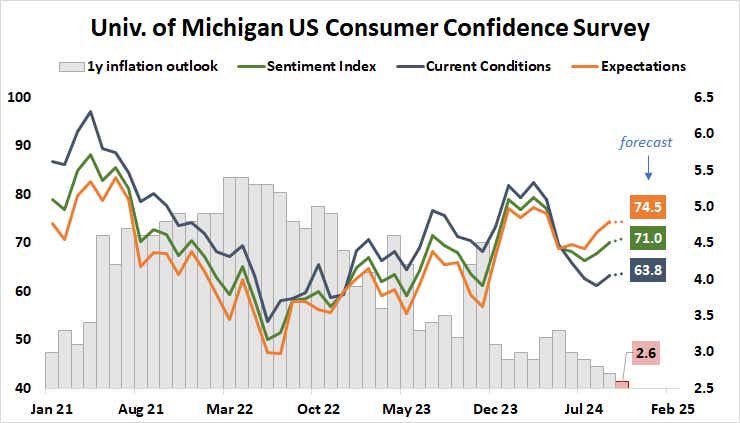

University of Michigan consumer confidence survey

Improving sentiment among U.S. consumers may be another reason for the markets to rethink Fed rate cut bets. The University of Michigan is expected to report that survey respondents’ mood brightened for a third consecutive month as one-year inflation expectations fall to 2.6%, the lowest since December 2020.

Household consumption is the top growth engine for the U.S. economy, accounting for close to 70% of output expansion. Robust hiring and an increase in wages seem likely to encourage an upbeat disposition. If that helps extend the recent run of better-than-expected U.S. data to these figures, still fewer rate cuts might seem plausible in 2025.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.