U.S. CPI Preview: Stocks at Risk if Inflation Data Keeps Fed Rate Path Clouded

U.S. CPI Preview: Stocks at Risk if Inflation Data Keeps Fed Rate Path Clouded

By:Ilya Spivak

Investors don't want to be left guessing about Fed rate cuts

Stock markets fear the Fed is cutting interest rates too late to avoid recession.

August U.S. CPI inflation data is now in focus before next week’s FOMC meeting.

Economic outcomes close to expectations are likely to disappoint Wall Street.

Stock markets think the Federal Reserve interest rate cuts will fall short of delivering a “soft landing” for U.S. economic growth. Policy officials have hoped to time lowering borrowing costs just right to keep inflation on a confident path to their 2% objective without causing a recession. Traders fear that this hope may be slipping away.

This seems to be the story told in Wall Street price action since the central bank began to signal loudly the imminent arrival of stimulus in early July. By then, markets had watched three months of increasingly disappointing U.S. economic data. When the Fed all but assured September would bring rate cuts, worries about the business cycle multiplied.

Stocks fear Fed rate cuts won’t avert recession

The bellwether S&P 500 stock index and the tech-oriented Nasdaq 100 have seesawed sharply higher between bouts of brutal selling in the past two months, muddying the waters for market-watchers hoping for directional conviction. Nevertheless, worries about an economic downturn seem persistent.

That much seems evident because markets continue to price the probability of a jumbo 50-basis-point (bps) interest rate cut at next week’s meeting of the policy-steering Federal Open Market Committee (FOMC) at close to 30%. Such a move would amount to an admission that the Fed is scrambling, having realized that it ought to have cut in July.

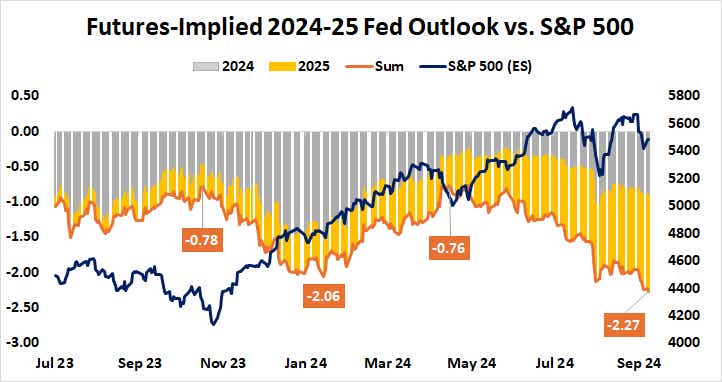

The evolution of rate cut expectations for this year vs. 2025 tells a similar story. Benchmark Fed Funds interest rate futures priced in 100bps in cuts for 2024 amid the market meltdown on Aug. 5. That tally fell to as much as 75bps by Aug. 19 and has subsequently rebuilt to 91bps. Last month’s dovish extreme is yet to be matched.

Meanwhile, the expected rate cut total for 2025 now stands at 136bps, surpassing August’s panic readings by over 30bps. In total, the markets now price in 227bps in cuts through the end of next year. This amounts to adding one standard-sized reduction on the docket compared with the volatility spike high a month ago.

This speaks to speculation the Fed will have to race to catch up to an economic downturn already underway by cutting more in 2025 after having dragged its feet this year.

All eyes on U.S. CPI inflation data

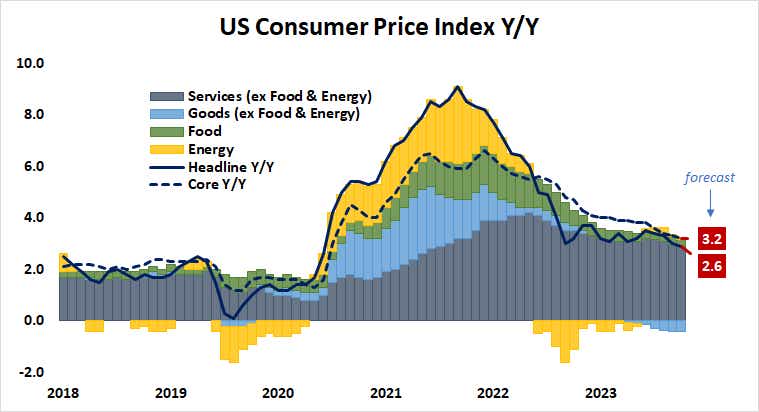

Against this backdrop, the spotlight now turns to August’s U.S. inflation data. The headline consumer price index (CPI) is seen growing 2.6% year-on-year, the slowest increase since March 2021. The core reading excluding volatile food and energy prices—a focal point for central bank officials—is expected to remain at 3.2%, matching July’s three-year low.

As with last week’s data flow, outcomes closely in line with forecasts seem most troubling for stock market bulls. Only a very sharp (and inherently unlikely) upside surprise would make traders seriously consider the possibility that the Fed will delay stimulus again. A miss may well cheer up traders with hopes for a 50bps reduction.

Meanwhile, numbers closely aligned with what is already priced in would lead the markets into next week’s Fed policy meeting with an unwelcome degree of ambiguity. Locking that in after U.S. CPI crosses the wires might trigger de-risking, hurting stocks and lifting the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.