Stocks May Rise as Tariff News Gives Way to Fed Rate Cut Hopes

Stocks May Rise as Tariff News Gives Way to Fed Rate Cut Hopes

By:Ilya Spivak

Will inflation data give the stock markets the green light to go higher?

- Stocks, bonds and the U.S. dollar seem to shrug off another tariff hike.

- U.S. PCE inflation data is unlikely to dislodge the Fed rate cut outlook.

- Sentiment may brighten as the markets embrace stimulus speculation.

Stock markets have managed to hold up despite another wave of tariff headlines from Washington. Wall Street began a cautious recovery from recession-worry lows ahead of last week’s monetary policy announcement from the Federal Reserve, hoping for a bit of soothe-saying. They kept building cautiously upward as officials obliged.

A roadblock seemed to appear midweek as President Donald Trump unveiled a new 25% tariff on imported cars and auto parts. The benchmark S&P 500 stock index lurched lower, recording the biggest one-day drop in two weeks. Bonds fell as yields rose with the U.S. dollar, as if to underscore traders’ belief that tariffs are inflationary.

Markets appear to take another tariff shock in stride

Follow-through has proven to be curiously absent, however. Stocks stalled without making further progress to the downside and managed to sustain their upward slope from mid-March lows. Bonds clung to the lower end of their range, containing yields. The U.S. dollar weakened. Even the euro rose, despite its would-be sensitivity to auto sales.

On balance, this seems to suggest the markets took some heart in reading the tariff news as fodder to convince the Fed that more stimulus is needed instead of as a purely risk-off catalyst. The spotlight now turns to the Fed’s favored personal consumption expenditure (PCE) inflation gauge due from the Bureau of Economic Analysis (BEA).

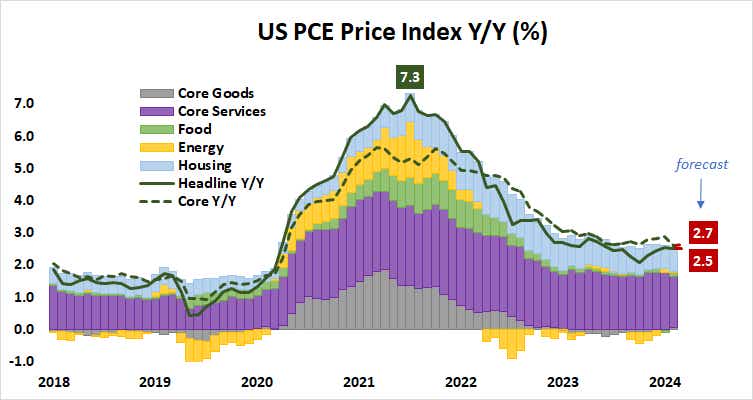

The data is expected to show a headline rise of 2.5% year-on-year for February, matching the previous month’s result. The core measure excluding volatile food and energy prices—the focus for Federal Reserve officials—is seen inching up to 2.7% year-on-year from 2.6% in January. That would fall well within the narrow sub-3% range in place since April 2024.

Stocks and bonds may rise after U.S. PCE inflation data

With the benefit of already-published consumer (CPI) and producer (PPI) price index data, economists’ PCE forecasts tend to hit close to the mark. This hints at relatively little room for a surprise to move markets and dislodge baseline Fed rate cut expectations. As it stands, traders and officials broadly agree on 50 basis points (bps) in cuts this year.

This might mean the PCE result could be more potent in its passing than its substance. Having dispensed with event risk, the markets may once again revert to their most recent default setting: Waiting for the Fed to make good on dovish speculation. Stocks may have room to rise with bonds in this scenario, while yields and the U.S. dollar fall.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.