The Euro May Be in the First Days of a Long Rise Against the U.S. Dollar

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

The Euro May Be in the First Days of a Long Rise Against the U.S. Dollar

By:Ilya Spivak

A big rally is looming for the currency as Europe builds up its own military defenses

- The euro has soared alongside local yields on speculation of at defense buildout in Europe.

- EU leaders seem likely to actually deliver on lofty rhetoric with bold action on arming the Continent.

- With shifts in expectations for growth and inflation, the euro rally may prove lasting

The euro is surging in March. The single currency is on pace to add 3.7% against the U.S. dollar this month, making for the strongest performance since November 2022. A broadly weaker greenback is part of the story: The currency is struggling as fear of an economic slowdown and speculation about cuts in interest rates combine to erode its yield advantage.

However, something special is afoot for Europe’s single currency as well. Eurozone inflation expectations priced into the markets are marching higher and benchmark German bond yields have surged, pointing to a hawkish repricing of European Central Bank (ECB) monetary policy expectations.

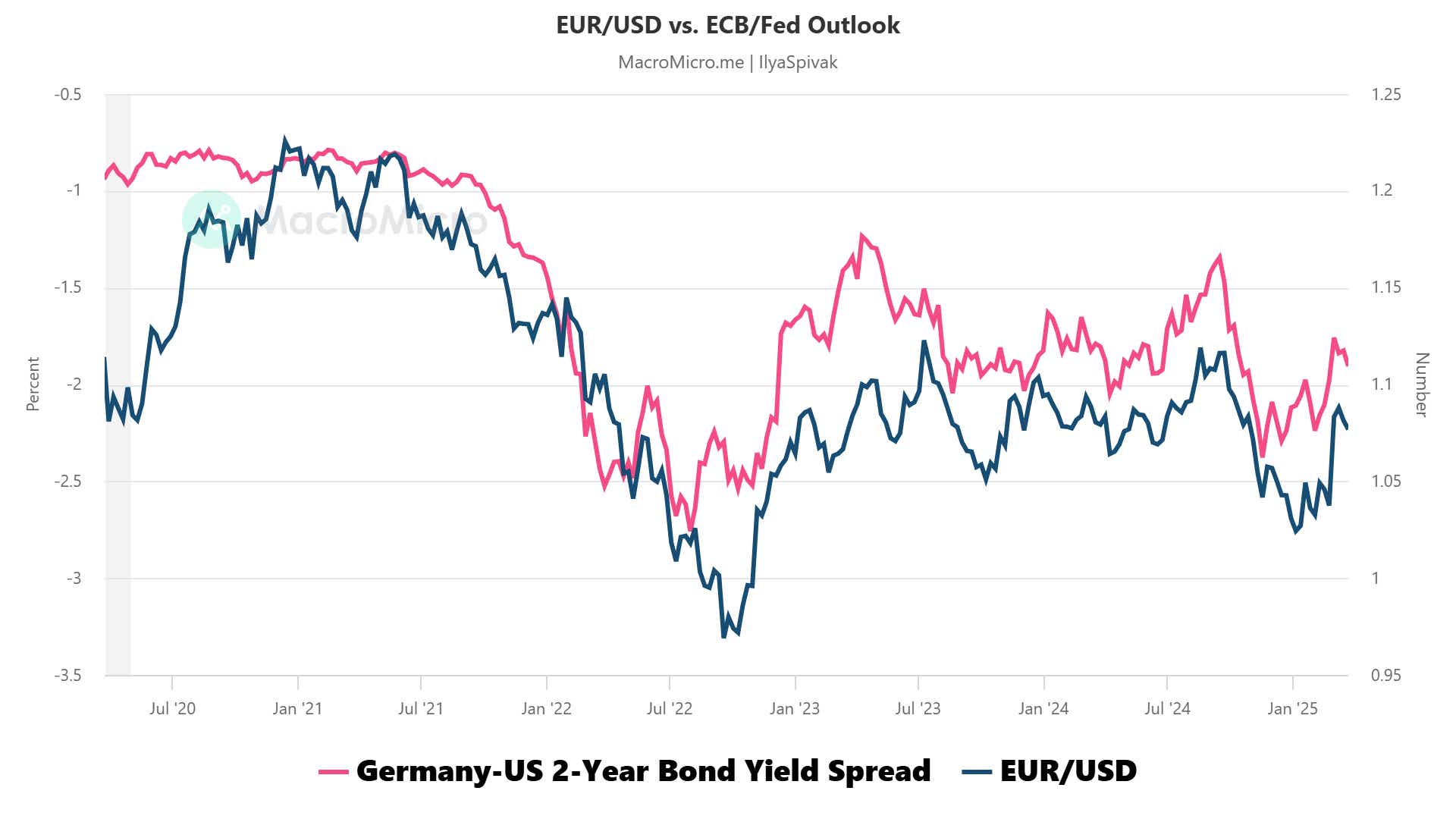

That has been a boon for the euro, which has traded in lockstep with the spread between German and U.S. two-year bond yields for close to four years. The U.S. yield advantage at the front end of the yield curve has rapidly narrowed, touching a five-month low at 176 basis points (bps). That’s down from 224bps a mere month earlier.

The euro wins as markets position for European military buildout

This reflects a flurry of activity among European Union (EU) leaders to boost military spending amid signs of a U.S. pivot away from familiar security guarantees for European allies. A dramatic demonstration came as the White House (briefly) withheld defense assistance for Ukraine after a public row between presidents Trump and Zelensky.

European Commission President Ursula von der Leyen promptly floated a plan to boost defense spending by as much as 800 billion euros, including a 150-billion-euro loan program for member states. Incoming German Chancellor Friedrich Merz secured a deal with rival parties to suspend the country’s “debt brake” to pay for military buildup.

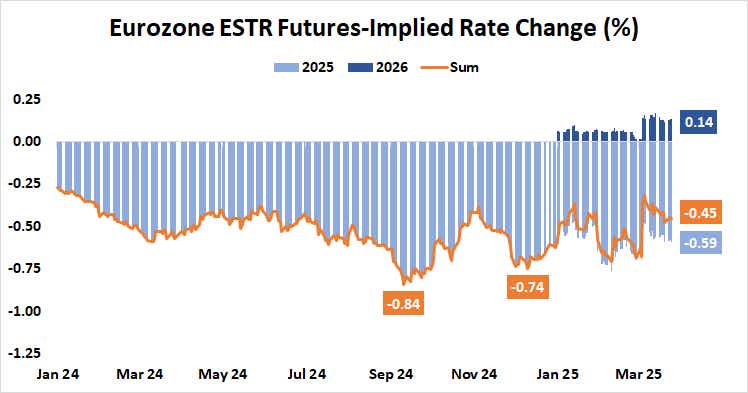

The markets have dutifully revised their ECB outlook. Benchmark ESTR interest rate futures now put the probability of a 25bps rate hike next year at 56%, even as the central bank is still expected to cut rates twice this year. The key question now is whether the notoriously inert EU bureaucracy will actually follow through.

Do European leaders really mean business on defense spending?

Some skepticism is probably understandable: Many European leaders have long resisted defense spending increases. Indeed, arm-twisting EU allies to meet their NATO obligations was a prominent feature of the first Trump administration. Nevertheless, this time the commitment to re-arm appears both earnest and urgent.

In fact, current events follow a familiar script. Defense policy prerogatives have been a forcing function for European integration from the start. The first steps toward what is now the EU—a customs union and joint governance of coal and steel as well as atomic energy—gave post-WWII France some sway over German military industry.

A similar logic prevailed with the EU’s southern expansion: the admission of Spain, Portugal and Greece with what turned out to be dubious economic bonafides. That was done to cement their nascent embrace of democracy and secure their place on the Western side of the Cold War with the USSR.

Familiar EU playbook bodes well for long-term euro gains

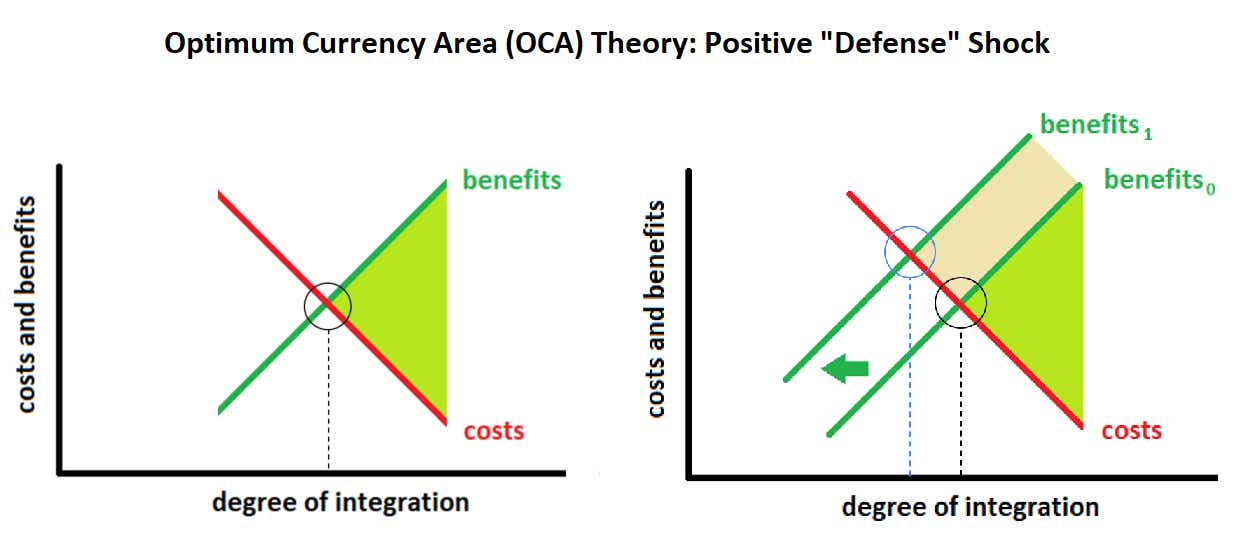

A simple tweak of the Optimum Currency Area (OCA) framework developed by famed economist Robert Mundell reveals the forces at work. The model simply shows that, the greater the degree of pre-existing economic symmetry between countries, the more sense it makes for them to surrender some sovereignty to a formal tie-up.

Introduce the obvious economic benefit of avoiding war as an external force into this calculus, and it is revealed that a poorer economic fit becomes acceptable. That the EU prioritizes security over macroeconomic goals was widely on display as a herd of sacred cows were slaughtered to contain the 2010 European debt crisis.

In all, this probably means that a tectonic defense spending spree is truly imminent in Europe. Its follow-on consequences for growth, inflation and interest rates are already making their way into market pricing and will likely continue to do so for months if not years to come. The euro rally may be just beginning.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.