Stocks May Keep Sinking as Liquidation Takes Hold of Markets

Stocks May Keep Sinking as Liquidation Takes Hold of Markets

By:Ilya Spivak

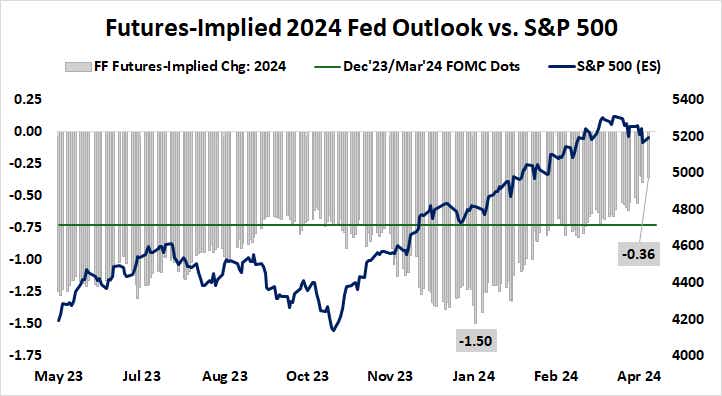

Evaporating Fed rate cut expectations are short-circuiting appetite for risk

- Stock markets are battered by U.S. CPI data and fading Fed rate cut bets.

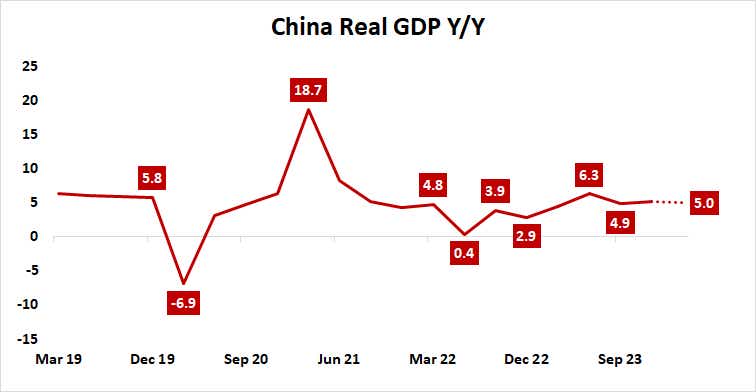

- Soft Chinese GDP data may compound market-wide risk aversion.

- Fed-speak and CPI data from the U.K. and Japan are in focus for investors.

A wave of brutal liquidation struck Wall Street last week. The bellwether S&P 500 plunged 1.6%, marking the second-largest loss this year. The tech-tilted Nasdaq 100—the home of market leaders powering the blistering equities rally since late October 2023—lost 0.7%, marking the first three-week losing streak in seven months.

Hotter-than-expected U.S. inflation data started the bloodletting, sharply scaling back Federal Reserve interest rate cut expectations and scattering a critical tailwind for risk appetite. Treasury bonds tellingly plunged, lifting yields. The U.S. dollar raced higher against its major peers and bitcoin sank.

Signs of escalating geopolitical risk in the Middle East were widely cited as the catalyst of a compounding force as the selloff accelerated Friday. However, soggy performance from gold and crude oil prices, as well as proxy currencies like the Canadian dollar and Norwegian krone, cast doubt on that narrative as a decisive factor.

Here are the macro waypoints likely to shape price action in the week ahead.

China gross domestic product (GDP) data

A narrow slowdown in Chinese economic growth is expected to appear in first-quarter gross domestic product (GDP) data. Output is seen rising 5% year-on-year, a step down from the 5.2% expansion in the three months to December. March retail sales and industrial production numbers are seen posting weaker readings in tandem.

Analytics from Citigroup reveal that Chinese data outcomes have taken a turn lower compared with baseline forecasts. This hints that market-watchers’ models are rosier than reality is validating, setting the stage for downside surprises. Ongoing weakness in the world’s second-largest economy may add to the markets’ risk-off mood.

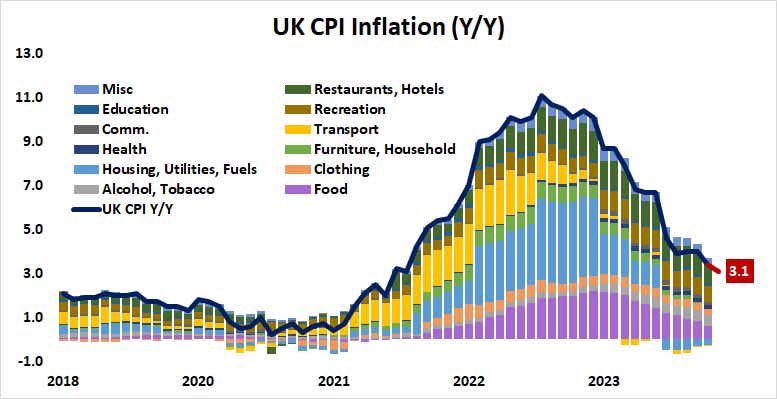

U.K. consumer price index (CPI) data

U.K. inflation is expected to slow sharply in March, cooling to 3.1% year-on-year to mark the lowest reading since September 2021. As with the Eurozone, discretionary spending categories—recreation and hospitality—are now the stickiest areas of price growth as the influence of food costs recedes. They ought to moderate amid anemic economic growth.

With that in mind, the data might strengthen Bank of England interest rate cut expectations and weigh on the British pound. As it stands, 45 basis points (bps) in easing is priced in for 2024. That implies one standard-sized 25bps reduction and an 80% probability of a second. The first move is priced in to appear by August.

Speeches from Federal Reserve officials

A steady stream of scheduled comments from Federal Reserve officials throughout the week will keep speculation about the U.S. central bank’s next steps front and center. Markets have moved sharply to the hawkish side of policymakers’ March forecast of three cuts this year. They have priced in just one, and a 56% probability of a second.

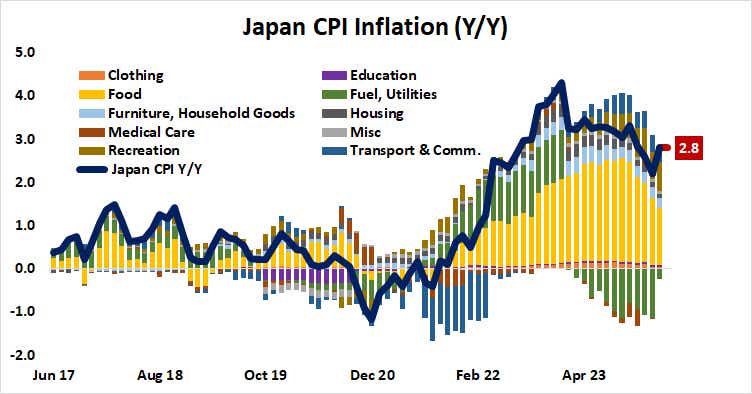

Japan consumer price index (CPI) data

Japan’s inflation is expected to hold steady at 2.8% year-on-year in March. An upside surprise in line with the trend in data outcomes relative to baseline forecasts since the beginning of the year may signal that the Bank of Japan (BOJ) might need to step up the pace of interest rate hikes.

That might push the Japanese yen higher, relieving the weakest levels in over there decades. Local authorities tend to wait for the market to begin a pullback from extremes before intervening, opting to amplify instead of fight traders. A hotter CPI release may well emerge as a trigger.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.