Will Stocks and the Dollar be at Risk If U.S. Retail Sales Data Confirms a Scary CPI Signal?

Will Stocks and the Dollar be at Risk If U.S. Retail Sales Data Confirms a Scary CPI Signal?

By:Ilya Spivak

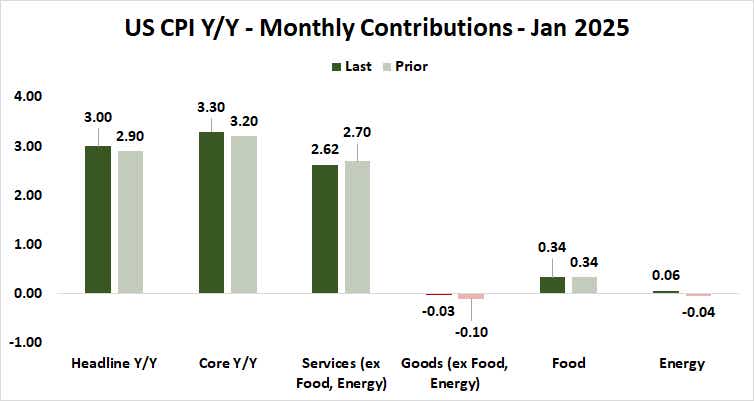

Meanwhile, headline inflation accelerated to 3% year-on-year, topping projections calling for 2.9%

- Bonds sink as yields surge after hotter than expected U.S. inflation data.

- Stocks and the U.S. dollar seesaw as CPI internals reveal worrying trends.

- Retail sales data is now in focus as economic growth takes center stage.

Unexpectedly hot U.S. consumer price index (CPI) inflation data has rattled the Treasury bond market, pushing yields sharply higher. The bellwether 10-year note is on pace to record its biggest one-day loss in a month while the 30-year bond is on pace to lose over 1% in a single session for the first time since mid-December.

Figures from the Bureau of Labor Statistics (BLS) showed headline inflation accelerated to 3% year-on-year, topping projections of 2.9% for a second consecutive month. The core rate excluding volatile food and energy prices—the focus for central bank officials—jumped to 3.3%. It was projected to decline from 3.2% to 3.1%.

Stock markets and the U.S. dollar seesaw on inflation data

A wave of selling struck Wall Street as the CPI report hit the wires, but most of the downswing was rapidly reversed. As the closing bell approached, the benchmark S&P 500 index was trading down just 0.3%, having lost as much as 1.15% intraday. The tech-tilted Nasdaq has erased its earlier drop entirely.

A similar story is on display for the U.S. dollar. The currency shot higher alongside yields as the CPI results ate into Federal Reserve interest rate cut expectations but has since retreated. It is now trading flat or lower against most of its peers. The yields-sensitive Japanese yen is an exception. It is down 1.3%, echoing the bond market.

A look under the hood of the CPI data may explain this seesaw. The contribution from core services to overall inflation fell to 2.62 percentage points last month, the lowest since February 2022. Moreover, the sector’s contribution fell to 87% of the headline figure, the smallest since April 2023.

Will U.S. retail sales data spook risk appetite?

This marks unambiguous disinflationary progress in the stickiest part of CPI and the area of greatest concern for central bank officials. It also seemingly rhymes with last week’s twin purchasing managers index (PMI) reports from S&P Global and the Institute of Supply Management (ISM) that revealed shocking service-sector deceleration.

.png?format=pjpg&auto=webp&quality=50&width=735&disable=upscale)

This puts the spotlight on January’s U.S. retail sales report as the next key inflection point. A 0.1% downtick from the previous month is expected, marking the first negative reading since June. Household consumption is by far the largest contributor to overall economic growth, and traders will be keen to see if something more sinister is brewing.

That’s after a stark disappointment on a closely watched gauge of U.S. consumer confidence from the University of Michigan (UofM). It showed sentiment has fallen to a three-month low as one-year inflation expectations surged to 4.3%, the highest since November 2023. Survey respondents cited the risk of rising tariffs as an outsized concern.

A soft result on retail activity would add to the signs from PMI and CPI statistics suggesting the main driver of U.S. demand—the domestic service sector—is misfiring. That may be sobering for stock markets, especially since the U.S. has been uniquely strong among the major engines of global demand. Without that, a global recession beckons.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.