Analyzing Stock Splits and Market Effects

Analyzing Stock Splits and Market Effects

By:Kai Zeng

Stock splits hit 10-year record in 2024 as S&P 500 soars 26%. Here's what history reveals about split returns.

Thanks to a high-flying stock market and a robust economy overall, we've seen an increased number of companies announcing stock splits this year. In the second quarter, there were 100 stock split announcements, the most since the second quarter of 2023. Plus, the first half of 2024 saw 168 stock split announcements, setting a record for the most stock splits in the first half of any year in over ten years.

Let's look at how stock splits work and their impact on the stock market.

Why do companies split stock?

Companies split their stock for several reasons, including:

- Making the stock more affordable: A lower share price can make the stock more accessible to smaller investors who may not have been able to buy it before.

- Improving liquidity: The increased number of shares can make it easier for investors to trade.

- Signaling management's confidence: A stock split can signal management's confidence in the company's current and future performance.

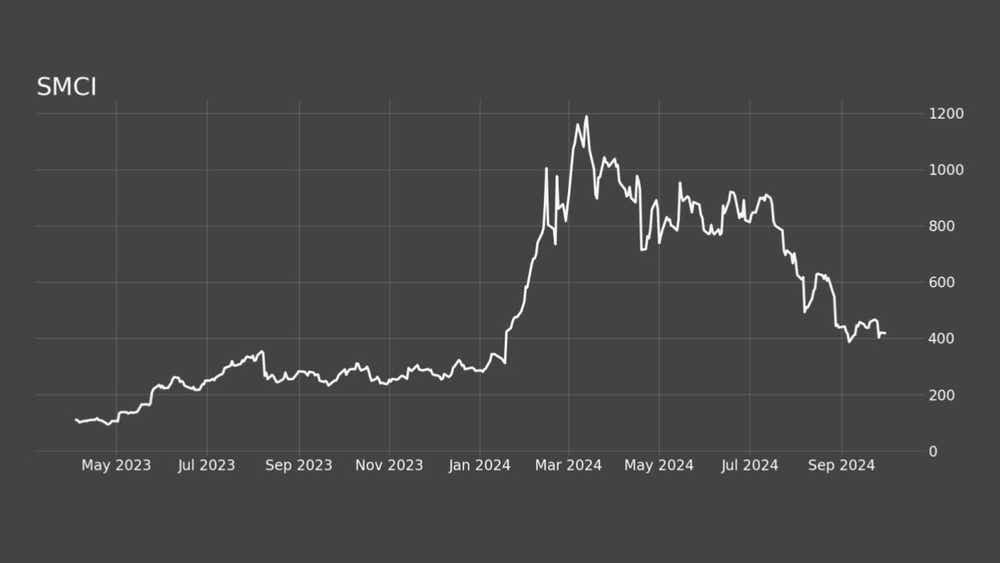

For example, this year, Super Micro Computer Inc.'s (SMCI) price reached $1,200 at one point, almost six times higher than the average price the year before. This could be one motivation for the company to conduct the split.

On Oct. 1, SMCI completed a 10-for-1 stock split. This means the number of SMCI shares increased tenfold, while the value of each share was reduced to one-tenth of its pre-split value. Before the split, SMCI's stock price was trading near $416. After the split, the new stock price would be $41.6. If an investor had one share of SMCI before the split, their position would convert to 10 shares of SMCI, each worth $41.6. This adjustment made the stock more attractive to new investors.

The most common stock split ratio is between 2:1 and 5:1, but due to the high prices of these stocks, the ratio has been adjusted to 10:1 or higher.

Most significant companies with stock splits in the past five years

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Top 5 most anticipated stock splits this year

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Since the beginning of this year, the S&P 500 index (SPX) has surged 26%, outperforming most of the split stocks. For instance, Nvidia's (NVDA) stock price increased by 240% in 2023, but only marginally moved since the split.

Does a stock split really boost the price upward?

Data shows that a stock split doesn’t necessarily guarantee better returns than simply holding SPX within a year, and the volatility of individual stocks is often much higher.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Next, let’s take a look at Apple (AAPL). AAPL had three splits since 2000 (June 2000, February 2005 and June 2014).

We recorded its performance for 12 months directly after each stock split and compared it to the average performance of randomly selected 12-month periods.

Like some other stocks, AAPL yielded a positive return, averaging 10% in the 12 months following the stock split. However, it had an even better performance during randomly selected trading periods of the same length.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

While the initial signaling of a stock split is generally positive to public investors, it does not guarantee better performance. Even if the returns in the following months are positive, they should be compared to the stock's long-term average performance.

Takeaways:

- Stock splits provide various benefits to retail traders, including a more affordable price and better liquidity. They often send positive signals to the market.

- However, the action of stock splits does not necessarily indicate future performance.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.