S&P 500 Struggles to Hold Gains as Bonds Slip Post-PPI

S&P 500 Struggles to Hold Gains as Bonds Slip Post-PPI

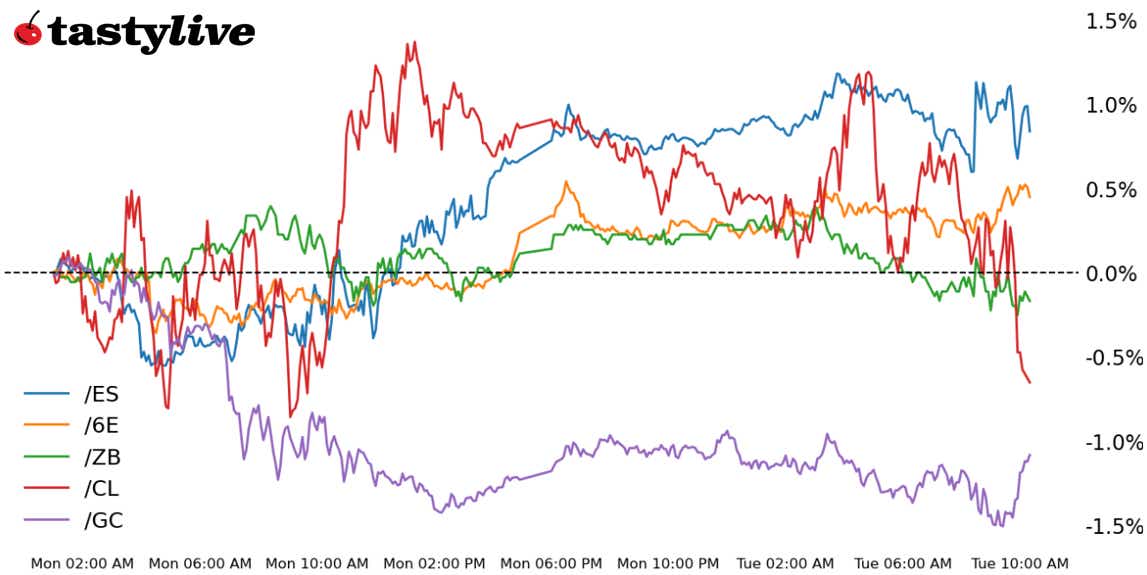

Also, 30-year T-bond, gold, crude oil and euro futures

- S&P 500 E-mini futures (/ES): +0.33%

- 30-year T-bond futures (/ZB): +0.03%

- Gold futures (/GC): -0.01%

- Crude oil futures (/CL): -1.34%

- Euro futures (/6E): +0.6%

A cooler December U.S. producer price index (PPI) initially provoked a drop in Treasury yields and the U.S. dollar, helping to boost U.S. equity markets ahead of the U.S. cash open today. However, the PPI-inspired move has proved fleeting, with bonds trading near their lows of the day and equity markets giving up all their gains. The big inflation print of the month comes out tomorrow, so traders may not want to get too far over their skis. Elsewhere, energy is mixed ahead of weekly inventory figures due out this afternoon and tomorrow morning.

Symbol: Equities | Daily Change |

/ESH5 | +0.33% |

/NQH5 | +0.34% |

/RTYH5 | +0.78% |

/YMH5 | +0.25% |

A cooler-than-expected producer price index print pushed equity markets higher this morning ahead of tomorrow’s CPI report. Traders are focused on the Federal Reserve’s path forward as they brace for earnings season. The banks will kick off the quarterly reports this week, with Citigroup (C), Wells Fargo (WFC) and Goldman Sachs (GS) reporting tomorrow morning. Signet Jewelers (SIG) fell 14% after the opening bell after the company cut guidance. KB Home (KBH) rose 10% after beating estimates.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5810 p Short 5820 p Short 5970 c Long 5975 c | 59% | +275 | -225 |

Short Strangle | Short 5820 p Short 5970 c | 47% | +8900 | x |

Short Put Vertical | Long 5810 p Short 5820 p | 59% | +187.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.03% |

/ZFH5 | +0.05% |

/ZNH5 | +0.05% |

/ZBH5 | +0.03% |

/UBH5 | -0.09% |

The 30-year T-bond futures (/ZBH5) moderated today after days of selling after news crossed the wires that President-elect Donald Trump would take a gradual approach to introducing tariffs, which could potentially keep inflation from spiking. The news prompted some buying not only in U.S. bonds but in Europe as well. Tomorrow’s CPI report is in focus now for bond traders.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 110 p Short 112 c Long 113 c | 27% | +703.13 | -296.88 |

Short Strangle | Short 110 p Short 112 c | 53% | +2515.63 | x |

Short Put Vertical | Long 109 p Short 110 p | 64% | +359.38 | -640.63 |

Symbol: Metals | Daily Change |

/GCG5 | -0.01% |

/SIH5 | +0.14% |

/HGH5 | +0.10% |

Gold continued to trim last week’s gains this morning despite the new inflation data, which opened the door for more rate cutting from the Fed. Meanwhile, the news on tariffs reduced the chances for inflation to rise drastically and for growth to slow. The risk-taking in equity markets is likely distracting from the gold trade, and that trend may continue if earnings season proves bullish for equites.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2665 p Short 2670 p Short 2735 c Long 2740 c | 20% | +390 | -110 |

Short Strangle | Short 2670 p Short 2735 c | 56% | +7530 | x |

Short Put Vertical | Long 2665 p Short 2670 p | 63% | +210 | -290 |

Symbol: Energy | Daily Change |

/CLG5 | -1.34% |

/HOG5 | -0.83% |

/NGG5 | -2.03% |

/RBG5 | -0.19% |

Crude oil prices (/CLG5) fell despite rising confidence in Fed rate cut bets following this morning’s inflation report, which could support more economic growth. However, prices rose to a four-month high yesterday. The move today is likely happening because traders are taking some profits amid the multi-month highs. Fresh U.S. sanctions on Russia’s oil complex helped lift prices earlier this week, and that narrative will likely help support oil markets in the days to come. The American Petroleum Institute (API) will release weekly storage data later today.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 75 p Short 75.5 p Short 79 c Long 79.5 c | 22% | +380 | -120 |

Short Strangle | Short 75.5 p Short 79 c | 54% | +3820 | x |

Short Put Vertical | Long 75 p Short 75.5 p | 57% | +210 | -290 |

Symbol: FX | Daily Change |

/6AH5 | +0.5% |

/6BH5 | +0.08% |

/6CH5 | +0.26% |

/6EH5 | +0.6% |

/6JH5 | -0.16% |

Euro futures (/6EH5) rose against a broadly weaker dollar. The recent news about tariffs is a positive for Europe’s economy. That, combined with this morning’s inflation report out of the U.S., which pushed bond prices higher, was a positive confluence of factors for the European currency. The dollar will likely play the primary role in currency moves this week, especially with tomorrow’s CPI report. Tomorrow we will also see data on European industrial production, and later this week we’ll get the European Central Bank’s monetary policy meeting accounts.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.015 p Short 1.02 p Short 1.04 c Long 1.045 c | 29% | +437.50 | -187.50 |

Short Strangle | Short 1.02 p Short 1.04 c | 57% | +2312.50 | x |

Short Put Vertical | Long 1.015 p Short 1.02 p | 69% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.