S&P 500 Reverses Gains as Traders Get Ready for FOMC Tomorrow

S&P 500 Reverses Gains as Traders Get Ready for FOMC Tomorrow

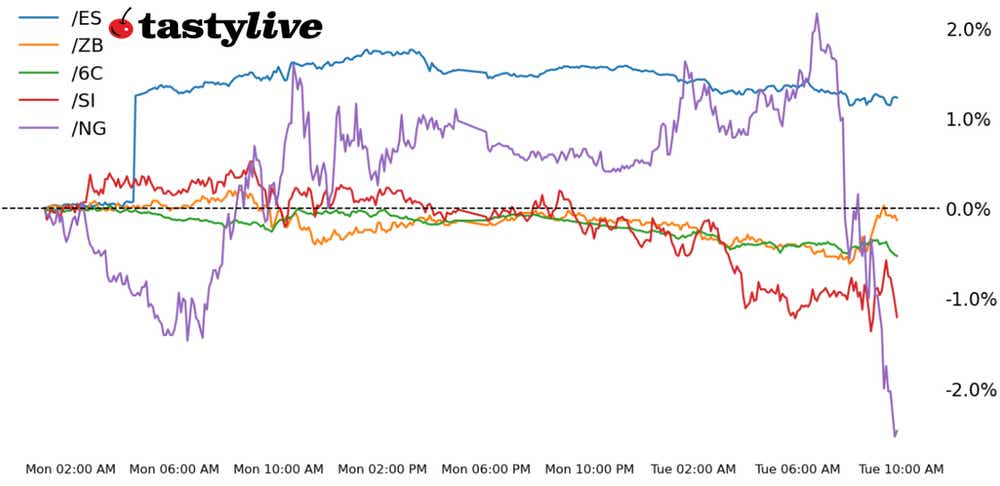

Also, 30-year T-bond, silver, natural gas and Canadian dollar futures

- S&P 500 E-mini futures (/ES): -0.55%

- 30-year T-Bond futures (/ZB): +0.19%

- Silver futures (/SI): -1.28%

- Natural gas futures (/NG): -3.3%

- Canadian dollar futures (/6C): -0.48%

It’s a turnaround Tuesday in the bearish sense, with traders shifting into relative safe havens (bonds, the Japanese Yen) and out of growth-oriented assets (energy, equities, metals). Stronger-than-expected U.S. retail sales and weaker-than-expected U.S. manufacturing figures have led to a slight reduction in the odds for a cut in interest rates at tomorrow’s Federal Open Market Committee (FOMC) meeting, with Fed funds futures discounting a 95% chance of a 25-basis-point (bps) rate cut, down from 99% yesterday; while this is still more-or-less a guaranteed outcome, the reality is that cut odds are in retreat through 2025.

Symbol: Equities | Daily Change |

/ESH5 | -0.55% |

/NQH5 | -0.53% |

/RTYH5 | -0.63% |

/YMH5 | -1.1% |

The strong start yesterday has been met by weaker action today for U.S. equity markets. The weakest performer is the Dow Jones 30 (/YMH5), but attention remains on the high-flying Nasdaq 100 (/NQH5) as longtime leader Nvidia (NVDA) may be in the early stages of a technical topping pattern. Elsewhere, the S&P 500 (/ESH5) continues to flag, having traded sideways for most of December amid what may now be the 12th consecutive day of negative breadth.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5800 p Short 5825 p Short 6425 c Long 6450 c | 63% | +240 | -1010 |

Short Strangle | Short 5825 p Short 6425 c | 69% | +2425 | x |

Short Put Vertical | Long 5800 p Short 5825 p | 84% | +137.50 | -1112.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | 0% |

/ZFH5 | +0.01% |

/ZNH5 | +0.01% |

/ZBH5 | +0.19% |

/UBH5 | +0.28% |

Federal Reserve rate cut odds are down marginally across the board, and Treasuries are rallying for the first time in days. Counterintuitive? Maybe not. If bonds are afraid of inflation, then more Fed cuts means higher inflation risk; reduced Fed cut odds moving forward mean lower odds of reflation. There is a 20-year bond auction later today – both notes (/ZNH5) and bonds (/ZBH5) are in focus.

Strategy (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 112 p Short 122 c Long 125 c | 67% | +671.88 | -2328.13 |

Short Strangle | Short 112 p Short 122 c | 71% | +1140.63 | x |

Short Put Vertical | Long 109 p Short 112 p | 84% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCG5 | -0.72% |

/SIH5 | -1.28% |

/HGH5 | -1.25% |

Metals have been weak for four consecutive days, now buttressed by the decline in energy markets: Concern about growth may be percolating as traders reshuffle their positions in the final full week of 2024. Silver prices (/SIH5) have quickly returned to their post-election lows. Most concerning for the precious metals? Volatility metrics have started to contract again, which has been a contemporaneous indicator for weakness throughout this year.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.5 p Short 28.25 p Short 33.5 c Long 34.25 c | 64% | +900 | -2850 |

Short Strangle | Short 28.25 p Short 33.5 c | 70% | +2610 | x |

Short Put Vertical | Long 27.5 p Short 28.25 p | 82% | +445 | -3305 |

Symbol: Energy | Daily Change |

/CLG5 | -2.16% |

/HOF5 | -1.99% |

/NGF5 | -3.3% |

/RBF5 | -1.76% |

Global economic data has not been impressive in recent days, and demand-sensitive energy markets are wearing it on their sleeve. Natural gas prices (/NGF5) are dealing with another layer of concern, insofar as the two-week ahead temperature forecast for the lower 48 states is now showing approximately 97% of the U.S. population experiencing above average temperatures.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.4 p Short 2.55 p Short 3.8 c Long 3.95 c | 61% | +480 | -1020 |

Short Strangle | Short 2.55 p Short 3.8 c | 69% | +1480 | x |

Short Put Vertical | Long 2.4 p Short 2.55 p | 71% | +370 | -1130 |

Symbol: FX | Daily Change |

/6AH5 | -0.45% |

/6BH5 | +0.02% |

/6CH5 | -0.48% |

/6EH5 | -0.08% |

/6JH5 | +0.42% |

The Canadian economy is in shambles, and the latest wrinkle is the abrupt resignation of Canadian Finance Minister Chrystia Freeland. Political betting markets are pricing in a 1-in-5 chance that Prime Minister Justin Trudeau resigns. Against the backdrop of a dovish central bank, the Canadian dollar (/6CH5) has traded to fresh yearly lows while seeing volatility explode to near its highest levels of the year (IVR: 96.4).

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.67 p Short 0.685 p Short 0.715 c Long 0.73 c | 68% | +310 | -1190 |

Short Strangle | Short 0.685 p Short 0.715 c | 70% | +400 | x |

Short Put Vertical | Long 0.67 p Short 0.685 p | 90% | +150 | -1350 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.