The S&P 500 Passed on AppLovin—Should Investors Do the Same?

The S&P 500 Passed on AppLovin—Should Investors Do the Same?

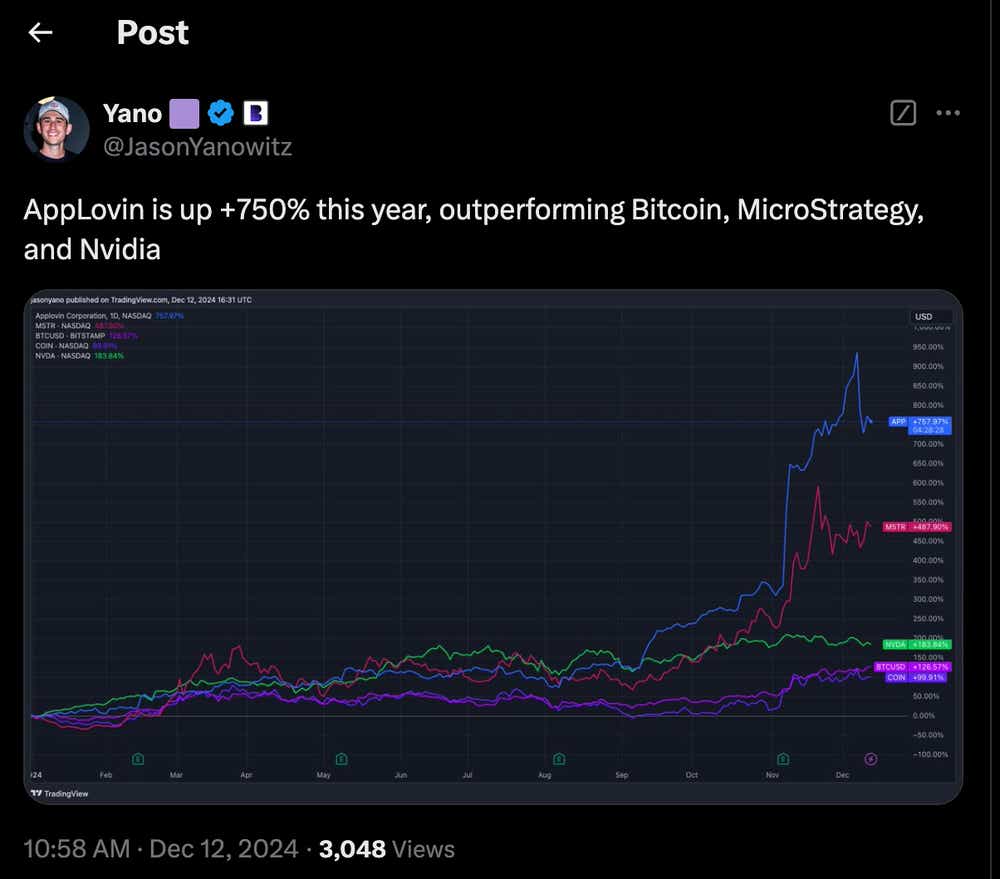

AppLovin shares dropped 20% after the snub, but AI and a 725% gain this year suggest a possible buying opportunity

- Shares in AppLovin have surged 725% in 2024, but a recent S&P 500 omission pushed the stock down more than 20%.

- The company’s pivot toward AI-driven advertising tools fueled optimism among investors.

- With price targets as high as $480, analysts suggest the recent pullback may represent an opportunity.

Stock in AppLovin (APP), a pioneer in AI-powered mobile advertising and app monetization, has skyrocketed more than 725% this year, outpacing high-flyers like Bitcoin (BTC), MicroStrategy (MSTR) and Nvidia (NVDA) to reach a 52-week high of $417.

But the euphoria cooled on Dec. 9, when AppLovin wasn’t included in the S&P 500—an omission that sent shares tumbling more than 20%. Is the pullback temporary or an indication the stock has reached a plateau? Let’s unpack the implications and explore what could be next for one of the 2024's standout performers.

Revolutionizing the app economy

AppLovin (APP) has become a cornerstone of the mobile app economy, powering the infrastructure that turns downloads into dollars. Its AI-driven software platform isn’t just keeping pace with the rise of data-driven advertising—it’s redefining how advertisers and developers engage with users.

Positioned at the intersection of app monetization and digital marketing, AppLovin helps brands and developers navigate the fast-moving world of mobile advertising with precision and scale.

At the heart of AppLovin’s business is its software platform, which provides advertisers and app developers with powerful tools to market, monetize and analyze their apps. Flagship tools like AppDiscovery, MAX and Adjust can all leverage advanced AI to optimize ad placement, enhance user engagement and drive monetization.

AppLovin has also cemented its dominance in mobile gaming advertising with AI-driven products that offer customers a competitive. Beyond its software, the company’s portfolio of free-to-play games provides a steady revenue stream from in-game ads and user spending, creating a business model poised for sustained growth.

Recent revenue trends illustrate the rising popularity of AppLovin’s AI-focused offerings. In 2023, its software platform accounted for 56% of total revenue, but by mid-2024, this had grown to 66%—driven by a remarkable 75% year-over-year increase.

This shift demonstrates AppLovin’s focus on scalable, high-margin software instead of its own game portfolio, as advertisers increasingly rely on AppLovin’s tools to reach targeted audiences. AI integration, in particular, has driven AppLovin’s recent financial success, creating significant value for clients and resulting in sharp revenue and EBITDA gains.

Looking ahead, AppLovin’s growth prospects are intertwined with the expansion of mobile gaming and e-commerce. The mobile gaming market is poised for steady growth, with industry revenues expected to reach about $120 billion by 2027.

As a key player in mobile advertising, AppLovin stands to benefit from the increasing demand for in-game ads. Its AI-powered platform, particularly tools like AppDiscovery, helps advertisers reach users more precisely, making it an essential partner for gaming app developers looking to drive engagement. That strengthens AppLovin’s ability to capture a larger share of an ever-expanding digital advertising market.

Plus, AppLovin’s push into e-commerce represents a promising avenue for growth. With mobile commerce projected to account for 60% of all retail e-commerce revenue by 2028, shopping apps are rapidly becoming a critical part of the app business.

AppLovin’s advertising platform, already known for its success in mobile gaming, can be adapted to help shopping apps engage users through targeted, interactive advertising. Playable ads, a proven driver of engagement in gaming, are also being reimagined for retail apps, creating a more immersive shopping experience. With its advanced capabilities and expertise, AppLovin can capitalize on these opportunities.

AppLovin’s financial position continue to strengthen

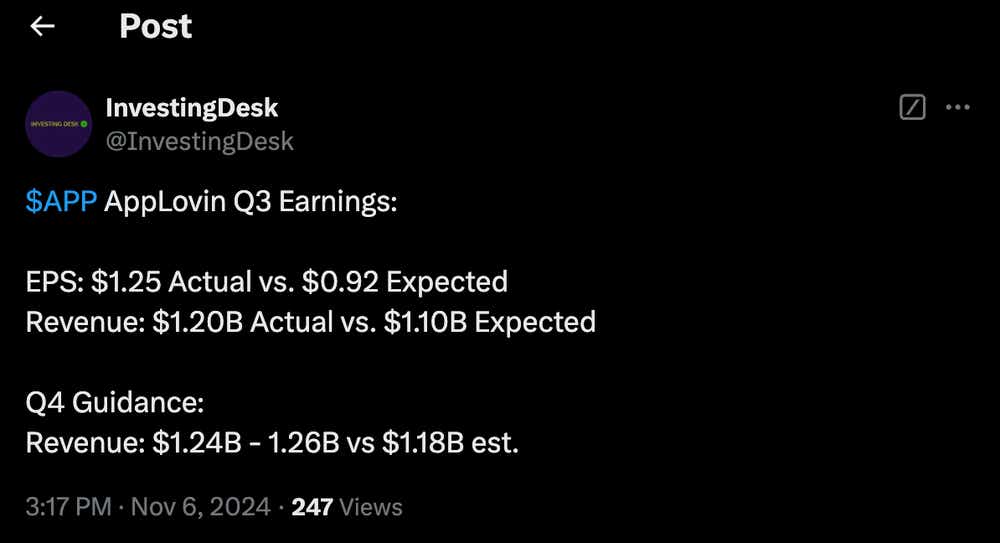

AppLovin’s recent earnings reports highlight its growth story, driven by its focus on high-margin software solutions. Year-over-year (YoY), revenue surged, rising 44% in Q2 to $1.08 billion and an additional 39% in Q3 to $1.2 billion. The software platform division led the charge, with staggering YoY growth of 75% in Q2 and 66% in Q3, reflecting robust demand for the company’s AI-driven advertising tools. \

In contrast, the apps division delivered more modest results, with gains of 7% in Q2 and just 1% in Q3. This divergence highlights AppLovin’s strategic emphasis on scaling its software operations, which now account for a significant portion of its revenue.

Quarter-over-quarter data sheds light on AppLovin’s shifting growth dynamics. Revenue climbed from $1.08 billion in Q2 to $1.2 billion in Q3, propelled largely by the software platform’s robust performance. In contrast, the apps division showed minimal growth, signaling potential challenges in this segment. This disparity highlights why AppLovin has increasingly positioned its software platform at the forefront of its strategy—capitalizing on its scalability and profitability to offset slower gains in other areas.

AppLovin’s meteoric rise—over 725% year-to-date—has been matched by equally impressive gains in profitability. In Q3, net income catapulted 300% year-over-year to $434 million, driven by a standout 60% adjusted EBITDA margin. Even more telling, operating cash flow surged 177% to $551 million, while free cash flow soared 182% year-over-year. These results highlight a company firing on all cylinders, converting top-line growth into bottom-line success, and solidifying its reputation as a tech sector powerhouse. AppLovin’s ability to consistently deliver such efficiency helps explain why investors remain captivated by its growth story.

AppLovin’s forward guidance reflects a company confident in its ability to sustain momentum while adapting to shifting market dynamics. For Q4, the company anticipates a 31% year-over-year increase in revenue and a 58% jump in adjusted EBITDA—figures that remain impressive despite marking a more measured pace compared to earlier quarters. Its long-term annual growth target of 20-30% reflects confidence in its ability to sustain momentum, while its strategic expansion into e-commerce highlights a bold effort to capture emerging opportunities in mobile-first shopping. CEO Adam Foroughi has called this pivot a potential “strong contributor” to the company’s evolution, signaling a deliberate push to diversify its influence within the app ecosystem.

Pivot to e-commerce central to AppLovin’s premium valuation

AppLovin’s valuation tells the story of a company riding the high tide of growth and innovation, but one that also carries the weight of lofty expectations. With a trailing twelve-month (TTM) GAAP price-to-earnings (P/E) ratio of 102—more than triple the sector median of 32—the numbers reflect not just confidence in its current performance but a bet on its future as a dominant force in mobile advertising and e-commerce. At a market capitalization of $110 billion and a share price near $325, AppLovin is priced as a leader poised to capture an outsized share of two booming markets, leaving little room for missteps along the way.

Beyond the P/E ratio, some additional valuation metrics further underscore the lofty expectations surrounding the company’s growth story. For example, the company’s TTM price-to-book ratio has risen above 100, compared to a sector median of just 3.5, while its price-to-sales ratio stands at 26.5, far surpassing the sector median of 3.3. These figures reflect the market’s confidence in AppLovin’s ability to sustain its rapid expansion, particularly through its high-margin software platform, which now accounts for 66% of total revenue. This segment’s impressive 75% year-over-year growth in the first half of FY 2024 has fueled substantial gains in EBITDA and free cash flow, reinforcing the company’s profitability edge.

Elevated valuation metrics like those outlined above come with inherent risks. High P/E and P/S ratios often indicate that a stock is priced for perfection, leaving little room for missteps. For AppLovin, this translates into a need not only to sustain its impressive double-digit revenue growth, but also to improve margins and cash flow to justify its current valuation. Furthermore, any slowdown in the growth of its software platform segment or setbacks in its push into newer ventures, such as e-commerce, could swiftly erode investor confidence, and place significant pressure on the company’s valuation.

Placing the above metrics in context adds additional depth to the narrative. AppLovin’s focus on AI-driven tools for user acquisition and monetization gives it a distinct advantage, as these capabilities are increasingly sought after in both gaming and shopping app ecosystems. This strategic positioning helps explain the company’s premium valuation, as does its proven ability to deliver consistent cash flow growth. Yet, AppLovin’s journey is not without challenges. The highly competitive nature of its markets and its push into e-commerce expose the company to new uncertainties, including the cyclicality of consumer behavior and fluctuating advertising budgets. These factors could test the durability of its premium pricing in the months and years ahead.

A potential window of opportunity for long-term bulls

AppLovin’s current valuation reflects the market’s ambitious expectations for its ability to lead in mobile advertising and app monetization. With a trailing twelve-month P/E ratio of 102 and a price-to-sales ratio of 26.5—well above sector medians—these elevated metrics reflect a strong belief in the company’s ability to sustain rapid growth and capitalize on lucrative opportunities. The high-margin software platform, now accounting for 66% of total revenue, is at the heart of this optimism, with additional momentum coming from AppLovin’s strategic ventures into shopping-focused apps and e-commerce—both growing segments with long-term upside.

While the recent pullback in AppLovin’s share price—dropping from a 52-week high of $417 to roughly $325—may have tempered enthusiasm, it could present a strategic entry point for forward-looking investors. This decline, largely attributed to the company’s unexpected omission from the S&P 500 index, reflects a temporary setback instead of a structural weakness. Inclusion in the index would have driven additional institutional interest, but its absence also means its current valuation could reflect near-term execution risk, setting the stage for more sustainable long-term growth.

The recent pullback, combined with AppLovin’s robust growth prospects, has analysts viewing the stock with cautious optimism. Of the 30 covering the company, 20 rate it a “buy,” with an average price target of $340—implying meaningful upside from today’s levels. One standout voice, Oppenheimer, recently named AppLovin a top pick, setting an aggressive price target of $480. Such bullish projections reinforce the view that AppLovin’s recent slide may be an overcorrection, creating an opportunity for investors willing to bet on its execution.

Now trading near $325 per share, AppLovin’s valuation appears more reasonable than when it soared above $400, providing a more attractive risk-reward profile. The coming months will be pivotal, as the company’s earnings reports will offer insight into its ability to maintain an impressive growth trajectory, innovate in AI-driven products and expand its influence in emerging markets. If AppLovin delivers on these fronts, the current pullback could be remembered as a key inflection point for long-term investors.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.