S&P 500 Sentiment is Not Aggressively Bullish Yet

S&P 500 Sentiment is Not Aggressively Bullish Yet

Market update: The S&P 500 is up 1.19% for the month so far

- The S&P 500 is just one day removed from an all-time closing high.

- Many market commentators point to concentration in equity exposure as a sign that stock markets are at risk of a sharp correction.

- However, history suggests that current levels of investor sentiment are not indicative of exhaustion in the bull market.

The past few weeks have been an interesting time for U.S. equity markets.

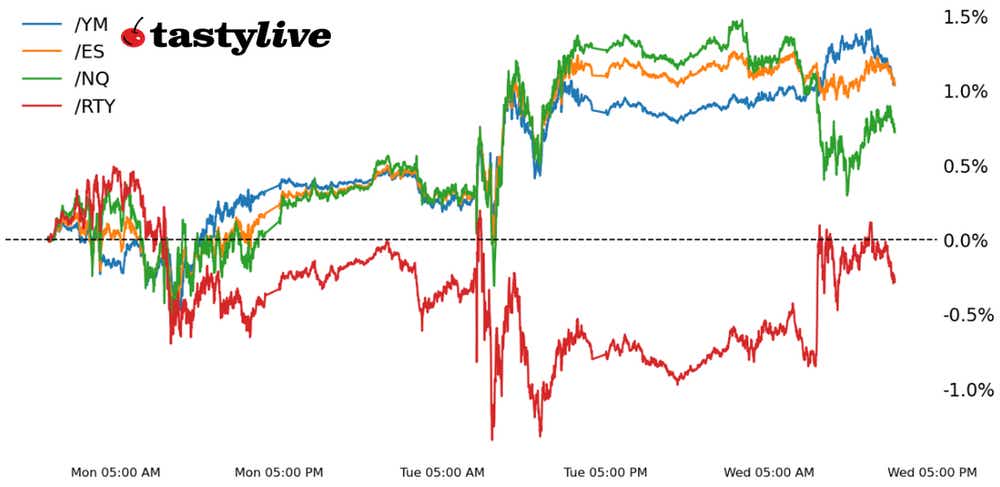

On one hand, the S&P 500 (/ESM4) is just one day removed from all-time closing highs (and very well may close there again today). On the other hand, the Nasdaq 100 (/NQM4) is trading around levels first seen Feb. 12.

As traders try to figure out if the broader stock rally is continuing, pausing, or getting ready to keel over, it’s worth considering investor sentiment (as a proxy for positioning) to see if markets are in the frothy territory that so many market commentators claim.

Bullish sentiment

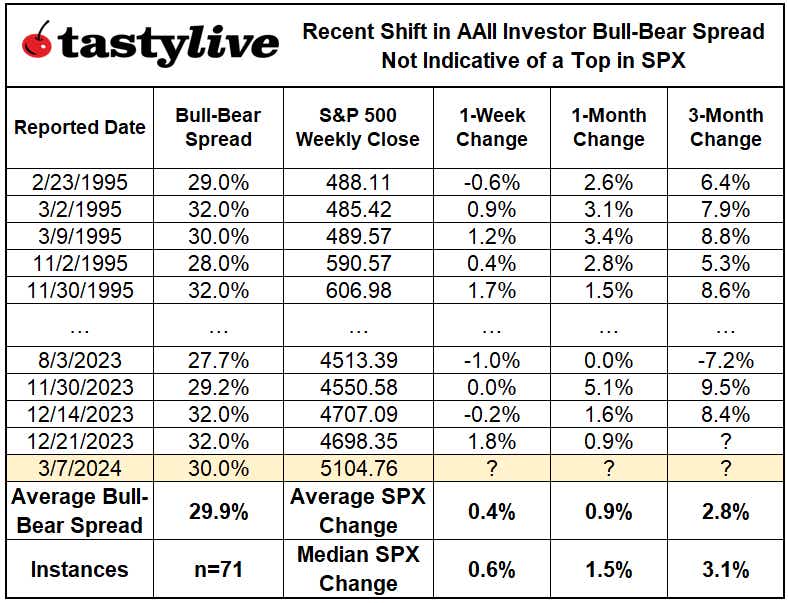

The AAII Investor Sentiment survey registered a bullish reading (respondents expecting stocks to go up over the next six-months) of 51.7% for the week ended March 6, while bearish respondents tallied 21.8%. The bull-bear spread is now 30% (rounding up).

The survey history goes back to 1987, but for the sake of this study data since March 1, 1994 (30 years) were reviewed. The filtering parameter was to identify the one-week, one-month, and three-month forward return profiles for other instances when the bull-bear spread was between 27.5% and 32.5%.

The data are clear: a bull-bear spread around 30% is not a sign that sentiment is aggressively bullish.

In fact, over the past 30 years, there have been 71 instances in which the bull-bear spread has been between 27.5% and 32.5%; each of the one-week, one-month, and three-month average and median returns are positive. And for /ESM4, with a bullish technical backdrop, the sentiment figures reinforce the idea that traders should retain long delta exposure.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.