Here's What to Expect After Stock Splits

Here's What to Expect After Stock Splits

By:Kai Zeng

Splits can provide a short-term boost but don’t necessarily indicate longer-term success

Stock splits provide benefits to retail traders, including a more affordable price and better liquidity.

Splits often send positive signal to the market, too.

However, the action of stock splits does not necessarily indicate outstanding future performance.

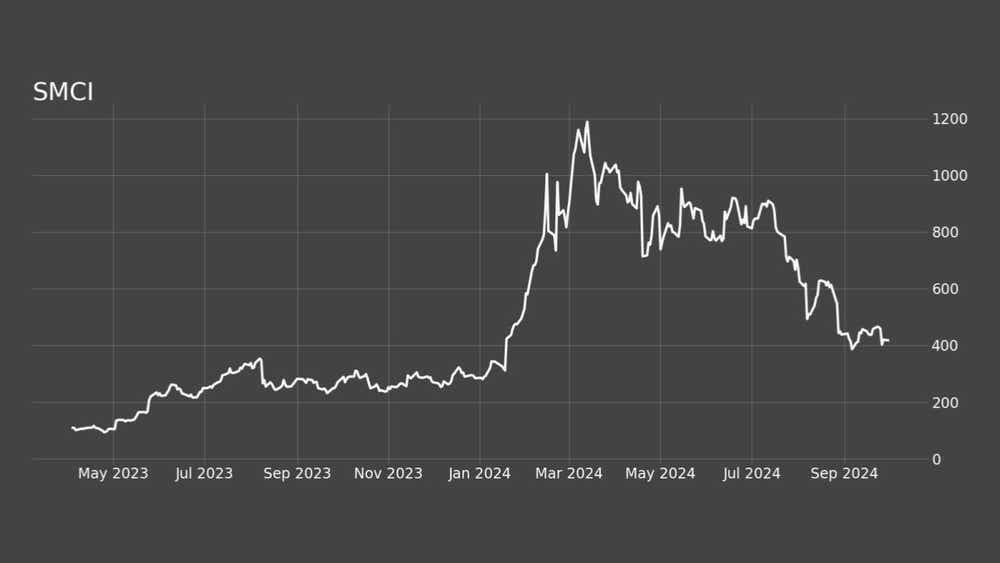

Super Micro Computer (SMCI) completed a 10-for-1 stock split Tuesday, meaning the number of SMCI shares increased tenfold while the value of each share was reduced to one-tenth of its pre-split value. It’s what’s known as a forward split.

The day before, stock in what’s called Supermicro for short, was trading near $416. After the split, the price was adjusted to $41.60. If an investor had one share of SMCI before the split, the position would convert to 10 shares.

Why Companies Split Stocks

Companies split their stock for several reasons, including:

Making the stock more affordable: A lower share price can make the stock more accessible to smaller investors who might not have been able to buy it before.

Improving liquidity: The increased number of shares can make it easier for investors to trade.

Signaling management's confidence: A stock split can demonstrate management's confidence in the company's current and future performance.

This year, Supermicro’s price reached $1,200 at one point, almost six times higher than the average price the year before. That could motivate the company to conduct the split.

Reverse stock split

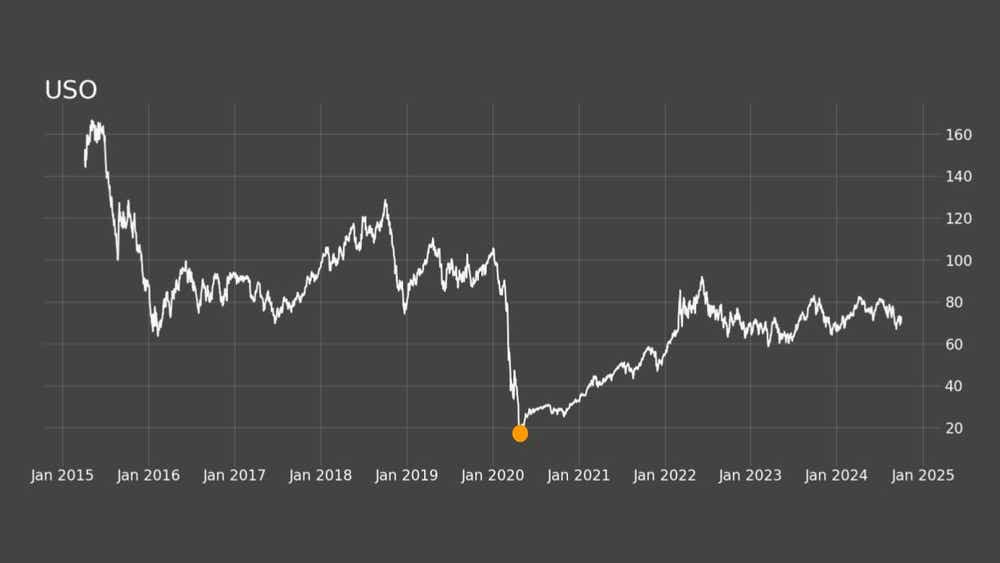

There’s also what’s called a reverse stock split, which is the opposite of a forward split. A company may use a reverse split when its stock price is so low that it’s in danger of being delisted. A higher share price can also attract investors who might not consider penny stocks.

An example is the April 2020 reverse split of the United States Oil Fund (USO). During the COVID-19 pandemic, the company’s’s stock price had dropped significantly to $2.50 per share. To attract investors and make the stock price look healthier, it conducted a 1-for-8 reverse split. The stock price started to bounce back, marking that day as its lowest point in the past 20 years.

How a split affects retail Investors

Stock and options investors should note two things:

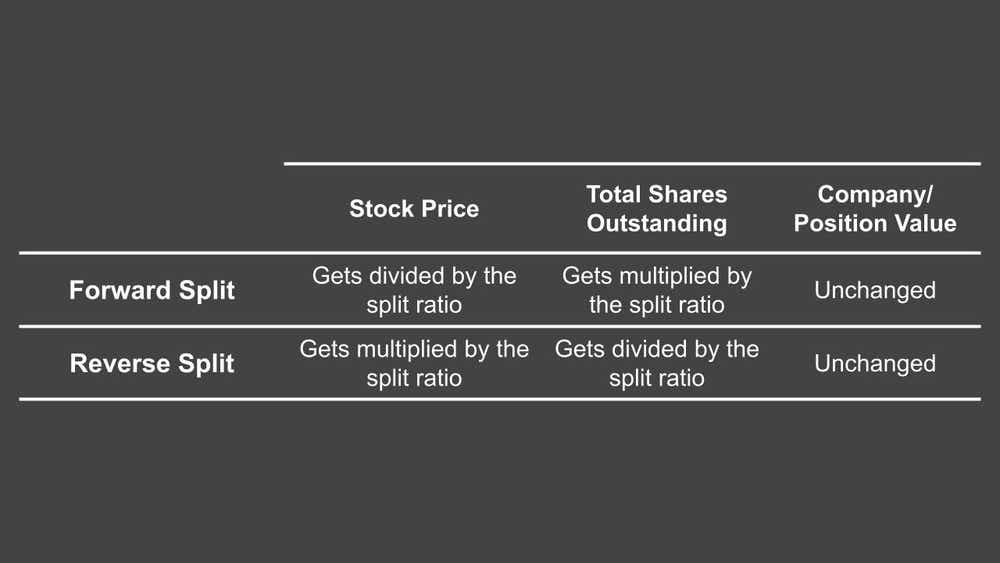

The total market value remains the same after the split.

The value of the trader's total position, whether in stocks or options, also remains the same.

For stock positions, it’s straightforward. The purpose of a stock split is to maintain the total value of the investment by increasing the number of shares while decreasing the stock price proportionally.

For options positions, split has more moving parts, but the principle remains the same. The stock price, option price, strikes and number of contracts change, but the total option position value remains the same.

Liquidity and the market

The day after a split, normal market fluctuations still affect everything the same way. As with the stock market, the option market's liquidity increases because the strike price and option price drop in a forward split. In Supermicro's case, for example, the strike distance tightens to $1, compared to $10 before. This is a huge advantage for small traders who couldn’t afford a $4,000 premium for a 45-day at-the-money (ATM) put. Now, the price drops to $400, and trading volume will increase quickly.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Anticipated Stock Splits and Market Performance

Next, let’s look at this year’s Top 5 most-anticipated stock splits. While the most common stock split ratio is between 2:1 and 5:1, some high-priced stocks have ratios adjusted to 10:1 or higher. Since the beginning of this year, the S&P 500 Index (SPX) has surged 20%, outperforming most of the split stocks. For instance, the stock price for Nvidia (NVDA) increased by 240% in 2023 but has moved only marginally since the split.

Data shows a stock split doesn’t necessarily yield better returns than simply holding SPX within a year, and the volatility of individual stocks is often much higher.

This raises a question: Does a stock split really drive the price upward? Let’s look at a case in point.

Apple stock splits

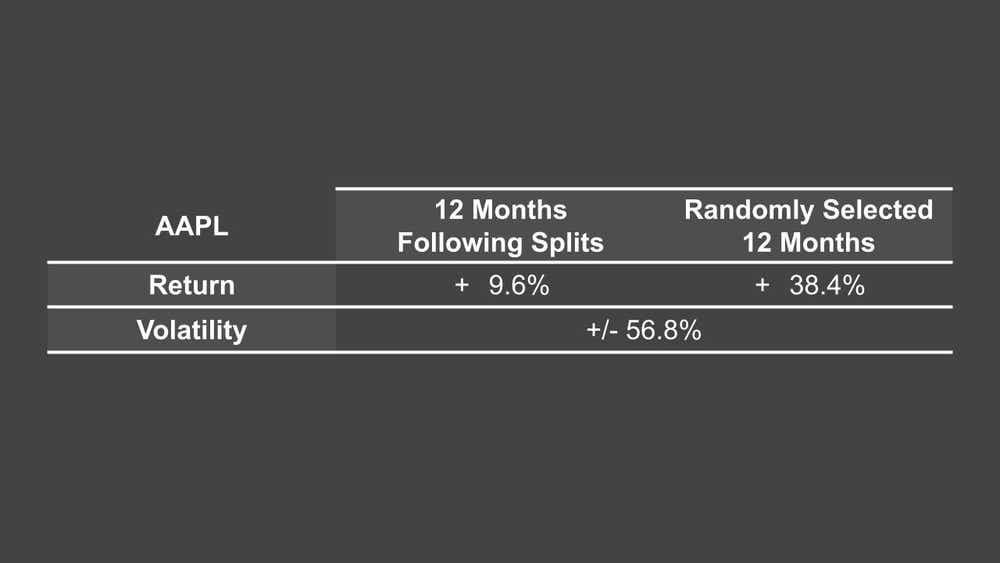

Apple (AAPL) had three stock splits since 2000 (June 2000, February 2005 and June 2014). We recorded its performance for 12 months directly after each stock split and compared it to the average performance of randomly selected 12-month periods.

Like some other stocks, Apple yielded a positive return, averaging 10%, in the 12 months following the stock split. However, it had an even better performance during randomly selected trading periods of the same length.

Conclusion

These observations suggest that while the initial signaling of a stock split is generally positive to public investors, it does not guarantee great performance. Even if the returns in the following months are positive, investors should compare them to the stock's long-term average performance.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.