Super Micro Computer Conundrum: Overvalued Then, Undervalued Now?

Super Micro Computer Conundrum: Overvalued Then, Undervalued Now?

SMCI just did a 10-for-1 stock split, but with legal challenges looming, is the company still worth the risk?

Super Micro Computer shareholders filed a class action lawsuit against the company three days ago, seeking to recover losses they allege were caused by securities fraud.

Super Micro stock has already ridden a wave of turbulent volatility this year, driven by an earlier whistleblower suit, a short-seller report and a Department of Justice investigation.

The stock’s price-to-earnings ratio has declined, making the valuation more attractive, but risk tied to legal and regulatory challenges create substantial uncertainty.

Our scenario analysis outlines a spectrum of outcomes, ranging from a sharp rebound to further downside.

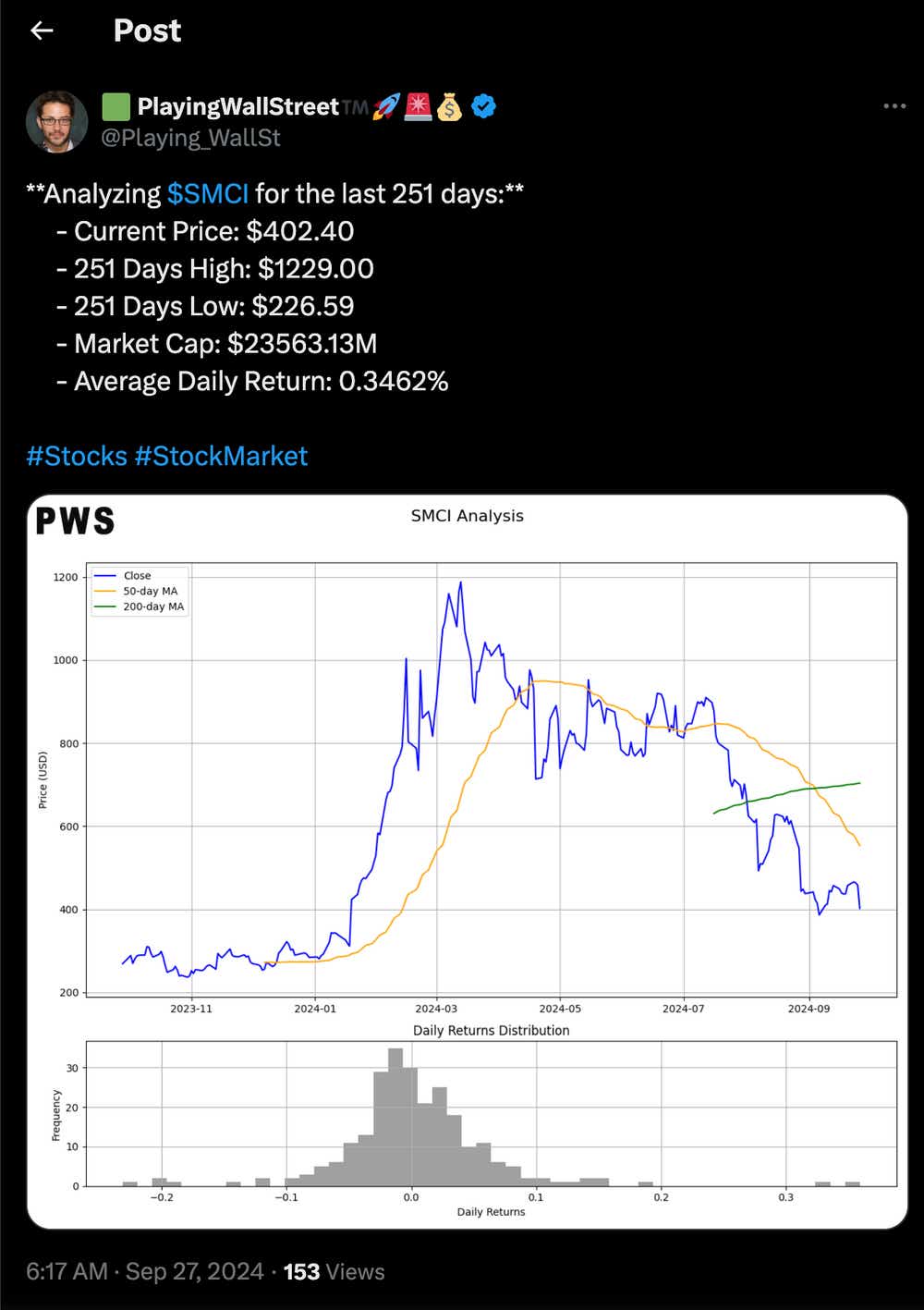

A lot has changed since February 2024 when we initially flagged Super Micro Computer (SMCI) as overextended from a valuation perspective and noted the stock seemed primed for a 10-for-1 split.

In the months that followed, Super Micro’s shares continued to climb, capturing the investment community’s attention. But the narrative has since shifted dramatically.

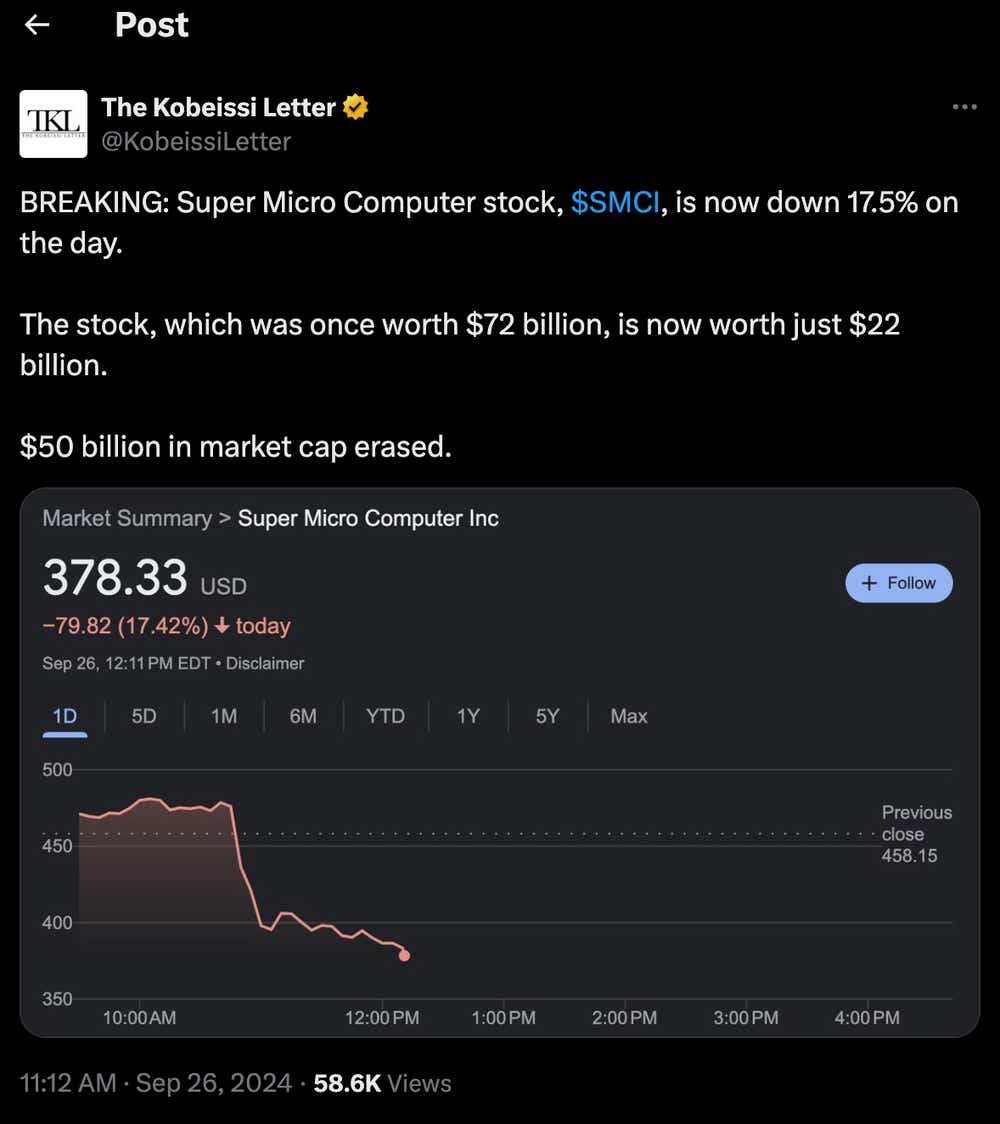

After peaking at $1,229 per share in March, Super Micro’s stock was jolted back to Earth with a sharp correction triggered by a series of developments:

April 2024: A former employee files a whistleblower lawsuit against Super Micro and its CEO.

August 2024: Hindenburg Research publishes a scathing short report on Super Micro.

August 2024: Super Micro announces a delay in filing its 10-K.

September 2024: The U.S. Department of Justice (DOJ) reportedly opens an investigation into Super Micro.

September 2024: Shareholders sue Super Mirco to seek recompense for a decline in stock prices.

While the company did eventually announce the 10-for-1 stock split we predicted, that news has been overshadowed by the developments listed above. Given the shifting landscape, it’s time to revisit Super Micro’s valuation and examine its prospects, taking into account the opportunities and the risk.

No longer overextended

Back in February, we were concerned about Super Micro’s inflated price-to-earnings (P/E) ratio. The stock was trading at a P/E of around 58—much higher than the sector median of 28. This overvaluation was why we believed the stock was poised for a pullback.

Today, Super Micro’s valuation has shifted dramatically. The company’s trailing 12-month (TTM) P/E has fallen from 58 to just 20, while the broader sector’s median P/E has inched up from 28 to 30.

From this perspective, Super Micro’s stock is no longer overextended—and might even be undervalued. If the company manages to deliver on its sales and profitability targets, this lower valuation could present a compelling opportunity.

But that’s a big "if." Unresolved legal and operational issues add a layer of uncertainty. There’s no clear indication of how these challenges will play out, nor whether they will erode Super Micro’s credibility with current and potential customers. Some scenarios that could increase or decrease sales and profitability more than anticipated.

In a vacuum, this P/E is more appealing to investors than the ratio we saw earlier this year. Had the decline in valuation been part of a broader market correction instead of company-specific setbacks, Super Micro might be a clear buy. But that’s not the case, and investors should weigh the risk before deciding whether to take a position in SMCI.

A legal and financial crossroads

Super Micro’s troubles began in April, when a former employee filed a whistleblower lawsuit against the company and its CEO, Taiwanese billionaire Charles Liang. The complainant in the suit alleges improper accounting practices, which is particularly concerning given the company’s history. In 2020, Super Micro settled with the Securities and Exchange Commission (SEC) over accounting violations, and the current allegations bear an uncomfortable resemblance to those past issues.

Not only is the company using improper accounting practices, it has even rehired employees involved in the earlier infractions, the whistleblower alleges. Hindenburg Research, in its August 2024 short report, built upon those allegations, stating it "found glaring accounting red flags, evidence of undisclosed related-party transactions, sanctions and export control failures, and customer issues."

That report added fuel to the fire, and just one day after its publication, Super Micro announced it would be delaying the filing of its 10-K. However, the company was quick to reassure the market, stating that it does not anticipate any "material changes" to its fiscal 2024 results. Super Micro also pushed back against the Hindenburg report, labeling it as "misleading and containing false or inaccurate information."

But at least some Super Micro stockholders were apparently unconvinced by the company’s attempts to proclaim innocence. They filed a class action securities lawsuit on Monday.

The plaintiffs allege in the suit that the company recognized revenue prematurely and failed to use adequate internal financial controls, failed to disclose multiple related-party transactions and, as a result, the defendants' statements about its business, operations and prospects were false and misleading.

But the true extent of wrongdoing (if any) will remain unknown until the whistleblower claims, short-seller allegations and class-action suit are fully investigated and the class-action suit is adjudicated.

The outcome of these inquiries will play a critical role in shaping Super Micro’s future. At this stage, however, the risk to shareholders is difficult to quantify, adding uncertainty that makes it difficult to predict the company's trajectory.

However, a scenario analysis provides a structured way to evaluate the possible outcomes, enabling current and prospective shareholders to develop a more-informed strategy for navigating these unresolved issues.

Mapping potential outcomes

As highlighted by the previous P/E analysis, Super Micro’s valuation has taken a hit since the stock peaked in March. Its future will depend on the outcome of the Department of Justice (DOJ) investigation. However, the ripple effects—such as reputational damage and the ongoing whistleblower lawsuit—could also influence the company’s trajectory.

Predicting the results of all this is challenging, particualarly in how customers might respond. The range of potential outcomes spans from best to worst with many possibilities in between.

On the optimistic end, if the DOJ clears Super Micro of any wrongdoing, the company’s stock could see a sharp rebound, moving from its current P/E of 20 toward the sector median of 30. That 50% improvement in valuation could lift the stock from $419 per share to nearly $630. And if the market were to assign Super Micro a premium P/E (above the industry average), the stock could rise even further, potentially reaching the $700–$800 range.

In the worst-case scenario, where the DOJ probe uncovers malfeasance, Super Micro could face fines, and management or other employees might be held accountable. While the conclusion of the investigation would provide some closure, the reputational damage could also be severe. Super Micro has benefited from surging demand in the artificial intelligence (AI) sector, but customers might turn to alternatives like Dell (DELL) or Hewlett Packard Enterprise (HPE) if trust in the company erodes.

In this less favorable scenario, the reputational damage could limit sales and profitability. Given that uncertainty, predicting a new P/E ratio relative to the industry median becomes complex.

However, if the company were to take corrective action—such as hiring a new management team and instituting stringent internal controls—investors might regain confidence.

Under this scenario, Super Micro’s stock could fall well below current levels and then rebound down the road. For example, a P/E ratio in the 10-20 range could send the stock price as low as $210, suggesting a potential trading range of $200 to $400 per share if the company faces moderate to significant fallout from the investigation.

Note that Super Micro received a non-compliance letter from Nasdaq on Sept. 17 because of the delayed filing of its 10-K. The company has 60 days (from that date) to file the 10-K or submit a compliance plan to Nasdaq. If Nasdaq accepts the plan, Super Micro could be granted an extension.

However, if the company fails to file the report or Nasdaq rejects its plan, the stock could be at risk of delisting. Super Micro would then have the option of appealing the decision.

Stock Split Overshadowed

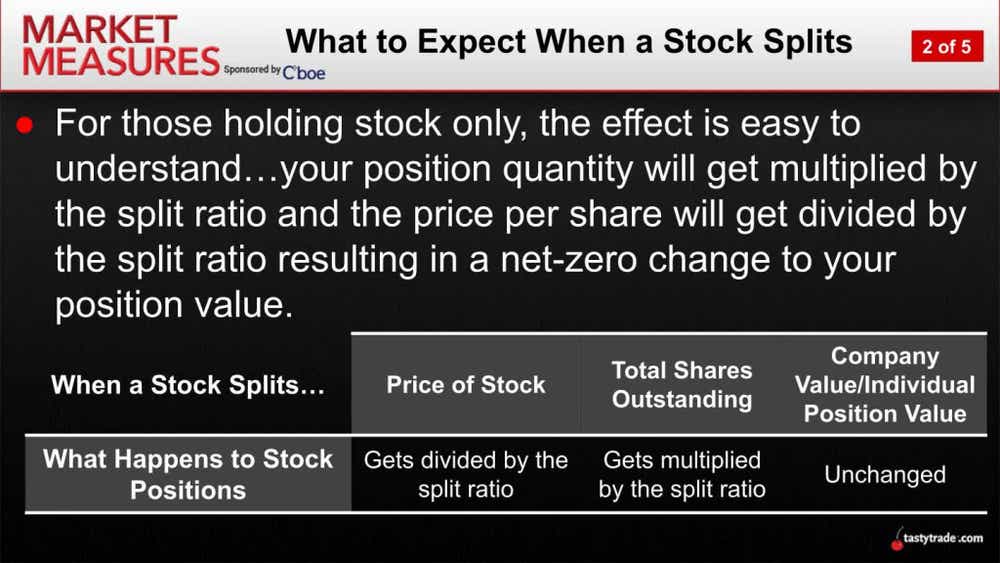

On Oct. 1, Super Micro completed the 10-for-1 stock split announced Aug. 29. Technically, a stock split increases the number of shares while proportionally reducing the price per share, without affecting the company’s overall market value. Case in point, shares of Super Micro closed at $416 on Sept. 30, and opened around $41.60 on Oct. 1, with the company's associated market capitalization remaining the same.

The 10-for-1 stock split was likely intended to make Super Micro’s shares more affordable for retail investors, a common strategy to boost liquidity and increase demand. But the timing of this split has arguably been overshadowed by the challenges the company faces. What might once have been a bullish signal has now faded into the background, eclipsed by the company’s mounting legal and regulatory concerns.

Takeaways: Navigating Uncertainty

Super Micro’s stock has seen considerable volatility in 2024, fueled by legal challenges, short-seller reports and delays in financial reporting. The DOJ investigation and whistleblower lawsuit have raised concerns about potential accounting misconduct. However, these are unproven allegations and the extent of wrongdoing (if any) remains unknown until the investigations are concluded.

On the valuation front, Super Micro’s current P/E ratio of 20 is far more reasonable than its ratio earlier in the year, potentially offering value to investors if the company can overcome its obstacles. However, there’s a risk the company suffers reputational damage that could reduce demand for its products and services. Deterioration in the company’s revenue projections could result in a reduced valuation, particularly if key clients opt for competitors' offerings.

Considering all the factors in play, Super Micro’s future hinges on the resolution of its legal and reputational challenges. Investors should weigh the potential for a sharp recovery if the company is cleared of wrongdoing against the downside risk of the investigation revealing misconduct that could harm its position in the AI and server markets. Given the uncertainty, a cautious approach is advisable, and investors should stay vigilant as the situation evolves.

According to The Wall Street Journal, 21 analysts cover Super Micro Computer, with eight rating the stock a buy, one rating it overweight and eleven rating it a hold. One rates its shares a sell. Based on those ratings, the average price target for Super Micro is roughly $690 per share. The stock is up 47% year-to-date and trades for about $415 per share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.