"Skinny" Spotlight: Options Modeling

"Skinny" Spotlight: Options Modeling

The "Skinny" series on the tastylive network is a platform for breaking down a variety of options trading concepts into more easily digestible building blocks.

Specifically, "Skinny" episodes typically feature experts in math, data, and modeling that share their experience with tastylive viewers to help provide background and reinforcement on many of the more complex trading-related subjects that are often featured in tastylive programming.

In the past, the blog has highlighted episodes from the The Skinny on Options Math and The Skinny on Options Data Science and today we complete the circle by introducing The Skinny on Options Modeling!

The Skinny on Options Modeling typically features Tom "TP" Preston, a frequent contributor and quantitative strategist on the tastylive network. However, Dr. Data (Mike Rechenthin) has also been known to take a seat at the options modeling table.

Today on the blog we are in fact putting the spotlight on one of Dr. Data's recent options modeling appearances because the subject dovetails very well with some other fresh content on the network and blog.

Entitled "Selling IV Where It Counts," Dr. Data joins Tom Preston and Tony Battista with some critical things to consider when dealing with high implied volatility as it relates to options trading decisions.

Dr. Data kicks off the episode by reminding viewers that when all else is equal, higher implied volatility generally translates to higher options prices, which means we can collect more premium when we sell options.

However, Dr. Data qualifies the above statement by saying that each and every instance of high implied volatility doesn't necessarily equate to an optimal trading opportunity.

As a reminder, Dr. Data reminds viewers that implied volatility is simply the option's price relayed in different terms, as shown below:

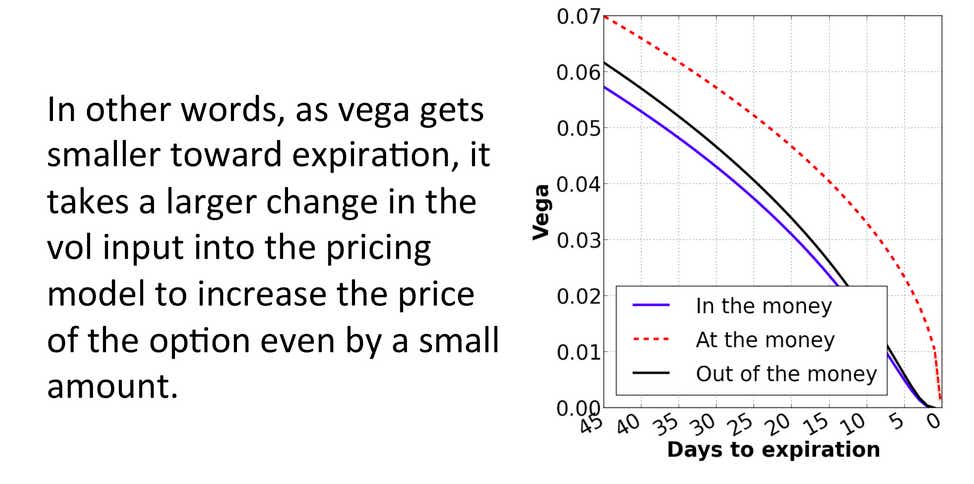

Dr. Data goes on to explain that vega, which is the measure of how much an option’s price changes given a 1% change in implied volatility, decreases over time. In simpler terms, this means that as an option gets closer to expiration, it takes a much more pronounced move in implied volatility to meaningfully impact an option's price.

This phenomenon is depicted in the graph below:

Breaking the above down even further, we can say that options with only a few days until expiration may have a very high implied volatility, but ultimately a very low price in dollar terms.

What this means is that as an option gets closer to expiration, implied volatility becomes less valuable as an input in trading decisions. Dr. Data goes on to detail how implied volatility can actually be deceiving when days-to-expiration (DTE) dips to three or less, as illustrated in the slide below:

Dr. Data concludes the episode by indicating the implied volatility measurements in options with 30-60 days-to-expiration should more accurately reflect their true premium and could therefore be more useful as a factor in trading decisions.

The entire episode on high implied volatility can be found by following this link.

Additionally, we encourage you to delve deeper into the tastylive library of content on implied volatility by following this link.

We greatly value your feedback and would appreciate any comments or suggestions on future tastylive programming in the "comments" section below.

Additionally, we encourage you to get in touch on Twitter or email at @tastylive or at support@tastylive.com.

Thanks for being the most important part of the tastylive community!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.