Extrinsic Value and Intrinsic Value | Options Trading

Extrinsic Value and Intrinsic Value | Options Trading

By:M. Slabinski

If this was the Scripp's National Spelling Bee and I was asked to spell the word intrinsic, I might ask the judge...

"Can you use the term in a sentence, please?"

To which the judge would reply with something like...

"You are both intrinsically and extrinsically motivated to learn about options. You are intrinsically motivated because you like learning about investing and you are extrinsically motivated because learning can help you make more money."

"Intrinsic. Intrinsic. I-n-t-r-i-n-s-i-c. Intrinsic." - Me

*And the crowd goes wild!

Ok, all jokes aside, we often get asked about intrinsic and extrinsic motivation as it relates to options trading so we wanted to break it down for you.

What Are Extrinsic Value and Intrinsic Value?

The dictionary definition (boring, I know, but essential to understand what intrinsic and extrinsic value represent in terms of options) of intrinsic is "belonging to the essential nature of a thing." Extrinsic is "not part of the essential nature, operating from the outside." So....

What do intrinsic and extrinsic value mean when it comes to options?

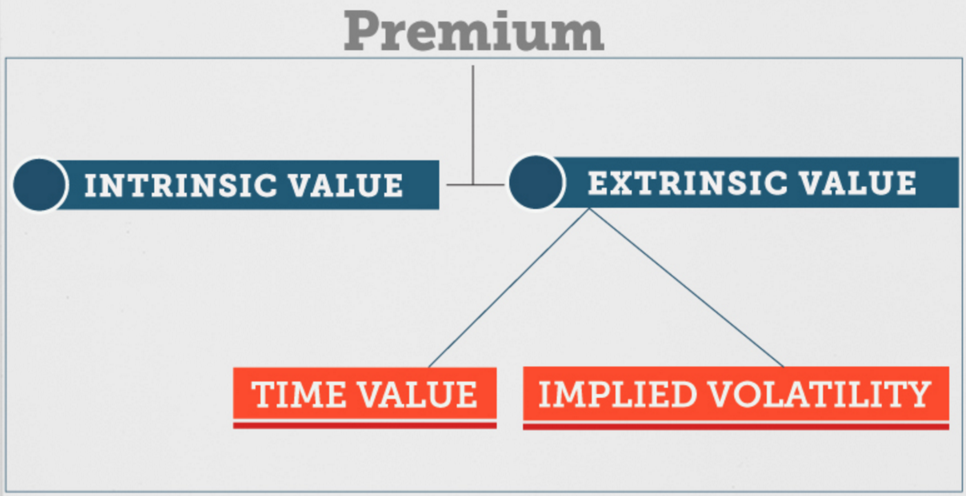

Well, options can be made up of intrinsic value, extrinsic value, or both! The intrinsic value of an option is the tangible value of the option at expiration (the value is the nature of the option). The extrinsic value of an option represents the external factors that can impact the intrinsic value like time and volatility (external factors).

The total value of an option can be broken down into two parts:

(a) Intrinsic Value + (b) Extrinsic Value = (c) Total Option Value

Or, phrased differently...

(a) The Current Value + (b) Time & Volatility Value = (c) Total Option Value

Now, let's break down that equation and first look at how we define intrinsic value.

Intrinsic Value

The intrinsic value when it comes to the options trading world, is how much an option would be worth if it expired right now. If all the time on an option suddenly disappeared and it was exercised, how much would you make (not including additional fees)?

- If you would make nothing ($0), the option would have no intrinsic value.

- If you make money, the amount you would make would be the option’s intrinsic value.

An option should never be worth less than its intrinsic value. If an option was ever being sold for less than its intrinsic value, experienced traders would buy the option and exercise it immediately (for the intrinsic value). The profit they would make would be equal to the difference between how much they paid for the option and the amount they get for exercising it (less commission fees).

Remember, options (specifically American options) can be exercised at any time before they expire. Options are always worth a minimum of their intrinsic value because they can be exercised for their intrinsic value at anytime.

How to Calculate Intrinsic Value?

What does intrinsic value mean for different option types?

Options only have intrinsic value if they are in the money. "In the money" is another way of saying an option has intrinsic value.

In other words, intrinsic value tells you that if the option were exercised right now, it would be “in” the range that would return “money” (hence the term, in the money). The amount that an option is in the money by, is the same as the amount of intrinsic value an option has.

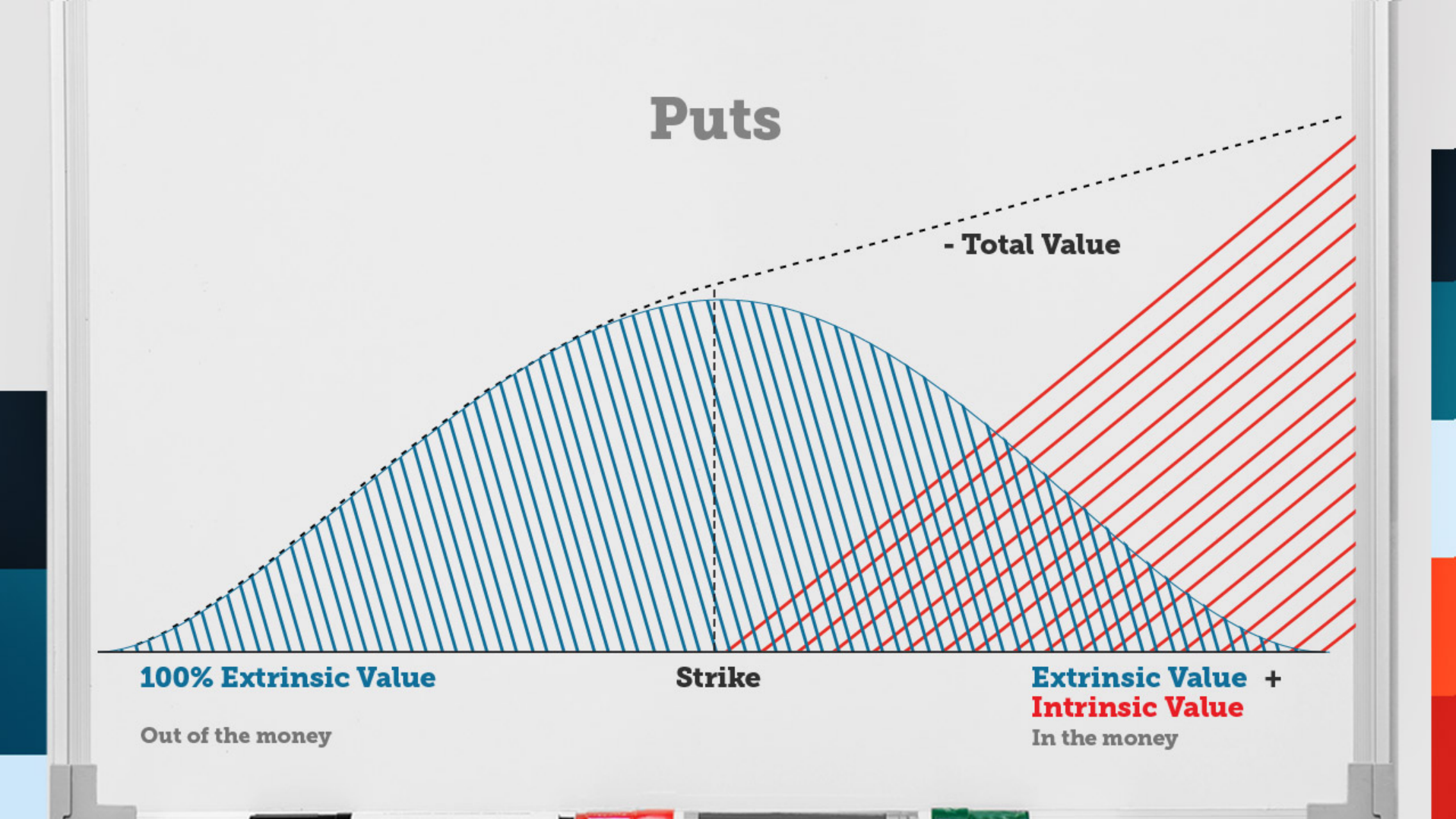

Intrinsic Value For Puts

Puts are in the money (have intrinsic value) if their strike price is above the current stock price. A put gives you the right to sell stock at the put’s strike price.

If the strike price is higher than the current stock price, you will be able to sell the stock for more than it is currently worth. Your total profit at expiration (no time left) is the intrinsic value, or the difference of the strike price and stock price (Strike Price – Stock Price = Option Value at expiration and intrinsic value). If an option has no intrinsic value at expiration (out of the money), it will expire worthless.

Finding The Intrinsic Value of A Put - Example

Let's say Costco (ticker symbol COST) is trading at $166.24, and we sell a put at a strike price of $170.00. How could we find the intrinsic value from those bits of information? Well, remember that...

Intrinsic Value = Strike Price – Stock Price

So, in using our example, the equation would look like: $170.00 - $166.24 = $3.76 (Intrinsic Value)

If you owned the $170.00 put and at expiration, the stock was trading at $166.24, you would make $3.76 (or $376 when multiplied times 100 - the number of shares of stock controlled by 1 option contract).

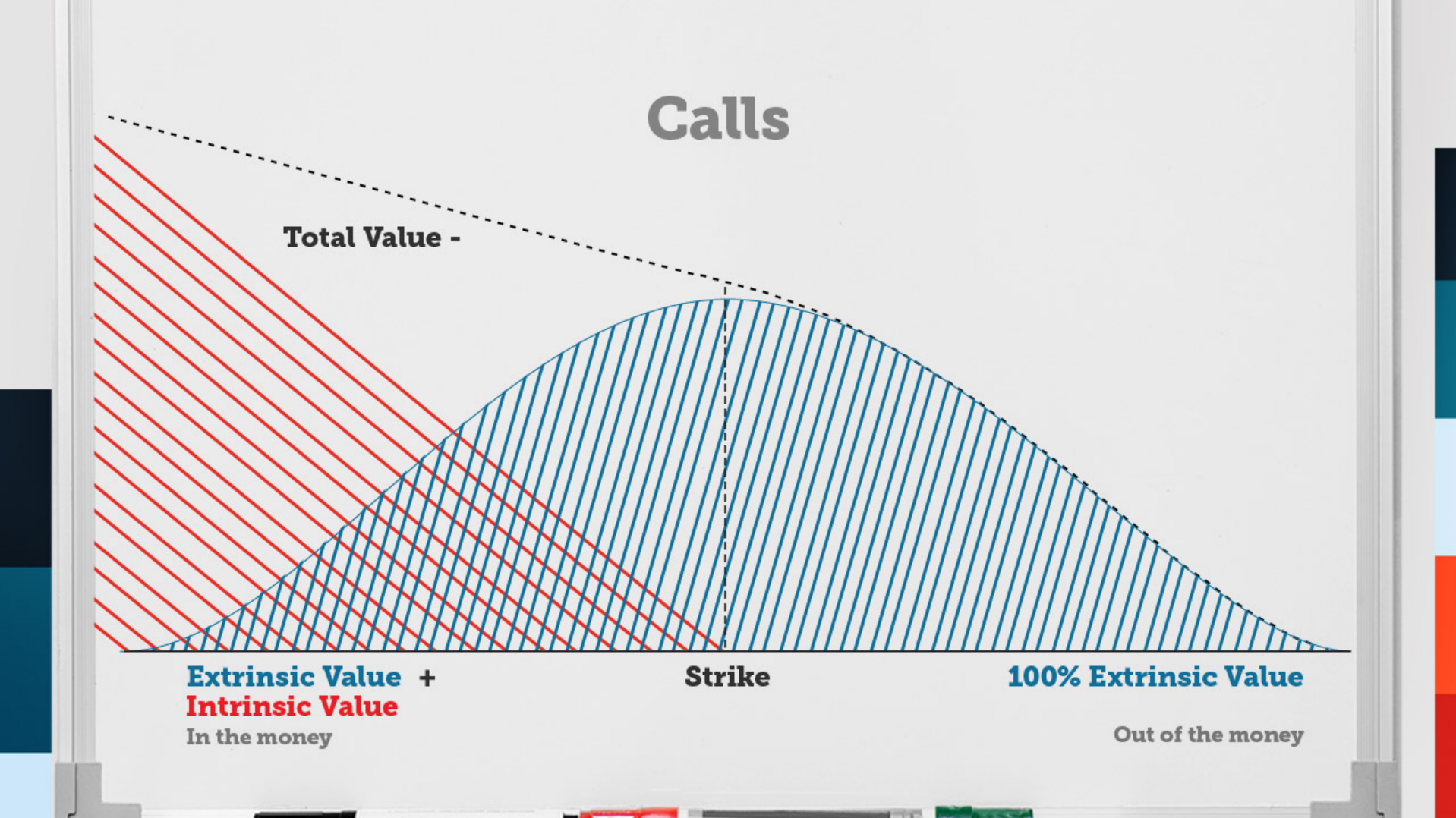

Intrinsic Value For Calls

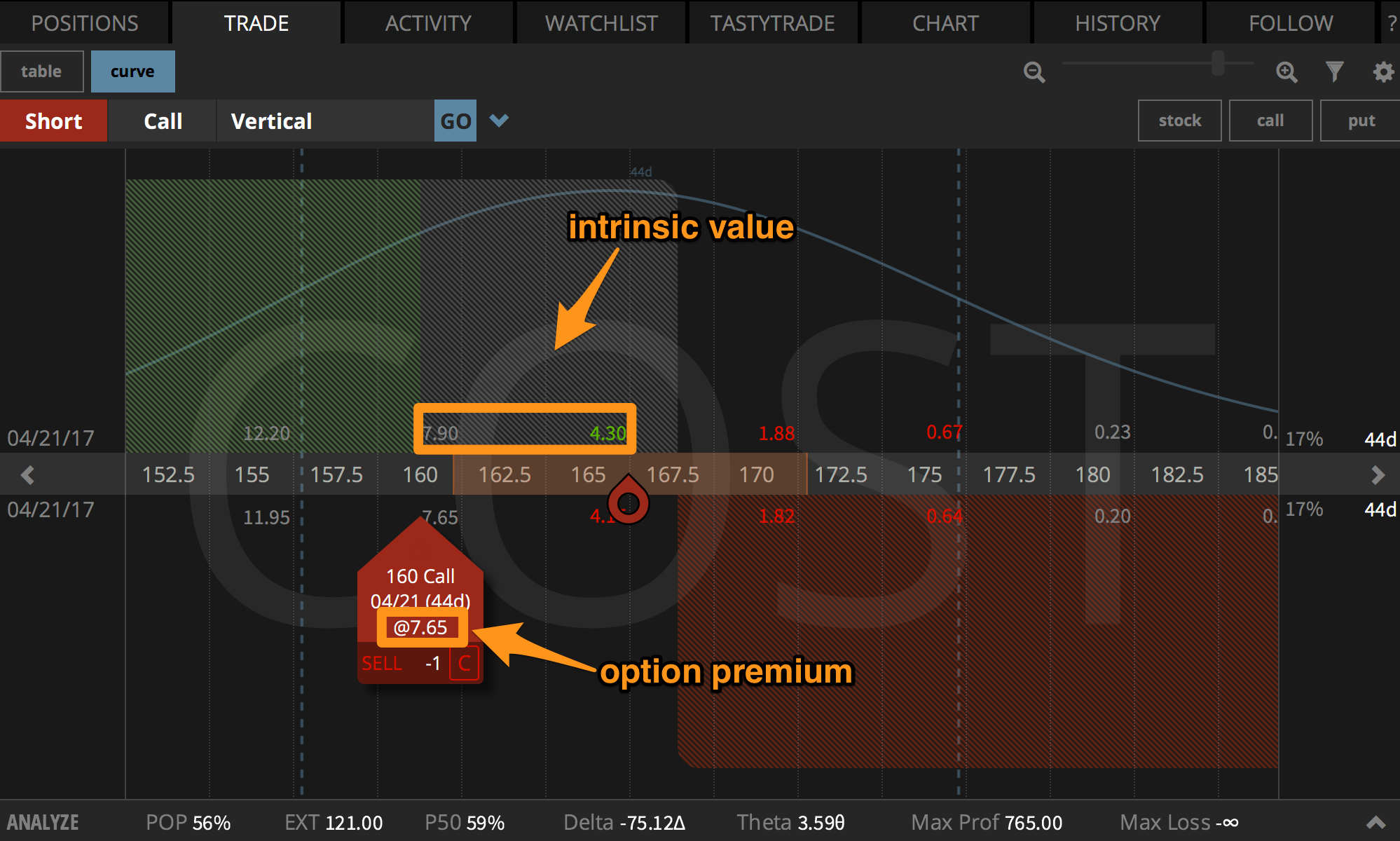

Calls are in the money (have intrinsic value) if the strike price is below the current stock price (remember that a call gives you the right to buy stock at the call’s strike price). In the picture to the right, we can see how the intrinsic value (in red) and extrinsic value (in blue) add together to form the option's total value.

If the strike price is below the current stock price you will be able to buy stock for less than it is currently worth. Your total profit at expiration (no time left) is the intrinsic value, the difference between the stock price and strike price (Stock price – Strike Price = Option Value at expiration and intrinsic value). Like puts, if a call option has no intrinsic value at expiration (out of the money), it will expire worthless.

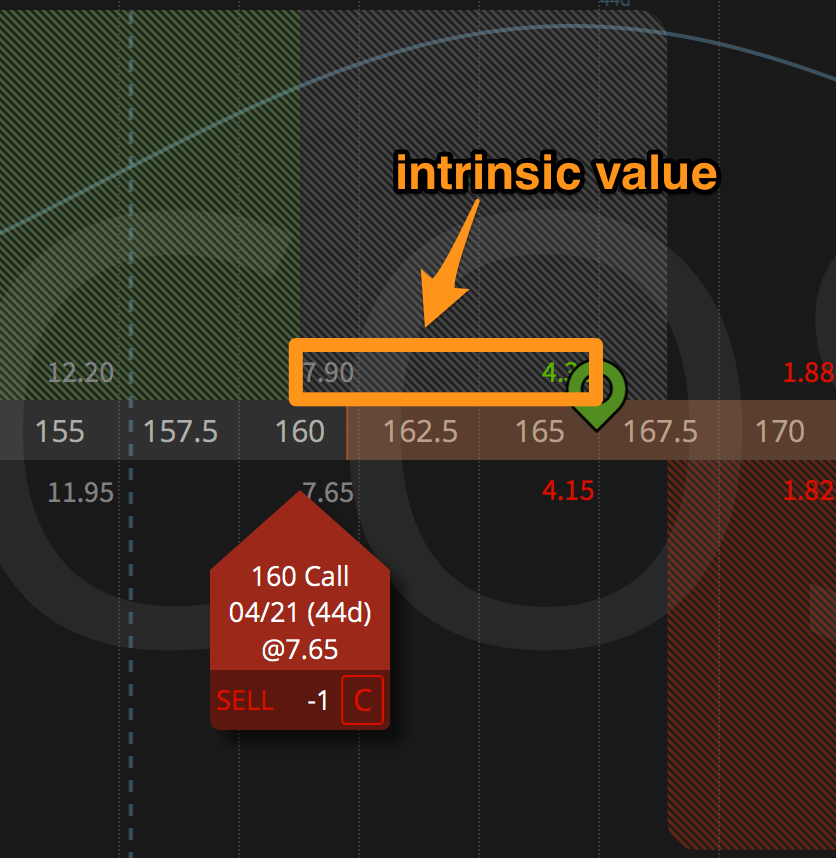

Finding The Intrinsic Value Of A Call - Example

For simplicity sake, let's look again at COST. If COST is trading at $166.24, and we sell a call at a strike price of $160.00, then the intrinsic value would be $6.24 (or $624).

How did we get that number?

Remember... Stock Price – Strike Price = Intrinsic Value

So, $166.24 - $160.00 = $6.24

Extrinsic Value

If intrinsic value is what the option is worth if it expired right now (if we took away all the time)...

Then what is the extrinsic value?

The easiest way to think about extrinsic value is this: extrinsic value is everything that is not intrinsic value.

If we know an option’s total value (which is the premium it is being bought/sold for), we can calculate the extrinsic value by subtracting the intrinsic value, from the total value. Whatever is left is the option’s extrinsic value. As an equation, it looks like:

Total Option Premium – Intrinsic Value = Extrinsic Value

Both intrinsic and extrinsic value are determined by the fill price and the bid/ask spread.

In the example to the right, the equations would be:

$7.65 (the premium) - $6.24 (intrinsic value) = $1.41 (extrinsic value)

But that doesn’t really help us understand where the extrinsic value comes from and why an option is worth more than it can be exercised for today.

So why on earth would anyone pay more for an option than what it could be exercised for? Let's explore.

Another way to understand extrinsic value is this: investors pay more than an option’s current exercise value because there is value in the ability to hold a contract over time. The amount of time left until expiration and the volatility of the underlying (we will look at these briefly in the next section), directly impact the price of an option, thus impacting the extrinsic value.

Investors buy options hoping the option’s value will increase during the option’s lifetime (or sell options and hope that the value will decrease). Options cost significantly less money than buying stock outright because options have expiration dates, while stocks do not. Because options have expiration dates, the extrinsic value is defined as the additional time & volatility value traders pay for. As stated before, traders are hoping that the options price will change in their favor.

Essentially, the market is aware the price may change so added premium (extrinsic value) is included to compensate for the changes in time value and volatility.

Time Value (Days To Expiration)

One aspect of extrinsic value is referred to as the option’s time value (or days to expiration).

The more time an option has until expiration, the more time the underlying price has to change. Thus, the more time the option has until expiration, the more valuable the option becomes.

Implied Volatility

Aside from time value, implied volatility also makes up the extrinsic value of an option. Implied volatility effectively measures how much the stock price may swing over a specific timeframe. Adding volatility to time value, gives us the extrinsic value of an option

As time expires, an option’s extrinsic value will move to $0.00, leaving only intrinsic value. If volatility in an underlying decreases, the extrinsic value of the option will also decrease.

If an option has a longer contract or higher implied volatility, the extrinsic value of the option will increase. You can see this in the option chain (pictured above) comparing options with the same strike price, but with longer or shorter timeframes.

Quiz Yourself!

Would you like to test yourself on the options knowledge you just picked up? Try answering the questions below.

What is the intrinsic value of the following calls?

1. $80.00 strike call with the stock at $100.00

2. $80.00 strike June 18 call in $XYZ when $XYZ is at $100.00

3. $100.00 strike June 18 call in $ABC when $ABC is at $80.00

What is the intrinsic value of the following puts?

4. $90.00 strike put with the stock at $70.00

5. $90.00 strike June 18 put in $XYZ when $XYZ is at $70.00

6. $70.00 strike June 18 put in $XYZ when $XYZ is at $90.00

Intrinsic and Extrinsic Value Recap

- All options expire with only intrinsic value

- Intrinsic Value = Strike Price - Stock Price

- Extrinsic value (time value/volatility) decreases as time decays, or volatility decreases

- Extrinsic Value = Total Option Premium – Intrinsic Value

- In the money options have intrinsic value, out of the money options do not (out of the money options are all extrinsic value)

More questions about intrinsic and extrinsic value? Reach out to our support team at support@tastylive.com

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.