S&P 500 Struggles After Trump Announces Auto Tariffs; Gold Hits All-Time High

S&P 500 Struggles After Trump Announces Auto Tariffs; Gold Hits All-Time High

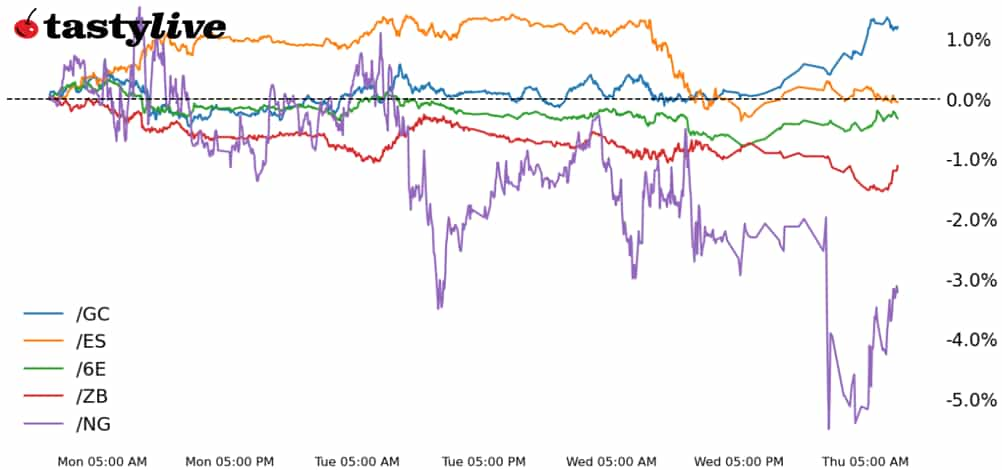

Also, 30-year T-bond, gold, natural gas and euro futures

- S&P 500 E-mini futures (/ES): -0.29%

- 30-year T-bond futures (/ZB): -0.43%

- Gold futures (/GC): +1.06%

- Natural gas futures (/NG): -0.34%

- Euro futures (/6E): +0.25%

The sudden imposition of auto tariffs by the Trump administration caught traders by surprise yesterday, and the announcement has pushed measures of volatility higher across nearly all asset classes. U.S. equity markets are trading weaker around the U.S. cash equity open, and with concerns about a near-term lift in inflation, U.S. Treasuries have proved unwilling to serve as a safe haven. Instead, traders have turned to precious metals, with gold prices hitting a new all-time high. Tariff talk may be exhausted in FX markets, however: the U.S. dollar is not finding its usual bump in the wake of trade war escalation.

Symbol: Equities | Daily Change |

/ESM5 | -0.29% |

/NQM5 | -0.21% |

/RTYM5 | +0.01% |

/YMM5 | -0.03% |

S&P 500 futures (/ESM5) fell this morning, as investors assess the impact from the latest round of tariff announcements. The market remains uncertain of how the administration will move forward with reciprocal tariffs. How President Trump will react to responses by tariffed countries remains the biggest question mark for markets. That is perhaps why markets aren’t responding positively to upbeat economic data, notably this morning’s upwardly revised GDP figures for the fourth quarter. General Motors (GM) fell over 7% in early trading and Stellantis (STLA) dropped 3% after Trump announced auto tariffs for any cars not made in the United States.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5350 p Short 5400 p Short 6050 c Long 6100 c | 65% | +612.50 | -1887.50 |

Short Strangle | Short 5400 p Short 6050 c | 71% | +2862.50 | x |

Short Put Vertical | Long 5350 p Short 5400 p | 85% | +325 | -2175 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.02% |

/ZFM5 | -0.04% |

/ZNM5 | -0.14% |

/ZBM5 | -0.43% |

/UBM5 | -0.62% |

Long-term bonds fell as Wall Street mulled the possible impact of tariffs on the inflation outlook. The concern over the health of the U.S. economy is growing, as fear mounts over economic growth. The Congressional Budget Office (CBO) warned that the U.S. could run out of funding by the end of this summer. 30-year T-bond futures (/ZBM5) fell 0.38% this morning. The Treasury will auction seven-year notes today. Yesterday's five-year note auction came in soft, with a tail of about 0.5% on the auction.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 112 p Short 120 c Long 123 c | 64% | +781.25 | -2218.75 |

Short Strangle | Short 112 p Short 120 c | 68% | +1234.38 | x |

Short Put Vertical | Long 109 p Short 112 p | 82% | +421.88 | -2678.13 |

Symbol: Metals | Daily Change |

/GCM5 | +1.06% |

/SIK5 | +1.08% |

/HGK5 | -1.5% |

Precious metals have been the prime beneficiary of the latest turn in the trade war saga, with silver prices (/SIK5) returning to their monthly high. But attention is once again on gold (/GCM5), which surged above 3095 ahead of the U.S. cash equity session. A steeper equity market sell-off may ultimately hold back the metals as traders raise cash levels; nevertheless, technical momentum remains bullish. Elsewhere, copper prices (/HGK5) are reversing sharply after what appears to have been a blow-off top yesterday.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2890 p Short 2905 p Short 3265 c Long 3280 c | 64% | +430 | -1070 |

Short Strangle | Short 2905 p Short 3265 c | 71% | +3550 | x |

Short Put Vertical | Long 2890 p Short 2905 p | 84% | +220 | -1280 |

Symbol: Energy | Daily Change |

/CLK5 | +0.01% |

/HOK5 | -0.27% |

/NGK5 | -0.34% |

/RBK5 | -0.02% |

Natural gas prices (/NGK5) were slightly lower to day after trimming deeper losses from overnight when prices fell below the 3.8 level. The Energy Information Administration (EIA) will release its weekly inventory report for natural gas today. Traders expect about a 30 billion cubic feet (bcf) build in inventory for last week. Meanwhile, weather models have shifted to the warmer side for the next two weeks, indicating demand may drop as we move into the traditional injection season marked by April 1.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.15 p Short 3.3 p Short 4.5 c Long 4.65 c | 67% | +580 | -920 |

Short Strangle | Short 3.3 p Short 4.5 c | 80% | +2630 | x |

Short Put Vertical | Long 3.15 p Short 3.3 p | 88% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AM5 | +0.25% |

/6BM5 | +0.42% |

/6CM5 | -0.14% |

/6EM5 | +0.25% |

/6JM5 | -0.28% |

Considering that FX markets are the most liquid in the world, it is curious that the sudden imposition of the auto tariffs is not having a more profound impact on currencies. The U.S. Dollar is modestly weaker today, finding no support from the shift higher in Treasury yields. Perhaps this is a canary in the coal mine: Traders may have discounted much of the affect of the tariff during the significant shift in assets prices from mid-February onward.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.045 p Short 1.06 p Short 1.105 c Long 1.12 c | 62% | +462.50 | -1412.50 |

Short Strangle | Short 1.06 p Short 1.105 c | 67% | +825 | x |

Short Put Vertical | Long 1.045 p Short 1.06 p | 85% | +225 | -1650 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.