Revisiting IV Rank

Revisiting IV Rank

Today on the blog we are revisiting a key term on the tastylive network known as "IV Rank,” or IVR.

IV Rank is a tastylive original concept and one of the keystone elements in much of the programming on options trading.

The "IV" in "IV Rank" stands simply for "implied volatility" and the term could be written in longhand as “Implied Volatility Rank.”

As we already know, implied volatility is the reverse-engineered market value in volatility terms for current options prices. Implied volatility therefore represents the market's expectation for future movements in a stock's price.

On a recent blog post, Dr. Data ran a study comparing implied volatility with actual volatility. That is to say, the good doctor wanted to test how accurate the market was in forecasting options volatility as compared to what actually came to pass. You can also see more about that by watching the full episode here.

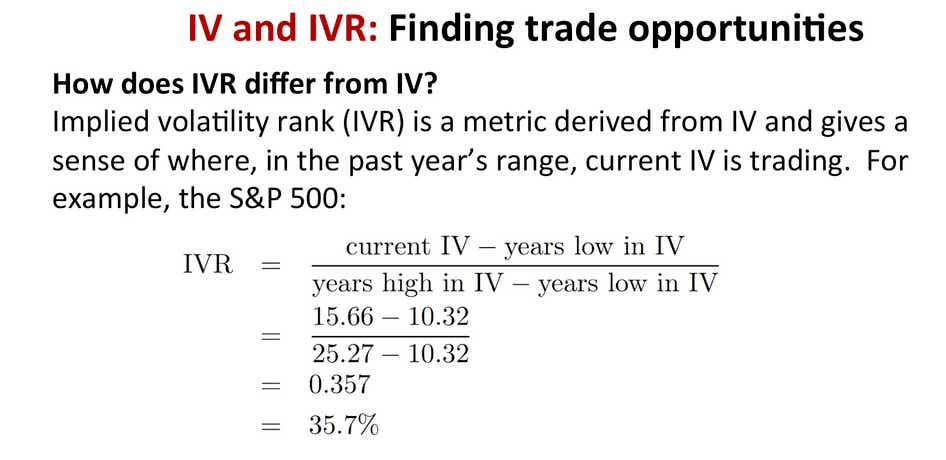

Now that we have reviewed "implied volatility", we can now move on to the "rank" part of the phrase. The "IV Rank" measurement simply tells us whether implied volatility is high or low in a specific underlying based on the past year of implied volatility data.

For example, if hypothetical stock XYZ had an implied volatility between 30 and 60 over the past year, and implied volatility is currently measured at 45, then stock XYZ would have an IV Rank (IVR) of 50%.

Since all underlyings have unique implied volatility ranges, stating an arbitrary implied volatility number does not help us decide how we should proceed with a strategy. The IVR is therefore useful because it indicates how the current implied volatility in a stock ranks compared to other time periods in the previous year.

An IVR of 100 would indicate that implied volatility in a particular expiration was equal to the highest point it had reached in the previous year. Likewise, a rank of 0 would indicate that implied volatility in a stock was equal to its lowest point of the year.

The actual calculation for IVR was discussed on a previous episode of Market Measures and is depicted in the graphic below:

IVR on the tastylive network may at times also be referred to as IV Percentile.

On an episode of The Webinar, Ryan Grace and Mike Hart discuss how IVR can be used to determine a trading strategy.

We encourage you to view both of the aforementioned episodes on IVR.

Additionally, you can access further information on the topic by clicking "Learn" on the tastylive homepage and choosing "IV Rank (IV Percentile)."

As always, we thank you for being a part of the tastylive community.

Happy Trading!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.