Palo Alto Networks Earnings Report: 7% Stock Price Move Expected

Palo Alto Networks Earnings Report: 7% Stock Price Move Expected

By:Mike Butler

The cybersecurity company’s platformization strategy is succeeding

- Palo Alto Networks will report quarterly earnings after the market closes tomorrow.

- The company’s stock is near all-time highs.

- It has exceeded earnings estimates three quarters in a row.

- Analysts expect earnings-per-share of $0.78 on $2.24 billion in revenue.

Palo Alto Networks (PANW) will report quarterly earnings tomorrow, after the market closes. The cybersecurity company has a history of strong earnings reports, beating estimates three quarters in a row leading up to this earnings call. The stock price is rallying from recent lows and sits at $197 per share, just $10 off of all-time highs.

The company is expected to report earnings-per-share of $0.78 on $2.24 billion in revenue. Both figures are slightly higher than last quarter, when the cybersecurity company exceeded both. Many analysts have a bullish view on PANW stock, ever since the shift from a single-focus product delivery to a "platformization" approach—in other words, delivering cybersecurity products and services as a suite instead one-off solutions.

Nikesh Arora, CEO of Palo Alto Networks, offered strong words in the last earnings call: “Our Q1 results reinforced our conviction in our differentiated platformization strategy ... We see a growing market realization that platformization is the game changer that will solve security and enable better AI outcomes. I expect this will be a multiyear trend for which we are best-positioned to deliver to our customers."

Dipak Golechha, PANW chief financial officer, echoed those positive sentiments: “Our platformization progress continued in Q1, driving strong financial results ... As a result, we are raising our NGS ARR, revenue and non-GAAP EPS guidance for the year."

It seems the executives have made a slight shift that's resulting in some major successes. That may be why we're seeing the stock price rally into earnings this week. But regardless of sentiment, we can always look to the options for more clarity on what the market is expecting from the earnings call.

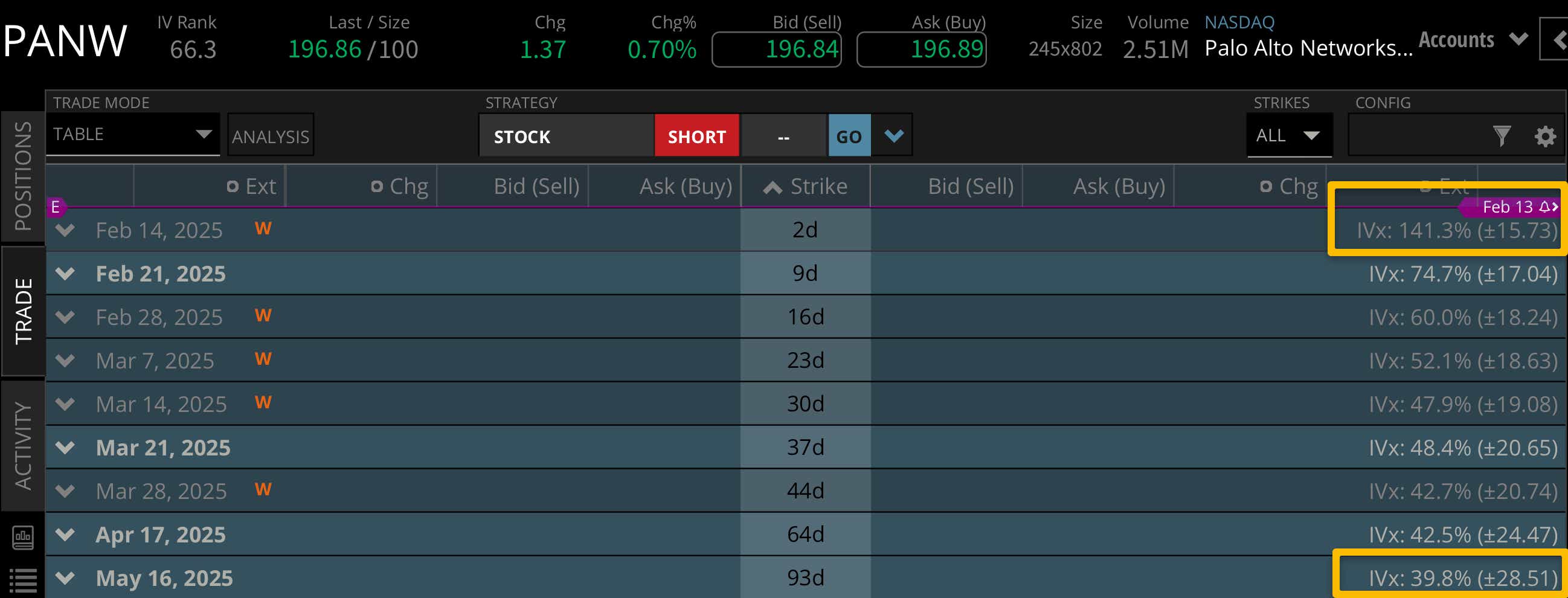

Based on current implied volatility, the market is expecting a +/- $15.73 expected stock price move this week. With a stock price hovering around $197, that means the market is expecting around a 7% notional value stock price move this week. This is a pretty wide range, considering most earnings calls land between 5%-10% of the notional value of the stock price.

Looking to May of this year, we only see a +/- $28.51 expected stock price move. In other words, over 50% of the expected move through May is being priced into this week's earnings call.

Bullish on Palo Alto Networks stock for earnings

If you're bullish on PANW stock for earnings, you're looking for the cybersecurity company to keep posting strong EPS and revenue figures tomorrow. If executives can pair that with a strong sentiment for the rest of 2025 with more clarity around platformization strategy performance, we could see the stock touch or exceed all-time highs by the end of the week.

Bearish on Palo Alto Networks Stock for Earnings

If you're bearish on PANW stock for earnings, you're looking for a rocky earnings report, with an EPS miss, a revenue miss or both. Any loss of positive sentiment could encourage investors to sell the stock, which could send the stock price lower by the end of the week.

Either way you see it, tune in to Options Trading Concepts Live tomorrow at 11 a.m. CST for a look at earnings strategies ahead of the announcement.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.